Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

Nepal’s Gen Z Revolution: The 48-Hour Uprising That Redefined Asia’s Digital Democracy

In September 2025, Nepal became the epicenter of a historic youth-led political upheaval. The Gen Z Revolution, as it came to be known, toppled a government in just 48 hours — an event that would ripple across three continents and inspire what analysts now call the Asian Spring.

This was not a traditional revolution. It was leaderless, digitally coordinated, and powered by a generation raised on smartphones and memes rather than manifestos. What began as outrage over a social media ban quickly evolved into a sweeping rebellion against corruption, inequality, and political decay.

The Spark: A Digital Ban in a Digital Nation

On September 4, 2025, the Nepalese government abruptly banned 26 major social media platforms, including Facebook, X (formerly Twitter), YouTube, Instagram, LinkedIn, and TikTok. The official justification — a “Digital Services Tax” on foreign platforms — fooled no one. Citizens saw it as an attempt to silence critics and suppress mounting frustration over elite corruption and nepotism.

Nepal’s youth, who make up more than 45% of the population, relied on these platforms for work, education, and social life. Overnight, they were digitally suffocated. The backlash was immediate and fierce. Within hours, Discord servers and VPN groups exploded with activity. A civil society organization called Hami Nepal became the nerve center of digital coordination, reportedly hosting over 100,000 active members organizing protests via Discord, Telegram, and gaming chats.

Why Nepal’s Youth Had Enough

The protests tapped into deeper structural rot:

-

Youth Unemployment: Over 20% of Nepal’s young adults were jobless despite record education rates.

-

Remittance Dependency: A staggering 33% of GDP came from remittances, turning the country into an economy of absence — families surviving on money from abroad.

-

Visible Inequality: Viral videos of “nepo babies” flaunting luxury cars and Dubai vacations contrasted sharply with Nepal’s average annual income of $1,400.

-

Digital Maturity: With 48% of Nepal’s population online, social media wasn’t just entertainment — it was empowerment.

The government’s move to block that digital lifeline triggered the largest youth mobilization in modern South Asian history.

Timeline: From Outrage to Overthrow

September 4–7, 2025 – The social media ban provokes immediate backlash. VPN downloads surge by 300%. Small street protests begin in Kathmandu and Pokhara.

September 8 – Tens of thousands march at Maitighar Mandala and outside Parliament. Security forces respond with live ammunition. 19 die, 347 are injured. The government imposes a nationwide curfew. Home Minister Ramesh Lekhak resigns that evening.

September 9 – Prime Minister K.P. Sharma Oli resigns after protesters storm major government buildings — including Singha Durbar, the Supreme Court, and Baluwatar (the PM’s residence). Fires erupt in party headquarters and elite homes. 13,500 prisoners escape after mobs breach prisons in Kailali, Nakhu, and Kaski. The army closes Tribhuvan International Airport.

September 10–11 – With 34 dead and 1,300 injured, protesters nominate Sushila Karki, Nepal’s first female Chief Justice, as interim leader. Army Chief Gen. Ashok Raj Sigdel meets her and President Ram Chandra Poudel to discuss a transition plan.

September 12 – Parliament is dissolved. Karki becomes Nepal’s first female interim Prime Minister. Elections are scheduled for March 5, 2026. The official death toll rises to 51, with thousands injured and prisoners still missing.

September 13 – Curfews lift. Karki visits hospitals, promising justice and compensation of 1 million rupees (US$7,000) to victims’ families.

By September 17, Nepal held a national day of mourning for the 75 dead and over 2,000 injured — but also celebrated what many called the rebirth of democracy.

Symbols of the Uprising

Among the many images circulating globally, one stood out — the Jolly Roger flag of the Straw Hat Pirates from One Piece. Adapted from Indonesian student protests, it became the de facto emblem of rebellion, symbolizing youth resistance against tyranny, greed, and deceit.

Graffiti reading “We Are the Straw Hats — No One Rules Us!” appeared across Kathmandu, Bhaktapur, and Biratnagar.

From Kathmandu to the World: The Contagion of Hope

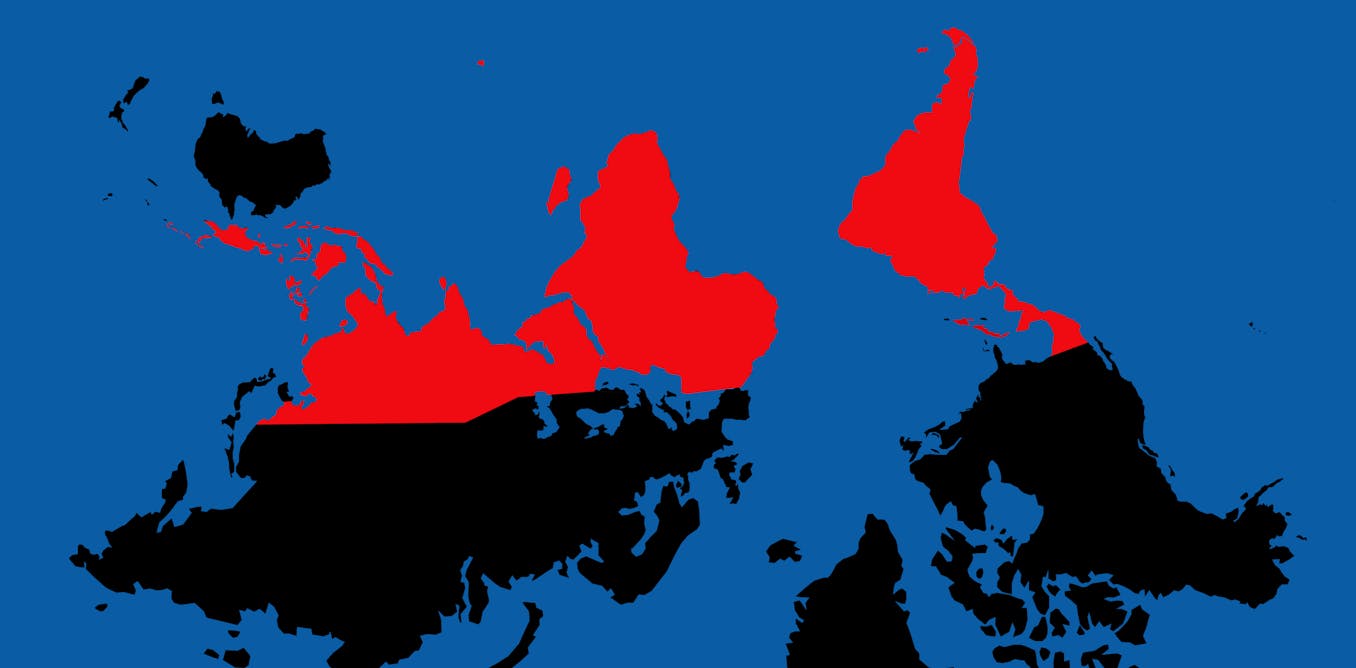

Within weeks, the revolution’s digital DNA spread globally — inspiring Gen Z-led uprisings in four countries across three continents.

Africa

-

Madagascar: Protests against chronic blackouts, corruption, and poverty erupted in late September 2025. Dubbed Gen-Z Mada, the movement forced President Andry Rajoelina to dissolve his cabinet after 22 deaths and 100 injuries. The One Piece flag flew in Antananarivo’s central square — a direct homage to Nepal’s uprising.

-

Morocco: Starting October 3, Gen Z 212 protests targeted the government’s lavish 2030 World Cup spending amid crumbling healthcare and education. Three were killed, dozens injured. Youth leaders cited Nepal as their playbook for mobilization.

South America

-

Peru: In late September, protesters demanded President Dina Boluarte’s resignation over corruption and crime. The same Jolly Roger banner reappeared in Lima — an unmistakable echo of Nepal’s revolt.

Asia

-

Philippines: On September 22, thousands protested corruption in flood-control funds. The One Piece flag was raised in Manila. Though the government survived, analysts called it “the loudest youth movement since People Power.”

The Anatomy of a Digital Revolution

Political scientists describe Nepal’s uprising as the world’s first “Discord Revolution.” It had:

-

No central leadership, preventing co-option or arrest of leaders.

-

AI-assisted organization, using bots to coordinate logistics anonymously.

-

Fractal communication — microgroups acting autonomously under broad shared principles (“11-11-11-11-11” networks, as activists described them).

-

Cultural hybridity, where memes, anime symbols, and civic ideals merged into a new aesthetic of protest.

The Institute for Economics & Peace later identified Nepal’s uprising as a case study in “Positive Peace,” citing it as a rare instance where free information flow directly produced democratic transition.

Who Are Gen Z? The Architects of a New Era

Born between 1997 and 2012, Generation Z comprises about 25% of the world’s population. They are:

-

The first digital natives, raised with internet and social media as extensions of identity.

-

The most diverse and globalized generation in history.

-

The most anxious — 40% report chronic stress.

By 2025, they were coming of age amid economic crises, climate disasters, and political disillusionment. Yet their collective consciousness — shaped by memes, data, and decentralized communication — gave rise to movements that traditional institutions failed to predict.

The Broader Gen Z Wave

Nepal’s uprising didn’t occur in isolation. It was part of a broader wave:

-

Kenya (2024–2025): Finance Bill protests forced fiscal rollbacks.

-

Bangladesh (2024): Youth-led revolt ousted Prime Minister Sheikh Hasina.

-

Sri Lanka (2022): Protests toppled Gotabaya Rajapaksa.

Each instance built digital infrastructure and emotional resonance that Nepal weaponized most effectively.

Beyond Politics: The Economic and Cultural Power of Gen Z

Economically, Gen Z faces unprecedented precarity. Many enter the workforce burdened with debt and low wages while AI threatens white-collar stability. In Nepal, AI automation in remittance-dependent sectors has deepened inequality. Globally, Gen Z responds through:

-

Side hustles and gig work over traditional careers.

-

Social entrepreneurship with ethical consumption (sustainability-first mindset).

-

Barbell strategies — some pursue high-risk crypto or creator ventures, while others return to trades and craftsmanship.

Culturally, they blend irony and idealism — using humor, aesthetics, and anime symbolism as tools of rebellion.

Environmental and Ethical Dimensions

Across movements, Gen Z ties corruption to environmental collapse. In Nepal, youth chanted:

“No green, no peace — corrupt hands pollute the land.”

In the Philippines and Madagascar, floods and blackouts became metaphors for failed governance. Deloitte surveys show over 70% of Gen Z link their career choices to sustainability.

The Road Ahead: From Revolt to Renewal

Nepal’s new interim government faces immense challenges — rebuilding institutions, drafting digital rights laws, and preventing another cycle of elite capture. Yet the revolution’s legacy endures.

By 2030, as Gen Z becomes the dominant global voting bloc, the political establishment everywhere will face a choice: Reform or be replaced.

As one viral X post declared:

“Gen Z isn’t waiting for change — we are the change.”

Nepal may well be remembered as the first nation where that prophecy came true.

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

नेपाल की जेन-ज़ क्रांति: 48 घंटों में सत्ता पलट देने वाली डिजिटल लोकतंत्र की क्रांति

सितंबर 2025 में नेपाल एक ऐतिहासिक युवा-नेतृत्व वाली राजनीतिक उथल-पुथल का केंद्र बन गया। जेन ज़ क्रांति के नाम से प्रसिद्ध यह आंदोलन केवल 48 घंटों में सरकार को गिरा देने वाला विद्रोह था — एक ऐसी घटना जिसने तीन महाद्वीपों तक लहरें भेजीं और जिसे विश्लेषक अब एशियन स्प्रिंग कहते हैं।

यह कोई पारंपरिक क्रांति नहीं थी। इसका कोई नेता नहीं था, यह पूरी तरह डिजिटल रूप से संगठित थी — ऐसे युवाओं द्वारा संचालित जो घोषणापत्रों से नहीं, बल्कि स्मार्टफोन और मीम-संस्कृति से राजनीतिक हुए थे। जो गुस्सा सोशल मीडिया प्रतिबंध के खिलाफ शुरू हुआ, वह जल्दी ही भ्रष्टाचार, असमानता और राजनीतिक सड़ांध के विरुद्ध व्यापक विद्रोह में बदल गया।

चिंगारी: एक डिजिटल देश में डिजिटल प्रतिबंध

4 सितंबर 2025 को नेपाल सरकार ने अचानक 26 बड़ी सोशल मीडिया साइटें — Facebook, X (पूर्व Twitter), YouTube, Instagram, LinkedIn और TikTok — प्रतिबंधित कर दीं। इसे “डिजिटल सर्विस टैक्स” के बहाने उचित ठहराया गया, पर जनता ने इसे आलोचकों को चुप कराने और सत्ताधारी अभिजात वर्ग के भ्रष्टाचार को ढकने की चाल के रूप में देखा।

नेपाल की आबादी का लगभग 45% हिस्सा युवा है, जो पढ़ाई, नौकरी और सामाजिक जीवन के लिए इन्हीं प्लेटफार्मों पर निर्भर था। एक रात में उनकी डिजिटल सांस रुक गई। प्रतिक्रिया तुरंत और तीखी थी। कुछ ही घंटों में Discord सर्वर और VPN ग्रुप्स में गतिविधि बढ़ गई। हामी नेपाल नामक संगठन आंदोलन का डिजिटल नर्व सेंटर बना, जिसके एक लाख से अधिक सदस्य Discord, Telegram और गेमिंग चैट्स के माध्यम से तालमेल बना रहे थे।

युवाओं के सब्र का बाँध क्यों टूटा

यह आंदोलन नेपाल की गहरी संरचनात्मक समस्याओं पर आधारित था —

-

युवा बेरोज़गारी: 20 % से अधिक युवा उच्च शिक्षा के बावजूद नौकरी से वंचित।

-

रेमिटेंस निर्भरता: GDP का 33 % विदेशों से भेजे गए धन पर निर्भर।

-

खुली असमानता: “नेपो बेबीज़” के लक्ज़री लाइफ़स्टाइल के वीडियो वायरल हो रहे थे, जबकि देश की औसत वार्षिक आय सिर्फ US$ 1,400 थी।

-

डिजिटल परिपक्वता: 48 % जनसंख्या ऑनलाइन थी, जहाँ सोशल मीडिया सशक्तिकरण का प्रतीक था।

सरकार ने जब उसी जीवनरेखा को काटा, तो यह आधुनिक दक्षिण एशियाई इतिहास का सबसे बड़ा युवा आंदोलन बन गया।

घटनाक्रम: गुस्से से सत्ता-परिवर्तन तक

4–7 सितंबर: प्रतिबंध के बाद VPN डाउनलोड 300 % बढ़े। छोटे-छोटे प्रदर्शन काठमांडू और पोखरा में शुरू हुए।

8 सितंबर: दस हज़ारों लोग मैतीघर मंडला और संसद भवन के बाहर उमड़ पड़े। सुरक्षा बलों ने लाइव गोली चलाई। 19 लोग मारे गए, 347 घायल। रात तक कर्फ्यू लग गया और गृह मंत्री रमेश लेखक ने इस्तीफ़ा दिया।

9 सितंबर: प्रधानमंत्री के. पी. शर्मा ओली ने त्यागपत्र दिया। भीड़ ने सिंहदरबार, सुप्रीम कोर्ट, बालुवाटार जैसे सरकारी भवनों को आग लगाई। 13,500 कैदी भाग निकले। सेना ने त्रिभुवन अंतरराष्ट्रीय हवाईअड्डा बंद किया।

10–11 सितंबर: 34 मृतक, 1,300 घायल। प्रदर्शनकारियों ने सुषिला कर्की (पूर्व मुख्य न्यायाधीश) को अंतरिम नेता नामित किया। राष्ट्रपति राम चंद्र पौडेल और सेना प्रमुख अशोक राज सिग्देल से बैठक हुई।

12 सितंबर: संसद भंग। कर्की नेपाल की पहली महिला अंतरिम प्रधानमंत्री बनीं। चुनाव 5 मार्च 2026 को घोषित। मृतक संख्या 51, घायल हज़ारों।

13 सितंबर: कर्फ्यू हटा, कर्की ने अस्पतालों का दौरा किया और मृतकों के परिवारों को 10 लाख रुपये (लगभग US$ 7,000) मुआवज़ा देने का वादा किया।

17 सितंबर: राष्ट्रीय शोक दिवस मनाया गया — 75 मृतक, 2,000 से अधिक घायल — पर साथ ही लोकतंत्र की “पुनर्जन्म कथा” भी लिखी गई।

क्रांति का प्रतीक

हर जगह लहराने वाला एक झंडा सबसे अधिक पहचान बना — वन पीस मंगा के स्ट्रॉ हैट पाइरेट्स का जॉली रॉजर ध्वज। इंडोनेशियाई छात्र आंदोलनों से प्रेरित यह चिह्न तानाशाही के ख़िलाफ़ स्वतंत्रता का वैश्विक प्रतीक बन गया।

काठमांडू की दीवारों पर लिखा था:

“हम ही स्ट्रॉ हैट्स हैं — कोई हम पर राज नहीं करेगा!”

नेपाल से दुनिया तक: आशा का संक्रमण

कुछ ही सप्ताह में नेपाल की यह डिजिटल क्रांति दुनिया भर में फैल गई — तीन महाद्वीपों में चार देशों में युवा विद्रोह भड़क उठे।

अफ़्रीका

-

मेडागास्कर: बिजली कटौती, भ्रष्टाचार और गरीबी के विरुद्ध “जेन-ज़ माडा” आंदोलन ने 22 मौतों के बाद राष्ट्रपति अंद्रि राजोएलिना को कैबिनेट भंग करने पर मजबूर किया। एंटानानारिवो में स्ट्रॉ हैट ध्वज लहराया।

-

मोरक्को: “Gen Z 212” नामक ऑनलाइन समूह ने 2030 वर्ल्ड कप पर खर्च के खिलाफ़ और शिक्षा-स्वास्थ्य सुधार की मांग की। 3 मृतक, दर्जनों घायल। नेपाल के डिजिटल रणनीति मॉडल को सीधे अपनाया गया।

दक्षिण अमेरिका

-

पेरू: सितंबर अंत में राष्ट्रपति दीना बोलुआर्टे के ख़िलाफ़ भ्रष्टाचार विरोधी प्रदर्शन। लीमा में उसी वन पीस ध्वज की प्रतिध्वनि।

एशिया

-

फ़िलीपींस: 22 सितंबर को बाढ़ नियंत्रण फंड घोटाले पर हज़ारों युवा सड़कों पर। सरकार भले गिरी न हो, पर नेपाल-प्रेरित तरीकों से राजनीति हिल गई।

डिजिटल क्रांति की संरचना

राजनीति विश्लेषकों ने नेपाल के आंदोलन को दुनिया की पहली “Discord Revolution” कहा —

-

कोई केंद्रीय नेतृत्व नहीं था।

-

गुमनाम AI बॉट्स से लॉजिस्टिक समन्वय।

-

“11-11-11-11-11” फ्रैक्टल नेटवर्क्स — छोटे सेल स्वायत्त रूप से सक्रिय।

-

मीम, ऐनिमे और नैतिक संवेदनाओं का मिश्रण — एक नई प्रतिरोध अभिव्यक्ति।

इंस्टिट्यूट फॉर इकॉनॉमिक्स एंड पीस ने इसे “Positive Peace” का उदाहरण बताया — जहाँ मुक्त सूचना प्रवाह ने सीधे लोकतांत्रिक परिवर्तन लाया।

कौन हैं जेन ज़: नए युग के निर्माता

1997 से 2012 के बीच जन्मे जेनरेशन ज़ दुनिया की 25 % आबादी हैं।

वे —

-

पहले सच्चे डिजिटल नेटिव, जिनके लिए इंटरनेट पहचान है।

-

सबसे वैविध्यपूर्ण और वैश्विक पीढ़ी।

-

सबसे चिंतित, जहाँ 40 % लगातार तनावग्रस्त।

वे आर्थिक मंदी, AI के खतरे और जलवायु संकट के बीच युवावस्था में प्रवेश कर रहे हैं। डेटा और मीम्स पर निर्मित उनकी साझी चेतना ने नए आंदोलनों को जन्म दिया जिन्हें पुरानी संस्थाएँ भांप ही न सकीं।

व्यापक जेन ज़ लहर

नेपाल का विद्रोह अलग-थलग नहीं था — यह वैश्विक श्रृंखला का हिस्सा था।

-

केन्या (2024–25): फाइनेंस बिल विरोध से सरकार को पीछे हटना पड़ा।

-

बांग्लादेश (2024): प्रधानमंत्री शेख हसीना को हटाया गया।

-

श्रीलंका (2022): गोतबाया राजपक्षे को जन विद्रोह ने भगाया।

इन सभी ने वही डिजिटल ढाँचा तैयार किया जिसे नेपाल ने सबसे सफल तरीके से प्रयोग किया।

राजनीति से परे: आर्थिक और सांस्कृतिक शक्ति

आर्थिक दृष्टि से जेन ज़ सबसे अस्थिर पीढ़ी है। ऋण, महँगाई और AI से नौकरियों का खतरा उन्हें नई राहें ढूँढने को मजबूर कर रहा है —

-

पारंपरिक करियर की बजाय साइड-हसल और गिग वर्क।

-

नैतिक उपभोक्तावाद और सस्टेनेबल ब्रांड्स।

-

“बारबेल रणनीति” — कुछ जोखिमपूर्ण क्रिप्टो-वेंचर, कुछ हुनर-आधारित काम।

सांस्कृतिक रूप से वे व्यंग्य और आदर्शवाद का मिश्रण हैं — हास्य, अंदाज़ और ऐनिमे के माध्यम से विद्रोह व्यक्त करते हैं।

पर्यावरण और नैतिक आयाम

हर देश में जेन ज़ भ्रष्टाचार को पर्यावरणीय विफलता से जोड़ते हैं। नेपाल में नारा था:

“हरी धरती बिना शांति नहीं — भ्रष्ट हाथ धरती को दूषित करते हैं।”

फ़िलीपींस की बाढ़ और मेडागास्कर के ब्लैकआउट्स ने शासन की नाकामी को उजागर किया। Deloitte के अनुसार 70 % से अधिक जेन ज़ अपने करियर निर्णय सस्टेनेबिलिटी से जोड़ते हैं।

आगे का रास्ता: विद्रोह से पुनर्निर्माण तक

नेपाल की नई अंतरिम सरकार के सामने चुनौतियाँ बड़ी हैं — संस्थागत पुनर्गठन, डिजिटल अधिकार क़ानून, और फिर से अभिजात्य कब्ज़े को रोकना। पर इस क्रांति की विरासत अमिट है।

2030 तक जेन ज़ वैश्विक मतदाता बहुमत बन जाएँगे — और हर राजनीतिक संस्था को चुनना होगा: सुधार या समाप्ति।

जैसा एक वायरल पोस्ट कहता है:

“जेन ज़ परिवर्तन का इंतज़ार नहीं कर रहे — हम खुद परिवर्तन हैं।”

नेपाल शायद वह पहला देश सिद्ध हो जहाँ यह भविष्यवाणी सच हुई।

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

Sidebar Feature: Comparative Table — The Global “Gen Z Revolutions” (2022 – 2025)

A snapshot of the digitally fueled youth uprisings that reshaped modern politics across three continents.

| Country | Year & Trigger | Primary Causes | Outcome / Impact | Key Symbol or Slogan |

|---|---|---|---|---|

| 🇳🇵 Nepal | 2025 (Sept) — Social-media ban on 26 platforms | • Widespread corruption • Youth unemployment (20 %) • Economic dependence on remittances (33 % GDP) • Digital-rights suppression | • Gov’t toppled in 48 hrs • PM K.P. Oli resigned • Former CJ Sushila Karki became first female interim PM • 75 dead, 2,000+ injured | 🏴 “One Piece” Jolly Roger — symbol of rebellion & digital freedom / Hashtag #GenZRevolt |

| 🇰🇪 Kenya | 2024–25 Finance Bill Protests | • Tax hikes & fuel price spike • Youth job crisis • Perception of elite greed | • Gov’t withdrew Finance Bill • Two dozen protesters killed • Birth of “Generation Power” youth coalition | 🚩 Kenyan flag + meme culture / #RejectFinanceBill #OccupyParliament |

| 🇧🇩 Bangladesh | 2024 (Student uprising) | • Authoritarian rule of Sheikh Hasina • Joblessness • Press freedom curbs | • PM Hasina resigned • Caretaker gov’t installed • Hundreds killed in crackdown | 📱 “Digital Dissent” emoji campaign / #NoMoreNepoRule |

| 🇱🇰 Sri Lanka | 2022 (Economic collapse) | • Fuel & food shortages • Hyper-inflation • Corruption by Rajapaksa family | • Gotabaya Rajapaksa fled country • New reformist cabinet formed | 🏠 “Gota Go Home” chant became rallying cry |

| 🇲🇬 Madagascar | 2025 (Sept – Blackouts & poverty) | • 12-hr daily power cuts • Infrastructure failure • Youth poverty • Gov’t corruption | • 22 dead, 100+ injured • President Rajoelina dissolved cabinet • Army-led transition | 🏴 “One Piece” flag + local drums / #GenZMada |

| 🇲🇦 Morocco | 2025 (Oct – World Cup spending vs. austerity) | • Misallocation of funds • Education & health crisis • Urban youth anger | • 3 deaths • Gov’t crackdown • “Gen Z 212” network survived online as digital watchdog | ⚽ “One Piece” flag + #BreadNotStadiums |

| 🇵🇪 Peru | 2025 (Sept – Corruption & pensions) | • Political rot • Rising organized crime • Youth demand for transparency | • 19 injured • Reform talks began • Regional solidarity with Nepal & Indonesia | 💀 Jolly Roger + Andean condor symbolizing unity & defiance |

| 🇵🇭 Philippines | 2025 (Sept – Flood fund scandal) | • Corruption in public-works • Widening wealth gap • Climate mismanagement | • Thousands protested • Gov’t faced parliament probe • Youth network remains active | 🌊 One Piece flag + #NoMoreFloods / Eco-justice slogan “No Green, No Peace” |

✳ Trend Analysis

Common Threads:

-

Digital Catalysts: Social-media bans, online censorship, or viral corruption scandals triggered every revolt.

-

Demographics: Median protester age < 25; students and gig-workers dominated.

-

Decentralized Leadership: Movements ran via Discord, Telegram, and TikTok micro-cells.

-

Shared Culture: Anime, memes, and music unified youth across languages.

-

Core Demands: Transparency, jobs, climate justice, and digital freedom.

Global Outcome:

By late 2025, at least four governments (Nepal, Bangladesh, Sri Lanka, Madagascar) had fallen or restructured under youth pressure. Others faced enduring reform movements. Analysts now call this networked phenomenon “The First Digital Spring.”

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

साइडबार फीचर: तुलनात्मक तालिका — “जेन ज़ क्रांतियाँ” (2022–2025)

तीन महाद्वीपों में फैली डिजिटल रूप से संचालित युवा क्रांतियों की एक झलक, जिन्होंने आधुनिक राजनीति की परिभाषा बदल दी।

| देश | वर्ष और ट्रिगर (प्रेरक घटना) | मुख्य कारण | परिणाम / प्रभाव | प्रमुख प्रतीक या नारा |

|---|---|---|---|---|

| 🇳🇵 नेपाल | 2025 (सितंबर) — 26 सोशल मीडिया प्लेटफॉर्म्स पर प्रतिबंध | • व्यापक भ्रष्टाचार • युवा बेरोज़गारी (20%) • रेमिटेंस पर निर्भरता (GDP का 33%) • डिजिटल अधिकारों का दमन | • 48 घंटों में सरकार गिरी • पीएम के.पी. ओली ने इस्तीफ़ा दिया • सुषिला कार्की बनीं पहली महिला अंतरिम प्रधानमंत्री • 75 मौतें, 2,000+ घायल | 🏴 “वन पीस” जोली रोजर झंडा — विद्रोह और डिजिटल स्वतंत्रता का प्रतीक / हैशटैग #GenZRevolt |

| 🇰🇪 केन्या | 2024–25 (फाइनेंस बिल विरोध) | • टैक्स वृद्धि और ईंधन की महंगाई • युवाओं में बेरोज़गारी • अभिजात वर्ग की लालच से नाराज़गी | • सरकार ने वित्त विधेयक वापस लिया • दो दर्जन प्रदर्शनकारी मारे गए • “Generation Power” नामक युवा गठबंधन उभरा | 🚩 केन्याई झंडा + मीम संस्कृति / #RejectFinanceBill #OccupyParliament |

| 🇧🇩 बांग्लादेश | 2024 (छात्र विद्रोह) | • शेख हसीना का अधिनायकवादी शासन • नौकरियों की कमी • अभिव्यक्ति की स्वतंत्रता पर अंकुश | • पीएम हसीना ने इस्तीफ़ा दिया • कार्यवाहक सरकार बनी • सैकड़ों लोग मारे गए | 📱 “डिजिटल डिसेंट” (Digital Dissent) इमोजी अभियान / #NoMoreNepoRule |

| 🇱🇰 श्रीलंका | 2022 (आर्थिक पतन) | • ईंधन और खाद्य संकट • अत्यधिक महँगाई • राजपक्षे परिवार का भ्रष्टाचार | • राष्ट्रपति गोटबाया राजपक्षे देश से भागे • सुधारवादी अंतरिम सरकार बनी | 🏠 “Gota Go Home” — जनक्रोध का नारा |

| 🇲🇬 मेडागास्कर | 2025 (सितंबर – ब्लैकआउट और गरीबी) | • रोज़ाना 12 घंटे बिजली कटौती • बुनियादी ढांचे की विफलता • युवाओं में ग़रीबी और भ्रष्टाचार | • 22 मौतें, 100+ घायल • राष्ट्रपति रजोएलिना ने कैबिनेट भंग की • सेना-नेतृत्व वाली अंतरिम व्यवस्था | 🏴 “वन पीस” झंडा + स्थानीय ड्रम / #GenZMada |

| 🇲🇦 मोरक्को | 2025 (अक्टूबर – वर्ल्ड कप खर्च बनाम जनसंकट) | • संसाधनों का दुरुपयोग • शिक्षा और स्वास्थ्य संकट • शहरी युवाओं की नाराज़गी | • 3 मौतें, दर्जनों घायल • सरकार की दमनकारी प्रतिक्रिया • “Gen Z 212” नेटवर्क डिजिटल निगरानी समूह बना रहा | ⚽ “वन पीस” झंडा + #BreadNotStadiums |

| 🇵🇪 पेरू | 2025 (सितंबर – भ्रष्टाचार और पेंशन संकट) | • राजनीतिक पतन • अपराध और माफिया का प्रभाव • पारदर्शिता की माँग | • 19 घायल • सुधार वार्ताएँ शुरू • नेपाल और इंडोनेशिया के साथ एकजुटता अभियान | 💀 “जोली रोजर” + एंडियन कोंडोर — एकता और विद्रोह का प्रतीक |

| 🇵🇭 फ़िलीपींस | 2025 (सितंबर – बाढ़ राहत घोटाला) | • सार्वजनिक परियोजनाओं में भ्रष्टाचार • अमीरी-गरीबी की बढ़ती खाई • जलवायु कुप्रबंधन | • हज़ारों युवा सड़कों पर उतरे • संसद ने जाँच शुरू की • “Gen Z नेटवर्क” सक्रिय रहा | 🌊 “वन पीस” झंडा + #NoMoreFloods / पर्यावरण नारा — “No Green, No Peace” |

✳ रुझान विश्लेषण (Trend Analysis)

साझे सूत्र:

-

डिजिटल उत्प्रेरक: हर आंदोलन की शुरुआत सोशल मीडिया प्रतिबंध, ऑनलाइन सेंसरशिप या किसी वायरल भ्रष्टाचार घोटाले से हुई।

-

जनसांख्यिकी: औसत प्रदर्शनकारी की उम्र 25 वर्ष से कम; छात्र, गिग वर्कर और डिजिटल क्रिएटर अग्रणी भूमिका में।

-

नेतृत्वहीन संरचना: Discord, Telegram, TikTok जैसे प्लेटफ़ॉर्मों पर विकेन्द्रीकृत संगठन।

-

संस्कृति का मिश्रण: एनीमे, मिम्स और संगीत ने भाषाई सीमाएँ तोड़ीं।

-

मुख्य माँगें: पारदर्शिता, रोज़गार, जलवायु न्याय और डिजिटल स्वतंत्रता।

वैश्विक परिणाम:

2025 के अन्त तक कम से कम चार देशों (नेपाल, बांग्लादेश, श्रीलंका, मेडागास्कर) में सरकारें गिरीं या पुनर्गठित हुईं। अन्य देशों में सुधार और जनदबाव की लहर जारी रही।

राजनीतिक विश्लेषक अब इस श्रृंखला को “द फर्स्ट डिजिटल स्प्रिंग” (The First Digital Spring) कह रहे हैं — अर्थात् इतिहास की पहली सच्ची वैश्विक डिजिटल जनक्रांति।

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

Nepal’s Gen Z Revolution: The French Revolution of the Digital Age

Just as the French Revolution of 1789 marked a historic rupture from feudalism and monarchy — dismantling old hierarchies and heralding modern democracy — Nepal’s Gen Z Revolution of 2025 represents an equally profound break from the past. It is not merely a protest against political corruption; it is a demand for a new kind of democracy, a new kind of economics, and a new kind of social contract for the 21st century.

Beyond Corruption: A Rebellion Against Systemic Decay

The French Revolution was triggered by hunger, taxation, and the moral decay of the aristocracy. Nepal’s Gen Z Revolution, centuries later, is born from a similar disillusionment — only this time, the oppressor is not a king but a system infected by corruption, nepotism, and digital-age inequality.

For years, Nepal’s youth — one of the most educated generations in the country’s history — have watched their hopes eroded by elite privilege, unemployment, and institutional rot. The social media ban of September 2025, intended to silence dissent, instead ignited a nationwide revolt that toppled a government in just 48 hours.

But the revolt’s real fuel was not a single policy misstep; it was decades of accumulated frustration — frustration at seeing national wealth stolen, dreams outsourced, and opportunities traded for remittances.

A Revolt Against the Remittance Economy

Where the French peasants once rebelled against feudal landlords, today’s Nepali youth have rebelled against another invisible master: the remittance economy. For years, a third of Nepal’s GDP has depended on money sent by workers abroad.

This system has created a fractured society — parents separated from children, villages hollowed out, and entire generations defined by absence. The economy survives, but families crumble.

Gen Z’s revolt, therefore, is not only about political accountability. It is about reclaiming dignity at home. It is a cry for a Nepal where no one must leave to live.

As one protest banner read:

“We don’t want visas — we want value.”

A New Kind of Democracy

Just as the French Revolution expanded the definition of citizenship, Nepal’s Gen Z uprising seeks to redefine democracy itself.

The youth are not asking for the mere right to vote every five years — they are demanding participatory, transparent, tech-enabled democracy.

Through platforms like Discord, Telegram, and decentralized online networks, Nepal’s young citizens have already built a parallel model of governance — a democracy from below, not above.

This “fractal democracy,” where leadership emerges organically from communities rather than being imposed by party hierarchies, could become Nepal’s greatest political innovation.

If the French Revolution birthed the idea of the Republic, Nepal’s movement may well birth the world’s first digital republic — powered by data, openness, and direct citizen engagement.

A New Kind of Economics

Gen Z’s rebellion also questions the very foundations of the economic model Nepal has inherited — one based on extraction, dependency, and inequality.

They envision an economy not driven by remittances or foreign loans, but by domestic productivity, innovation, and job guarantees.

The idea is radical but not utopian: with anti-corruption reforms, digital transparency, and local investment in green and tech sectors, it is possible to ensure employment for every Nepali inside Nepal.

Such a system would transform Nepal from a labor-exporting nation to a talent-retaining nation, from a remittance receiver to a creator of value.

It is a vision where economic security replaces despair, and where work becomes not migration but contribution.

Corruption-Free Nepal: A Global First

Perhaps the most revolutionary goal of all is the call for a corruption-free Nepal.

If realized, this would not only transform the country’s destiny but also set a precedent for the world.

No nation has yet achieved zero corruption, but Nepal’s Gen Z believes it is possible — through digital governance, blockchain transparency, and moral renewal.

This ambition mirrors the moral clarity that once animated the French revolutionaries, who sought liberty, equality, and fraternity. In Nepal, those ideals find new expression: transparency, dignity, and opportunity for all.

Echoes of 1789, Rewritten for 2025

The French Revolution replaced kings with citizens; the Nepali Revolution seeks to replace corruption with integrity.

The French tore down castles; the Nepali youth are tearing down firewalls.

Where the French stormed the Bastille, Nepalis stormed Singha Durbar — not with muskets, but with memes, messages, and mass mobilization.

Both revolutions share one timeless truth: when ordinary people unite against oppression — whether royal or systemic — history bends toward justice.

The Promise of a New Nepal

If Nepal succeeds in building a corruption-free, job-guaranteed, digitally democratic society, it could become the first truly post-corruption nation on Earth — a beacon of hope for the Global South and beyond.

Just as France once lit the torch of modern democracy, Nepal may light the torch of digital democracy — proving that even a small Himalayan nation can lead humanity into a new political era.

The world once said, “We are all French.”

Perhaps soon, it will say, “We are all Nepali.”

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

नेपाल की जेन-ज़ क्रांति: डिजिटल युग की फ्रांसीसी क्रांति

जिस तरह 1789 की फ्रांसीसी क्रांति सामंती व्यवस्था और राजशाही से एक ऐतिहासिक मोड़ थी — जिसने पुराने ढाँचों को तोड़ा और आधुनिक लोकतंत्र की नींव रखी — उसी तरह 2025 की नेपाल की जेन-ज़ क्रांति भी एक गहरे ऐतिहासिक परिवर्तन का प्रतीक है। यह केवल भ्रष्टाचार के खिलाफ़ विद्रोह नहीं था; यह नई तरह के लोकतंत्र, नई तरह की अर्थव्यवस्था, और नई तरह के सामाजिक अनुबंध की माँग थी — डिजिटल युग के लिए।

भ्रष्टाचार से परे: तंत्र के पतन के खिलाफ़ विद्रोह

फ्रांसीसी क्रांति भूख, करों और अभिजात वर्ग की नैतिक पतन से शुरू हुई थी। नेपाल की जेन-ज़ क्रांति भी उसी प्रकार की मोहभंग से उपजी — बस फर्क इतना था कि इस बार दुश्मन कोई राजा नहीं था, बल्कि भ्रष्टाचार, भाई-भतीजावाद और डिजिटल युग की असमानता से ग्रस्त एक व्यवस्था थी।

सालों से नेपाल के शिक्षित युवाओं ने देखा कि अवसर कैसे अभिजात वर्ग के हाथों में सिमटते जा रहे हैं, जबकि आम जनता बेरोज़गारी और भ्रष्टाचार के दलदल में फँसी है।

सितंबर 2025 में सोशल मीडिया प्रतिबंध ने इस असंतोष को विस्फोटित कर दिया — और महज़ 48 घंटों में सरकार गिर गई।

लेकिन यह विस्फोट केवल एक नीति के कारण नहीं था; यह दशकों से जमा आक्रोश था — चुराए गए संसाधनों, बर्बाद किए गए सपनों और रेमिटेंस पर निर्भर अर्थव्यवस्था के खिलाफ़।

रेमिटेंस अर्थव्यवस्था के खिलाफ़ विद्रोह

जिस तरह फ्रांसीसी किसानों ने ज़मींदारों के ख़िलाफ़ विद्रोह किया था, वैसे ही आज के नेपाली युवाओं ने रेमिटेंस अर्थव्यवस्था के एक अदृश्य शासक के ख़िलाफ़ बगावत की है।

वर्षों से नेपाल की अर्थव्यवस्था का लगभग एक-तिहाई हिस्सा (33%) विदेशों से भेजे गए पैसों पर निर्भर रहा है।

यह एक टूटा हुआ समाज बना चुका है — माता-पिता विदेशों में, बच्चे गाँवों में अकेले; परिवारों का बिखराव, युवाओं की हताशा, और राष्ट्र का पलायन।

इसलिए यह क्रांति केवल राजनीतिक जवाबदेही के लिए नहीं थी, यह सम्मान और स्वाभिमान की पुनर्स्थापना के लिए थी।

यह आवाज़ थी — “अब कोई नेपाली रोज़गार के लिए नेपाल से बाहर क्यों जाए?”

जैसा कि एक बैनर पर लिखा था:

“हमें वीज़ा नहीं, मूल्य चाहिए।”

लोकतंत्र का नया रूप

फ्रांसीसी क्रांति ने नागरिकता की परिभाषा बदली; नेपाल की जेन-ज़ क्रांति लोकतंत्र की परिभाषा बदलना चाहती है।

यह पीढ़ी केवल हर पाँच साल में वोट देने का अधिकार नहीं चाहती — यह भागीदारी वाला, पारदर्शी और तकनीक-संचालित लोकतंत्र चाहती है।

Discord, Telegram और अन्य डिजिटल प्लेटफॉर्मों पर युवाओं ने पहले ही एक समानांतर लोकतंत्र बना लिया है — जहाँ नेतृत्व नीचे से ऊपर आता है, न कि ऊपर से थोप दिया जाता है।

यह “फ्रैक्टल लोकतंत्र” या Digital People’s Republic की झलक देता है — एक ऐसा लोकतंत्र जो सीधे नागरिकों के हाथों में है।

यदि फ्रांसीसी क्रांति ने “रिपब्लिक” की अवधारणा दी थी, तो नेपाल शायद दुनिया को पहली डिजिटल रिपब्लिक देगा।

अर्थव्यवस्था का नया प्रतिमान

जेन-ज़ की यह क्रांति नेपाल की आर्थिक संरचना को भी चुनौती देती है — जो विदेशी ऋण, रेमिटेंस और असमानता पर आधारित रही है।

युवा अब एक ऐसी अर्थव्यवस्था चाहते हैं जहाँ विकास बाहरी नहीं, घरेलू नवाचार, उत्पादन और रोज़गार गारंटी पर टिका हो।

यह कल्पना असंभव नहीं है — अगर भ्रष्टाचार समाप्त, डिजिटल पारदर्शिता स्थापित, और ग्रीन व टेक सेक्टर में निवेश बढ़ाया जाए, तो हर नेपाली को नेपाल में ही रोजगार देना संभव है।

इससे नेपाल एक “श्रम-निर्यातक देश” से “मूल्य-निर्माता राष्ट्र” बन सकता है — एक ऐसा राष्ट्र जहाँ “रोज़गार” का अर्थ “प्रवासन” नहीं, बल्कि योगदान होगा।

भ्रष्टाचार-मुक्त नेपाल: एक वैश्विक प्रथम

शायद इस क्रांति का सबसे साहसिक लक्ष्य है — भ्रष्टाचार-मुक्त नेपाल।

यदि यह संभव हुआ, तो यह केवल नेपाल की नहीं, बल्कि मानव इतिहास की दिशा बदल देगा।

आज तक कोई भी देश शून्य भ्रष्टाचार प्राप्त नहीं कर पाया है, पर नेपाल की युवा पीढ़ी मानती है कि यह संभव है —

डिजिटल गवर्नेंस, ब्लॉकचेन पारदर्शिता, और नैतिक पुनर्जागरण के माध्यम से।

यह वही नैतिक स्पष्टता है जो कभी फ्रांसीसी क्रांतिकारियों को प्रेरित करती थी — स्वतंत्रता, समानता, बंधुत्व।

नेपाल में यह भावना नए रूप में जन्म ले रही है — पारदर्शिता, गरिमा और अवसर।

1789 की गूँज, 2025 की भाषा में

फ्रांस ने राजा को हटाकर नागरिकों को केंद्र में रखा; नेपाल भ्रष्टाचार को हटाकर ईमानदारी को केंद्र में रखना चाहता है।

फ्रांस में लोगों ने महल तोड़े; नेपाल में युवाओं ने फ़ायरवॉल तोड़ दिए।

जहाँ फ्रांसीसी भीड़ ने बास्टिल पर धावा बोला था, वहीं नेपाली युवाओं ने सिंहदरबार को घेरा — हथियारों से नहीं, मेम्स, संदेशों और सामूहिक संगठन से।

दोनों क्रांतियाँ एक शाश्वत सत्य बताती हैं:

“जब आम लोग अन्याय के ख़िलाफ़ एकजुट होते हैं, इतिहास न्याय की ओर मुड़ जाता है।”

नए नेपाल का वादा

यदि नेपाल एक भ्रष्टाचार-मुक्त, रोजगार-गारंटीयुक्त और डिजिटल लोकतंत्र बना पाया, तो वह मानव इतिहास का पहला ‘पोस्ट-करप्शन’ राष्ट्र होगा — एक ऐसा देश जो वैश्विक दक्षिण के लिए आशा का दीप बनेगा।

जिस तरह फ्रांस ने आधुनिक लोकतंत्र का दीप जलाया था, नेपाल डिजिटल युग का दीप जला सकता है — यह दिखाते हुए कि एक छोटा हिमालयी राष्ट्र भी मानवता को नए युग में ले जा सकता है।

दुनिया ने एक समय कहा था — “हम सब फ्रांसीसी हैं।”

शायद अब समय आ गया है जब वह कहे —

“हम सब नेपाली हैं।”

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

Nepal’s Gen Z Revolution: The Global Antidote to the Anti-Immigration Wave

Across much of the Western world — from the United States to the United Kingdom, from Italy to France — an unmistakable political current is shaping our era: a rising wave of anti-immigration sentiment. Borders are tightening, refugee quotas shrinking, and populist rhetoric surging. Migration, once celebrated as a lifeline of global exchange, has increasingly been cast as a threat to identity, jobs, and security.

But far away from the polarized politics of the West, a very different kind of movement has emerged — one that could redefine the conversation on migration altogether. Nepal’s Gen Z Revolution of 2025, led by a digitally networked generation of young people, may prove to be the world’s first real antidote to the anti-immigration backlash.

The Global Context: When Migration Meets Fear

The anti-immigration wave did not appear overnight. In the United States, the issue has reshaped presidential elections and fueled border crises. In Europe, it has empowered far-right parties and fractured the idea of open borders that once defined the European Union.

The underlying anxiety is economic: who gets to work, and where.

Automation, stagnant wages, and demographic changes have made citizens in rich nations fear job loss and cultural dilution. Politicians have weaponized this fear, turning migrants — especially those from the Global South — into scapegoats for systemic problems.

As walls rise and visas vanish, the developing world faces a harsher reality: if the doors to opportunity abroad close, what happens to the millions who depended on migration for survival?

The Nepali Breakthrough: Jobs at Home, Dignity at Home

Nepal’s Gen Z Revolution has offered an answer that could rewrite that equation entirely.

In a country where one-third of GDP depends on remittances, migration has long been a survival mechanism. Over four million Nepalis work abroad, often in harsh and exploitative conditions — building Gulf skyscrapers, cleaning Malaysian factories, or working as domestic labor in the Middle East.

But in September 2025, after the youth-led uprising toppled the government in 48 hours, a new national conversation began:

What if every Nepali could have a guaranteed job inside Nepal?

This was not a utopian dream. Protest leaders, many of them under 25, framed job guarantees not as charity but as a right — the cornerstone of a new social contract.

Their vision:

-

Digital transparency to end corruption that bleeds billions.

-

Public works and green industries to absorb labor domestically.

-

Local entrepreneurship and AI-driven innovation hubs to keep talent home.

-

A participatory democracy where citizens co-design budgets and development plans.

If fully implemented, this model could not only end Nepal’s dependency on remittances but also reverse the logic of global migration itself.

Why the World Should Pay Attention

If Nepal can prove that a small, developing nation can create full employment through governance reform and youth-driven innovation, it would upend one of the most persistent myths in global economics: that prosperity for the Global South must come through migration.

Instead, it would signal a paradigm shift — from exporting labor to building dignity at home.

For the Global South — from Central America to Sub-Saharan Africa — this idea could be revolutionary.

Consider the parallels:

-

Guatemala, Honduras, El Salvador, and Mexico have seen millions flee northward, driven by corruption, violence, and unemployment.

-

Philippines and Bangladesh, like Nepal, survive on remittances at enormous social cost — families split for decades, economies vulnerable to global downturns.

If these countries adopted Nepal’s “Job Guarantee Within Borders” model, the outcome could be transformative: fewer desperate migrations, more local stability, and stronger domestic economies.

A Political Antidote to Western Fear

In the West, anti-immigration rhetoric thrives on a simple narrative — “They’re coming for our jobs.”

But if the Global South can offer jobs at home, that narrative collapses.

Imagine if nations across Asia, Africa, and Latin America each ensured dignified work and fair wages domestically. Migration would become a choice, not a compulsion. Borders would lose their toxicity. Global cooperation could return to being about trade, knowledge, and culture — not barbed wire and detention centers.

In that sense, Nepal’s Gen Z Revolution is not only a domestic awakening but a moral counterpoint to Western fear politics.

It replaces exclusion with inclusion, and dependency with dignity.

The Global South Template: A Possible Future

Nepal’s uprising may well serve as a blueprint for the Global South — particularly the regions south of the U.S.–Mexico border, where youth frustration mirrors Nepal’s own pre-2025 condition.

There, too, young people are online, angry, and eager for transformation. What they lack is not courage but a credible model — proof that reform can work. Nepal’s Gen Z movement may provide exactly that proof:

-

That corruption can be dismantled digitally.

-

That domestic industries can thrive with honest governance.

-

That migration can be reversed without isolation.

This is not about nationalism; it is about post-dependency economics — a new stage of development where the goal is not to leave one’s country, but to rebuild it.

Conclusion: From the Himalayas to Humanity

In an age when powerful nations build higher walls and harsher laws, Nepal’s youth have built something else — a new idea.

A vision that says:

“The answer to migration is not rejection, but regeneration.”

By demanding jobs at home, dignity in work, and transparency in governance, Nepal’s Gen Z Revolution has planted a seed that could grow far beyond the Himalayas.

It challenges both North and South — the rich and the poor — to rethink what freedom, mobility, and prosperity mean in the 21st century.

If the French Revolution once inspired political equality, and the Industrial Revolution economic progress, then perhaps the Nepali Revolution will inspire a world where no one must leave home to live with dignity.

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

नेपाल की जेन-ज़ क्रांति: अमीर देशों में फैली एंटी-इमिग्रेशन लहर का वैश्विक समाधान

आज पूरी दुनिया में — अमेरिका से लेकर यूरोप तक — एक नई राजनीतिक हवा बह रही है: प्रवासन-विरोधी (Anti-Immigration) लहर।

सीमाएँ कड़ी की जा रही हैं, शरणार्थी कोटे घटाए जा रहे हैं, और प्रवासियों को “खतरा” बताने वाली राजनीति तेज़ी से लोकप्रिय हो रही है।

जो प्रवासन कभी वैश्विक आदान-प्रदान और अवसर का प्रतीक था, वही अब पहचान, रोज़गार और सुरक्षा के लिए खतरा बताया जा रहा है।

लेकिन पश्चिमी दुनिया की इस उथल-पुथल से दूर, हिमालय की गोद में एक बिल्कुल अलग आंदोलन उभर रहा है — एक ऐसा आंदोलन जो इस वैश्विक भय और विभाजन की राजनीति का पहला सच्चा प्रतिविष (antidote) बन सकता है।

यह आंदोलन है नेपाल की जेन-ज़ क्रांति (Gen Z Revolution) — जो यह साबित कर रही है कि अगर हर नागरिक को अपने ही देश में सम्मानजनक रोज़गार मिले, तो प्रवासन की मजबूरी खत्म की जा सकती है।

वैश्विक परिदृश्य: जब प्रवासन “भय” बन गया

अमेरिका और यूरोप में यह प्रवासन-विरोधी लहर अचानक नहीं आई।

अमेरिका में यह मुद्दा चुनावों का मुख्य हथियार बन चुका है।

यूरोप में “ओपन बॉर्डर्स” का सपना टूट चुका है, और अतिवादी दक्षिणपंथी दल सत्ता के केंद्र तक पहुँच रहे हैं।

असल डर आर्थिक है — “रोज़गार किसका होगा?”

ऑटोमेशन, मंदी, और बदलती जनसांख्यिकी ने पश्चिमी नागरिकों को असुरक्षित बना दिया है।

नेताओं ने इस असुरक्षा को राजनीतिक हथियार बना लिया — और प्रवासी मजदूरों को बलि का बकरा बना दिया।

पर जब अमीर देश दीवारें ऊँची कर रहे हैं और वीज़ा बंद कर रहे हैं, तब एक सवाल उठता है —

“जो लोग रोज़गार के लिए विदेश जाते हैं, उनका क्या होगा अगर ये दरवाज़े हमेशा के लिए बंद हो जाएँ?”

नेपाल का नया रास्ता: रोज़गार भी यहीं, सम्मान भी यहीं

नेपाल की जेन-ज़ क्रांति ने इस सवाल का जवाब दिया है।

नेपाल एक ऐसा देश है जिसकी एक-तिहाई अर्थव्यवस्था (33% GDP) रेमिटेंस यानी विदेशों से भेजे गए पैसों पर निर्भर है।

करीब 40 लाख नेपाली मजदूर विदेशों में काम करते हैं — खाड़ी देशों में निर्माण स्थलों पर, मलेशिया के कारखानों में, या मध्य पूर्व के घरों में घरेलू कामगार बनकर।

लेकिन सितंबर 2025 की क्रांति के बाद, जब युवा प्रदर्शनकारियों ने 48 घंटों में सरकार गिरा दी,

तो देश में एक नया विचार जन्मा —

“क्यों न हर नेपाली को नेपाल में ही रोजगार की गारंटी दी जाए?”

यह कोई काल्पनिक सपना नहीं था।

25 वर्ष से कम उम्र के युवाओं ने इसे “अधिकार” बताया — एक नए सामाजिक अनुबंध (social contract) का आधार।

उनकी दृष्टि थी:

-

डिजिटल पारदर्शिता, ताकि भ्रष्टाचार से लीक होता धन रोका जा सके।

-

हरित ऊर्जा और पब्लिक वर्क्स कार्यक्रम, जो स्थानीय रोजगार पैदा करें।

-

AI आधारित नवाचार केंद्र और उद्यमिता, जो प्रतिभा को देश में ही रोकें।

-

भागीदारी लोकतंत्र, जिसमें नागरिक स्वयं नीति निर्माण में शामिल हों।

यदि यह मॉडल सफल हुआ, तो नेपाल न केवल अपनी रेमिटेंस निर्भरता से मुक्त होगा, बल्कि वैश्विक प्रवासन की सोच को ही पलट देगा।

क्यों पूरी दुनिया को ध्यान देना चाहिए

अगर नेपाल यह साबित कर देता है कि एक छोटा, विकासशील देश भी शासन-सुधार और युवा नवाचार के ज़रिए पूर्ण रोजगार दे सकता है,

तो यह दुनिया की सबसे बड़ी आर्थिक धारणा को चुनौती देगा —

कि “गरीब देशों की समृद्धि का रास्ता प्रवासन से होकर गुजरता है।”

इसके बजाय यह एक नए युग की घोषणा होगी —

“प्रवासन नहीं, सम्मान और अवसर अपने घर पर।”

यह संदेश विशेष रूप से ग्लोबल साउथ के लिए महत्वपूर्ण है —

मध्य अमेरिका, अफ्रीका और दक्षिण एशिया के वे देश जहाँ युवा आज भी पलायन को ही एकमात्र विकल्प मानते हैं।

-

ग्वाटेमाला, होंडुरस, एल साल्वाडोर और मेक्सिको में बेरोज़गारी और भ्रष्टाचार से लाखों लोग उत्तर की ओर भागते हैं।

-

फिलिपींस और बांग्लादेश, नेपाल की तरह, रेमिटेंस पर निर्भर हैं — लेकिन इसकी कीमत परिवारों के बिछोह से चुकाते हैं।

अगर ये देश नेपाल के “Job Guarantee Within Borders” मॉडल को अपनाएँ, तो परिणाम क्रांतिकारी हो सकते हैं —

कम पलायन, अधिक स्थिरता, और मज़बूत स्थानीय अर्थव्यवस्था।

पश्चिमी भय का राजनीतिक समाधान

अमीर देशों की “एंटी-इमिग्रेशन” राजनीति एक ही डर पर टिकी है —

“वे हमारे रोजगार छीन लेंगे।”

लेकिन अगर दक्षिण के देश अपने नागरिकों को घर पर ही रोज़गार दे सकें,

तो यह डर मूल से समाप्त हो जाएगा।

कल्पना कीजिए — अगर एशिया, अफ्रीका और लैटिन अमेरिका के हर युवा को अपने देश में सम्मानजनक नौकरी मिले,

तो प्रवासन एक “मजबूरी” नहीं, बल्कि “चयन” बन जाएगा।

सीमाएँ ज़हर नहीं, संवाद बनेंगी।

विश्व सहयोग फिर व्यापार, ज्ञान और संस्कृति पर लौट आएगा — न कि दीवारों और नफ़रत पर।

यही कारण है कि नेपाल की जेन-ज़ क्रांति केवल एक देश की कहानी नहीं, बल्कि पश्चिमी भय की राजनीति का नैतिक प्रतिवाद है।

यह बहिष्कार की जगह सहभागिता, और निर्भरता की जगह गरिमा रखती है।

ग्लोबल साउथ के लिए एक नया टेम्पलेट

नेपाल की यह क्रांति ग्लोबल साउथ के लिए एक खाका (template) बन सकती है —

खासकर उन देशों के लिए जो अमेरिका–मेक्सिको सीमा के दक्षिण में हैं।

वहाँ भी युवा ऑनलाइन हैं, जागरूक हैं, क्रोधित हैं — उन्हें केवल एक प्रमाण चाहिए कि बदलाव संभव है।

नेपाल का उदाहरण यही प्रमाण बन सकता है:

-

कि भ्रष्टाचार डिजिटल शासन से मिटाया जा सकता है।

-

कि ईमानदार सरकार स्थानीय उद्योगों को खड़ा कर सकती है।

-

कि प्रवासन घटाया जा सकता है, बिना एकाकीपन के।

यह राष्ट्रवाद नहीं है — यह है “पोस्ट-डिपेंडेंसी इकॉनॉमिक्स” —

विकास का वह नया चरण जहाँ लक्ष्य विदेश जाना नहीं, अपने देश को बनाना है।

निष्कर्ष: हिमालय से मानवता तक

जब अमीर देश दीवारें ऊँची बना रहे हैं,

नेपाल के युवाओं ने एक नई दीवार नहीं, बल्कि एक नया विचार खड़ा किया है।

एक विचार जो कहता है —

“प्रवासन का समाधान बहिष्कार नहीं, पुनर्निर्माण है।”

अपने देश में रोज़गार, सम्मान और पारदर्शिता की माँग करके,

नेपाल की जेन-ज़ क्रांति ने एक ऐसा बीज बोया है जो हिमालय से बहुत दूर तक अंकुरित हो सकता है।

यह उत्तर और दक्षिण, अमीर और गरीब — दोनों को चुनौती देता है कि वे सोचें:

स्वतंत्रता, अवसर और समृद्धि का अर्थ अब क्या है?

अगर फ्रांसीसी क्रांति ने राजनीतिक समानता,

और औद्योगिक क्रांति ने आर्थिक प्रगति दी,

तो शायद नेपाल की क्रांति वह युग लाएगी

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

जहाँ कोई भी व्यक्ति गरिमा से जीने के लिए अपना घर छोड़ने पर मजबूर न हो।

Nepali Flag Waves in Tbilisi: Georgia’s Emerging Gen Z Movement Echoes Nepal

In a dramatic twist of global protest imagery, youth demonstrators in Georgia were recently seen waving the Nepali national flag during mass protests outside the presidential palace in Tbilisi — an act analysts say signals solidarity with Nepal’s Gen Z uprising and a broader cross-border youth rebellion. (myRepublica)

What’s Happening in Georgia

Tens of thousands of young Georgians have surrounded the presidential residence, demanding sweeping political reforms, accountability, and an end to entrenched corruption. (myRepublica) Among the signs of international resonance was the sudden appearance of the Nepal flag — fluttering amid chants and banners — a symbolic nod to the revolution Nepal witnessed in September 2025. (myRepublica)

An on-the-ground protester told OC Media that the Georgian government “has put itself into the Nepali scenario,” meaning that young Georgians view their struggle as analogous to Nepal’s Gen Z-led uprising. (myRepublica)

Social media and video footage show the Nepali flag held aloft near state security barriers and at key junctions during the protest. (Facebook)

Why the Nepali Flag? A Symbol Across Borders

Nepal’s Gen Z movement overthrew a sitting government in 48 hours, toppling a regime widely seen as corrupt and unaccountable. (Wikipedia) The flag’s appearance in Georgia is no accident — it is a deliberate symbolic act, linking youthful discontent in Georgia to a broader regional movement for transparency, equity, and digital freedom.

The flag is likely being used less as a purely national symbol and more as a protest emblem — borrowing the legitimacy of Nepal’s recent success to strengthen the moral claim of Georgian demonstrators.

There is precedent: in Nepal’s uprising, protestors adopted symbols from global youth culture (like the One Piece pirate flag) to convey rebellion and resistance. (The Guardian)

What We Don’t Yet Know — And What To Watch

-

It's unclear who brought the Nepali flag or whether the act was coordinated by a local group inspired by Nepal.

-

We don’t yet have confirmation of formal links or communications between Georgian youth activists and Nepali networks.

-

Official responses in Georgia to the flag gesture are not publicly documented yet.

-

The risk of backlash is real: some governments regard foreign symbolism in protests as subversive or foreign influence.

What will be interesting to observe in coming days:

-

Messaging: Will Georgian protest leaders explicitly cite Nepal as their model?

-

Network connections: Are there shared digital links (Discord, Telegram, etc.) forming bridges between Gen Z activists across nations?

-

Government reaction: Will Georgian authorities attempt to de-legitimize the protests by framing them as foreign-influenced?

A New Pattern of Youth Solidarity

What is unfolding in Georgia is more than a local protest — it is a sign of a shared language of resistance. In 2025, Gen Z movements from Nepal to Madagascar, Morocco to Peru, have borrowed each other’s symbols, tactics, and stories of defiance. (Wikipedia)

The waving of the Nepali flag in Tbilisi suggests that these are no longer isolated national struggles, but a networked uprising of youth voiced across borders. Whether Georgia’s movement will reap the same breakthroughs Nepal did remains to be seen — but it has embraced the symbolic aspiration.

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

त्बिलिसी में नेपाली झंडा: जॉर्जिया में उभरती जेन-ज़ क्रांति ने नेपाल को बनाया प्रतीक

जॉर्जिया की राजधानी त्बिलिसी में हाल ही में हुए व्यापक प्रदर्शनों में एक चौंकाने वाला दृश्य देखा गया — युवाओं की भीड़ नेपाली राष्ट्रीय झंडा लहराते हुए सड़कों पर थी।

यह दृश्य केवल जॉर्जिया की राजनीति की नहीं, बल्कि वैश्विक युवा आंदोलन की नई दिशा की कहानी कह रहा है — एक ऐसी दिशा जिसकी प्रेरणा है नेपाल की जेन-ज़ क्रांति (Gen Z Revolution of 2025)।

जॉर्जिया में क्या हो रहा है?

जॉर्जिया में हज़ारों युवा प्रदर्शनकारी राष्ट्रपति निवास के बाहर एकत्र हुए हैं।

उनकी माँगें हैं — राजनीतिक सुधार, जवाबदेही, और भ्रष्टाचार का अंत।

कई प्रदर्शनकारियों ने सोशल मीडिया पर लाइव वीडियो में कहा कि वे नेपाल से प्रेरित हैं, जहाँ 2025 में युवाओं ने 48 घंटे में भ्रष्ट सरकार को गिरा दिया था।

इन प्रदर्शनों के दौरान नेपाली झंडे का दिखाई देना कोई संयोग नहीं था।

यह एक प्रतीकात्मक संदेश था —

“हम भी वही कर रहे हैं जो नेपाल ने किया।”

स्थानीय मीडिया OC Media के मुताबिक, एक प्रदर्शनकारी ने कहा,

“हमारे हालात नेपाल जैसे हैं। सरकार ने जनता की आवाज़ को अनसुना किया है। अब युवा खुद परिवर्तन लाएँगे।”

वीडियो फुटेज में देखा गया कि नेपाली झंडा राष्ट्रपति भवन के सामने की भीड़ में लहराया जा रहा था, और लोग “Freedom, Transparency, Future!” के नारे लगा रहे थे।

नेपाली झंडा क्यों? सीमाओं से परे एक प्रतीक

नेपाल की जेन-ज़ क्रांति, जिसने भ्रष्टाचार और सोशल मीडिया प्रतिबंध के खिलाफ़ आवाज़ उठाई थी, अब वैश्विक प्रतीक बन चुकी है।

नेपाल के युवाओं ने दिखाया कि डिजिटल संगठन, विकेंद्रीकृत नेतृत्व, और पारदर्शिता की माँग से एक पूरी सरकार गिराई जा सकती है।

जॉर्जिया के युवाओं के लिए नेपाली झंडा अब प्रेरणा का प्रतीक है —

एक छोटा देश जिसने दिखाया कि जब युवा एकजुट होते हैं, तो सत्ता के किले हिल जाते हैं।

जैसे नेपाल के आंदोलन में One Piece मंगा का “Skull Flag” विद्रोह का प्रतीक बना,

वैसे ही अब जॉर्जिया में नेपाल का लाल नीला झंडा युवा संघर्ष का वैश्विक चिह्न बन गया है।

कौन हैं ये प्रदर्शनकारी और क्या हैं उनकी माँगें

रिपोर्टों के अनुसार, जॉर्जिया की यह नई Gen Z आंदोलन मुख्य रूप से विश्वविद्यालय के छात्रों, बेरोज़गार युवाओं और डिजिटल एक्टिविस्टों द्वारा संचालित है।

वे मांग कर रहे हैं:

-

संसद और न्यायपालिका में पारदर्शिता,

-

सरकारी खर्चों का सार्वजनिक ऑडिट,

-

युवाओं के लिए रोजगार योजनाएँ,

-

और अभिव्यक्ति की स्वतंत्रता की गारंटी।

नेपाली झंडा उनके लिए केवल एक विदेशी प्रतीक नहीं, बल्कि एक साझा आशा का झंडा बन गया है — यह दिखाने के लिए कि बदलाव संभव है।

नेपाल से जॉर्जिया तक: एक वैश्विक पैटर्न

साल 2025 में नेपाल की जेन-ज़ क्रांति के बाद से, युवा विद्रोहों की श्रृंखला पूरी दुनिया में फैल रही है —

मेडागास्कर, मोरक्को, पेरू, फिलिपींस, और अब जॉर्जिया तक।

इन आंदोलनों की समानताएँ उल्लेखनीय हैं:

-

भ्रष्टाचार और भाई-भतीजावाद के खिलाफ़ गुस्सा,

-

सोशल मीडिया और डिस्कोर्ड जैसे प्लेटफ़ॉर्मों पर संगठन,

-

और विदेशी प्रतीकों के माध्यम से वैश्विक एकजुटता का प्रदर्शन।

अब यह स्पष्ट हो रहा है कि यह कोई अलग-अलग घटनाएँ नहीं, बल्कि एक नेटवर्क्ड वैश्विक पीढ़ीगत क्रांति (Global Gen Z Revolution) है।

आगे क्या होगा?

फिलहाल यह स्पष्ट नहीं है कि नेपाली झंडा किसने लाया और क्या इसके पीछे नेपाल या किसी अंतरराष्ट्रीय नेटवर्क से सीधा समन्वय है।

लेकिन यह निश्चित है कि इसने जॉर्जियाई आंदोलन को अंतरराष्ट्रीय दृश्यता दिलाई है।

सरकार इस प्रतीक को “विदेशी प्रभाव” बताकर दमन कर सकती है, लेकिन युवाओं के लिए यह अब वैश्विक एकता का झंडा बन चुका है।

विश्लेषकों का कहना है कि आने वाले दिनों में देखने योग्य होगा:

-

क्या जॉर्जिया के आंदोलनकारी नेपाल की तरह “नेता-विहीन मॉडल” अपनाएँगे?

-

क्या दक्षिण एशिया और यूरोप के युवा डिजिटल रूप से जुड़ेंगे?

-

और क्या यह आंदोलन भी नेपाल की तरह सरकार बदलने में सफल होगा?

नए युग का संकेत

जॉर्जिया की सड़कों पर लहराता नेपाली झंडा केवल एक कपड़े का टुकड़ा नहीं है —

यह एक युग का प्रतीक है: जहाँ युवा सीमाओं से परे सोच रहे हैं।

नेपाल से शुरू हुई जेन-ज़ क्रांति अब एक वैश्विक भाषा बन चुकी है —

जहाँ हरेक झंडा केवल देश का नहीं, बल्कि न्याय, समानता और पारदर्शिता का प्रतीक है।

जैसा कि एक जॉर्जियाई छात्र ने कहा —

“हम केवल अपने देश के लिए नहीं लड़ रहे। हम नेपाल से प्रेरित हैं, और यह झंडा हमारे भविष्य की आवाज़ है।”

📍संपादकीय टिप्पणी:

यह घटना केवल भू-राजनीतिक दृष्टि से नहीं, बल्कि सांस्कृतिक दृष्टि से भी ऐतिहासिक है।

नेपाल का झंडा अब “Global Gen Z Resistance” का प्रतीक बन गया है —

एक ऐसा झंडा जो हिमालय से लेकर ब्लैक सी तक उम्मीद का संदेश दे रहा है।

Kalkiism Research Center: The Blueprint Behind Nepal’s Gen Z Revolution

When Nepal’s Gen Z Revolution erupted in September 2025 — toppling the government in just 48 hours — much of the world saw it as a spontaneous youth uprising against corruption. But behind the slogans and social-media coordination lay something more structured: a ready-made economic and political blueprint, quietly prepared by a group of 50 leading Nepali economists working under the banner of the Kalkiism Research Center (KRC).

Now, as Nepal prepares for its next phase of governance, attention is turning toward these economists — and their claim that all demands of the Gen Z Revolution can, in fact, be fully implemented.

The Hidden Architects of Reform

The Kalkiism Research Center, headquartered in Kathmandu, has spent the past few years developing a comprehensive framework for a corruption-free, inclusive, and job-guaranteed Nepal.

Over the past year alone, the KRC made multiple approaches to the Nepali government — both ruling and opposition parties — presenting detailed policy proposals and macroeconomic models.

Each time, their message was clear: the country could be re-engineered from within without foreign aid, debt, or donor dependence.

But their appeals fell on deaf ears. Political parties, steeped in patronage and inertia, declined to engage.

In the meantime, KRC’s leaders took their ideas directly to the people — training tens of thousands of college students across the country on the principles of corruption-free governance and economic justice.

It was this silent groundwork that set the intellectual and moral stage for the Gen Z uprising that followed.

The Three Pillars of a Corruption-Free Nepal

At the heart of KRC’s model is radical simplicity. The economists argue that a corruption-free society can be achieved by re-architecting the very mechanics of money and finance — rather than merely punishing corrupt individuals.

Their three-point proposal is deceptively straightforward:

-

A Fully Cashless Economy

-

Eliminate physical currency to ensure every transaction — from village markets to government contracts — is traceable, auditable, and transparent.

-

This single step, they argue, removes the underground economy where corruption thrives.

-

-

State Ownership of All Banks

-

Instead of a few private or politically-connected banks controlling credit, all banks would be publicly owned and digitally operated.

-

Profits from lending and transactions would return directly to the people through the state treasury.

-

-

A Zero-Interest-Rate Economy

-

With public banking, loans could be issued at 0% interest, eliminating the parasitic debt cycle that traps households and businesses alike.

-

This would unlock unprecedented liquidity and entrepreneurship, while ensuring money circulates productively within Nepal’s economy.

-

The Ripple Effects: Education, Health, and Justice for All

KRC’s economists call their model “the double whammy” — because the elimination of corruption not only cleanses governance but automatically liberates public resources for universal welfare.

With the savings from leakages and interest drains, Nepal could:

-

Fund free, high-quality education at all levels, from rural schools to universities.

-

Provide universal healthcare and legal services, accessible to every citizen without discrimination.

-

Invest in green infrastructure and digital systems that make the state accountable to its citizens in real time.

In essence, the KRC framework transforms corruption control into a development engine — turning what used to be state weakness into social strength.

A Revolution in Gender Equality

Perhaps the most striking aspect of the KRC proposal is its inclusion of women’s unpaid household labor within the national job guarantee program.

Under this system, women who manage homes, raise children, or care for elders would be recognized as full economic contributors — entitled to a state-backed income and social protections.

This would make Nepal the first nation in the world to institutionalize equality between domestic and formal work — a revolutionary step toward dismantling centuries of gender bias.

Job Guarantees for All Nepalis — Within Nepal

The same system that funds education and healthcare also enables full employment.

Because money is no longer a scarce commodity under zero-interest public banking, the government can guarantee meaningful work for every citizen — from infrastructure and innovation projects to community care and environmental renewal.

Crucially, this eliminates the need for mass migration.

Every Nepali, KRC economists argue, should have “the right to prosper without leaving home.”

If implemented, this could reverse decades of dependence on remittances, reuniting families and revitalizing local economies.

Why the Government Didn’t Listen

So why didn’t Nepal’s government act on such seemingly transformative proposals?

Insiders point to three reasons:

-

Political risk: A cashless, transparent system would expose entrenched patronage networks.

-

Economic inertia: Many policymakers remain wedded to IMF- and World Bank-style orthodoxy.

-

Threat to vested interests: A zero-interest, state-banking model challenges the private financial elite that underwrites both major political parties.

Yet the youth-led Gen Z movement has altered that calculus.

Now that public anger has broken through fear, ignoring KRC’s blueprint is no longer politically sustainable.

The Future: From Protest to Policy

If the next interim government under Sushila Karki embraces the KRC framework, Nepal could become the world’s first post-corruption nation — a case study for the entire Global South.

The movement’s motto, already trending among young activists, sums it up best:

“From Cash to Code, From Corruption to Creation.”

What began as a digital revolt may soon become an economic revolution — one where Nepal not only ends corruption but redefines what a just economy can look like.

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

कल्कीइज़्म रिसर्च सेंटर: नेपाल की जेन-ज़ क्रांति के पीछे का खाका

जब नेपाल की जेन-ज़ क्रांति सितम्बर 2025 में फूटी — और सिर्फ़ 48 घंटे में सरकार गिर गई — तो पूरी दुनिया ने इसे युवाओं के स्वतःस्फूर्त आक्रोश के रूप में देखा।

लेकिन इस उथल-पुथल के पीछे एक और कहानी थी — एक सुविचारित आर्थिक और नीतिगत ब्लूप्रिंट, जिसे चुपचाप तैयार कर रहे थे 50 अग्रणी नेपाली अर्थशास्त्री, जो कल्कीइज़्म रिसर्च सेंटर (KRC) के अंतर्गत काम करते हैं।

आज जब नेपाल एक नए युग के द्वार पर खड़ा है, सबकी निगाहें इन अर्थशास्त्रियों पर हैं — जो दावा कर रहे हैं कि जेन-ज़ क्रांति की सभी प्रमुख माँगें पूरी तरह लागू की जा सकती हैं।

नीति-निर्माण के गुप्त वास्तुकार

कल्कीइज़्म रिसर्च सेंटर, जिसका मुख्यालय काठमांडू में है, पिछले कुछ वर्षों से एक भ्रष्टाचार-मुक्त, समावेशी और रोजगार-गारंटी आधारित नेपाल का खाका तैयार कर रहा है।

पिछले एक वर्ष के दौरान KRC ने नेपाल सरकार — सत्ता और विपक्ष दोनों — को कई स्तरों पर संपर्क कर अपनी विस्तृत नीति-सिफारिशें प्रस्तुत कीं।

उनका संदेश साफ़ था — नेपाल को बिना विदेशी सहायता, बिना ऋण और बिना दाता-निर्भरता के पुनर्गठित किया जा सकता है।

लेकिन किसी ने ध्यान नहीं दिया।

भ्रष्ट राजनीतिक दलों ने, जो वर्षों से लाभ के नेटवर्क में फँसे हैं, कोई रुचि नहीं दिखाई।

इस बीच KRC ने जनता का रुख़ किया — दसियों हज़ार कॉलेज छात्रों को प्रशिक्षित किया, यह सिखाते हुए कि “भ्रष्टाचार-मुक्त राष्ट्र कैसे बनता है।”

यही वैचारिक और नैतिक आधार था जिसने 2025 की जेन-ज़ क्रांति को ज़मीन दी।

भ्रष्टाचार-मुक्त नेपाल के तीन स्तंभ

KRC के मॉडल की खूबसूरती उसकी सरलता में है।

उनका मानना है कि भ्रष्टाचार खत्म करने के लिए सिर्फ़ “सज़ा” नहीं, बल्कि पैसे और बैंकिंग की व्यवस्था को ही पुनर्परिभाषित करना होगा।

उनकी तीन-बिंदु नीति बेहद स्पष्ट है —

-

पूरी तरह कैशलेस अर्थव्यवस्था

-

भौतिक नकदी का अंत, ताकि हर लेन-देन — गाँव के बाज़ार से लेकर सरकारी ठेकों तक — ट्रेस किया जा सके।

-

यही वह कदम है जो “काले पैसे” की जड़ काट देता है।

-

-

सभी बैंकों का राज्य स्वामित्व

-

निजी या राजनीतिक रूप से नियंत्रित बैंकों की जगह सार्वजनिक डिजिटल बैंकिंग प्रणाली हो।

-

बैंक के लाभ सीधे जनता और सरकारी खज़ाने में लौटें।

-

-

शून्य ब्याज दर नीति

-

जब बैंक सार्वजनिक होंगे, तो ऋण 0% ब्याज पर दिया जा सकेगा।

-

इससे परिवारों, किसानों और छोटे व्यवसायों पर कर्ज़ का बोझ समाप्त होगा और अर्थव्यवस्था में पूँजी का स्वतंत्र प्रवाह सुनिश्चित होगा।

-

दोहरे लाभ का मॉडल — शिक्षा, स्वास्थ्य और न्याय सभी के लिए

KRC के अर्थशास्त्री इसे “डबल व्हैममी मॉडल” कहते हैं —

क्योंकि यह भ्रष्टाचार समाप्त करने के साथ-साथ राजस्व को मुक्त कर

सभी नागरिकों के लिए मुफ़्त और गुणवत्तापूर्ण सार्वजनिक सेवाएँ उपलब्ध करा देता है।

इस मॉडल के तहत —

-

मुफ़्त और उच्च गुणवत्ता की शिक्षा हर स्तर पर दी जा सकती है,

-

स्वास्थ्य और कानूनी सेवाएँ सभी के लिए सुनिश्चित हो सकती हैं,

-

और ग्रीन व डिजिटल इन्फ्रास्ट्रक्चर पर निवेश करके शासन को पारदर्शी बनाया जा सकता है।

भ्रष्टाचार-विरोध इस ढाँचे में केवल “सफ़ाई अभियान” नहीं, बल्कि विकास का इंजन बन जाता है।

लैंगिक समानता में विश्व क्रांति

KRC की सबसे क्रांतिकारी सोच यह है कि गृहिणियों और घरेलू काम करने वाली महिलाओं को भी औपचारिक कार्यबल में शामिल किया जाए।

उनका प्रस्ताव है —

महिलाओं का घरेलू श्रम भी राष्ट्रीय अर्थव्यवस्था का हिस्सा माना जाए,

और राज्य द्वारा उन्हें निश्चित आय और सामाजिक सुरक्षा दी जाए।

यह नीति नेपाल को दुनिया का पहला देश बनाएगी जो घर के श्रम को बराबरी का श्रम मानेगा —

यह न केवल आर्थिक, बल्कि सांस्कृतिक क्रांति भी होगी।

नेपाल में सभी के लिए रोजगार-गारंटी

यह व्यवस्था केवल कल्याणकारी नहीं, बल्कि रोजगार-सृजन का भी स्रोत है।

जब मुद्रा पर ब्याज का दबाव नहीं रहेगा, तब सरकार प्रत्येक नागरिक को

सार्थक और गरिमामय काम की गारंटी दे सकेगी —

चाहे वह बुनियादी ढाँचा हो, शिक्षा हो, हरित-ऊर्जा परियोजना या सामुदायिक सेवा।

इससे विदेश पलायन की आवश्यकता समाप्त हो जाएगी।

KRC का नारा है —

“हर नेपाली को अपने ही देश में समृद्ध होने का अधिकार है।”

यदि यह लागू हुआ, तो नेपाल रेमिटेंस पर निर्भरता से मुक्त होकर

स्वावलंबी और आत्मनिर्भर राष्ट्र बनेगा।

सरकार ने ध्यान क्यों नहीं दिया?

इतनी व्यावहारिक नीति के बावजूद सरकार ने इसे अपनाया नहीं।

इसके तीन मुख्य कारण बताए जाते हैं —

-

राजनीतिक खतरा: कैशलेस पारदर्शिता से पुराना संरक्षण-तंत्र उजागर हो जाता।

-

पुराने आर्थिक विचार: अधिकांश नीति-निर्माता अभी भी IMF-World Bank की सोच में बँधे हैं।

-

हित समूहों का डर: निजी बैंकिंग लॉबी और बड़े व्यापारी वर्ग की शक्ति को चुनौती मिलती।

लेकिन अब जेन-ज़ आंदोलन ने हालात बदल दिए हैं।

जनता की जागरूकता और युवाओं के दबाव ने KRC के प्रस्तावों को राजनीतिक रूप से अपरिहार्य बना दिया है।

भविष्य की दिशा: विरोध से नीति-निर्माण तक

यदि अंतरिम प्रधानमंत्री सुषिला कार्की के नेतृत्व में आने वाली सरकार

KRC के इस ढाँचे को अपनाती है, तो नेपाल

दुनिया का पहला भ्रष्टाचार-मुक्त राष्ट्र बन सकता है —

एक ऐसा उदाहरण जिससे पूरा ग्लोबल साउथ सीख सकेगा।

आन्दोलन का नया नारा पहले से ही ट्रेंड में है —

“कैश से कोड तक, भ्रष्टाचार से सृजन तक।”

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

जो क्रांति डिजिटल नारों से शुरू हुई थी,

अब वह एक आर्थिक पुनर्जागरण में बदल सकती है —

जहाँ नेपाल न केवल भ्रष्टाचार को समाप्त करेगा,

बल्कि यह भी दिखाएगा कि न्याय-आधारित अर्थव्यवस्था कैसी दिखती है।

Gen Z Kranti (novel)

The Banyan Revolt (novel)

Madhya York: The Merchant and the Mystic (novel)

Deported (novel)

Empty Country (novel)

Gen Z in Madagascar protested with the body of a colleague who was shot during anti-government protests.

— Cornelius K. Ronoh (@itskipronoh) September 30, 2025

The president dissolved the government after three days of massive protests. pic.twitter.com/EhmfcAfvIW

Gen Z is officially the worst generation:

— Alex Cohen (@anothercohen) December 16, 2023

- Can’t order at restaurants because of menu anxiety

- In relationships with AI partners

- Refuse to work more than 30 hours a week

- Brainwashed by the CCP from TikTok addiction

- Overly woke pic.twitter.com/NZan0En3ZD

Around one in six young people in India, China and Indonesia are out of work, says @KarishmaJourno. That's fueling Gen Z fury on the streets (via @opinion) https://t.co/wQxuRbNKwk

— Bloomberg (@business) October 5, 2025

Nepal’s iconic national flag was displayed during the youth-led protest in Georgia as a reference to Nepal’s recent Gen Z movement, which led to the fall of its previous government.

— No Next Question (@NoNext_Question) October 6, 2025

Tens of thousands rallied in the capital, Tbilisi, to protest the policies of the governing party pic.twitter.com/u2a6yJDYyI

And in Serbiahttps://t.co/rvBwcPqIwF

— Timothy Snyder (@TimothyDSnyder) October 5, 2025

2/5: MADAGASCAR: Youth-led demonstrations demanding access to water and electricity escalated into calls for the president's resignation, culminating in the government's dissolution amid at least 22 deaths.

— Charles Onyango-Obbo (@cobbo3) October 4, 2025

1️⃣ Birth of a Digital Uprising

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

🇳🇵 In Sept 2025, Nepal’s Gen Z toppled a corrupt government in just 48 hours — all organized on Discord.#GenZRevolution #Nepal #AsianSpring

Gen Z Kranti (novel) https://t.co/t8ubLRpECA

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

The Banyan Revolt (novel) https://t.co/Uf23QnY6CE

Madhya York: The Merchant and the Mystic (novel) https://t.co/L3QECvl9wa

Deported (novel) https://t.co/KrjKa39cyP

Empty Country (novel) https://t.co/yMDHpkCSP2

19️⃣ 48% Online, 100% Angry 📲

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

Nepal’s youth turned bandwidth into bullets of truth.#DigitalFreedom

37️⃣ Discord = Parliament 2.0

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

Every chatroom is a town hall.#GenZPower

54️⃣ Stop the Leak, Feed the People.

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

Anti-corruption = social investment.#CleanGovernance

72️⃣ Jobs at Home, Dignity Restored

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

Keep Nepali youth in Nepal.#JobGuarantee

88️⃣ “Delete Corruption, Install Dignity.”

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025

The slogan of a generation.#NewNepal

💯 It Began Where the Himalayas Touch the Clouds. ☁️#Nepal #Kalkiism #GenZRevolution

— Paramendra Kumar Bhagat (@paramendra) October 7, 2025