Trump sends handwritten letter to Powell demanding ultra-low interest rates

'Should be investigated': Leavitt says Trump could revoke mayoral candidate's citizenship

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

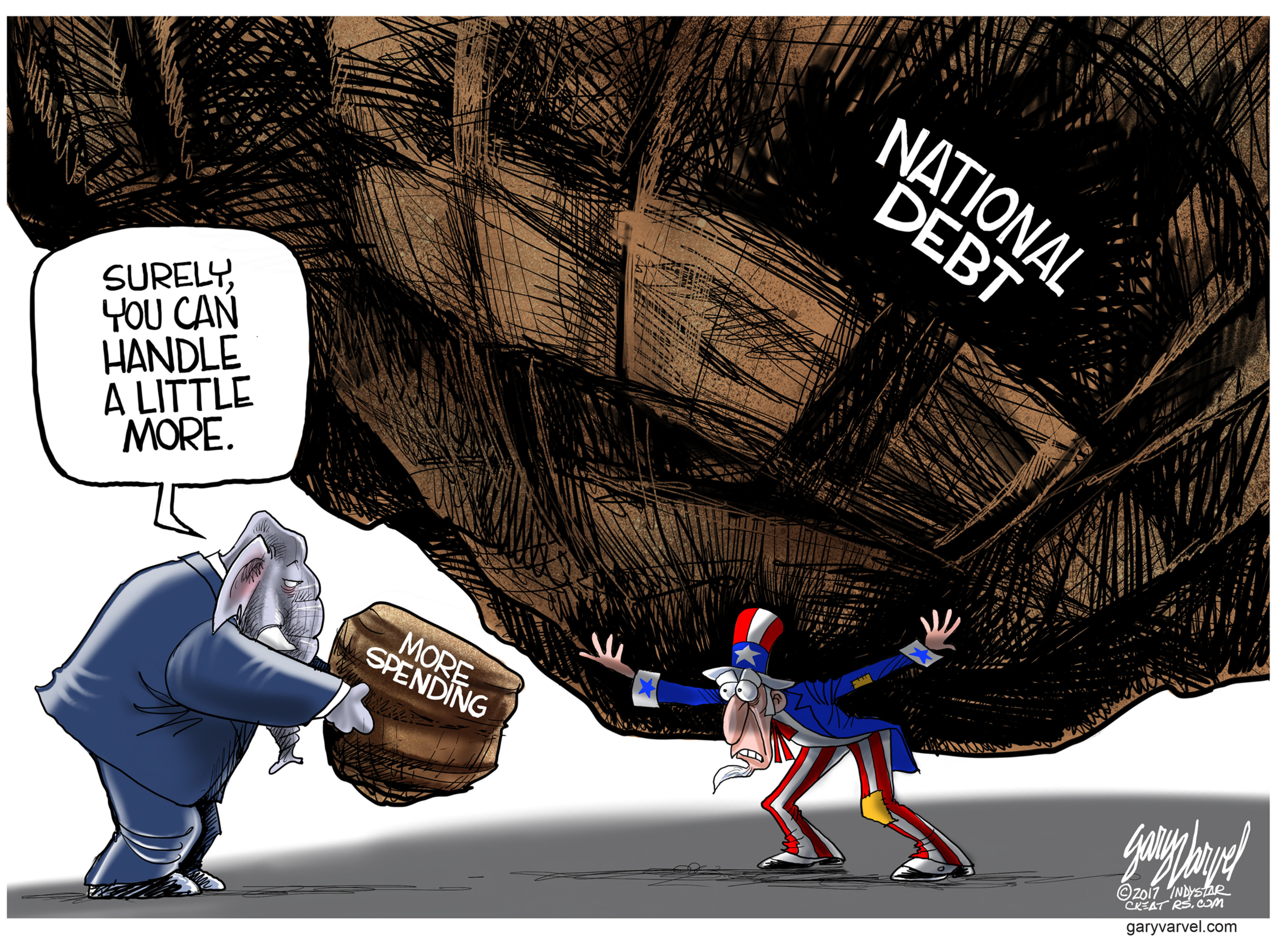

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

I agree. I agreed a month ago. Let's go!

— Paramendra Kumar Bhagat (@paramendra) June 30, 2025

The Tesla Of Political Parties https://t.co/NpochJijnS

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

I am heartbroken by the news from Colorado where Karen Diamond, a victim of the vicious attack earlier this month, has passed away.

— Zohran Kwame Mamdani (@ZohranKMamdani) June 30, 2025

May Karen’s memory be a blessing and a reminder that we must constantly work to eradicate hatred and violence. https://t.co/zDHK5bBJqe

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

🎯🎯🎯

— Paramendra Kumar Bhagat (@paramendra) June 30, 2025

https://t.co/ZiMOtZ1ZIa pic.twitter.com/fTvZSKEffe

— Ways and Means Democrats (@WaysMeansCmte) June 30, 2025

Trump folds in his absurd lawsuit against Ann Selzer and the Des Moines Register https://t.co/u15aiEXR2p

— MeidasTouch (@MeidasTouch) June 30, 2025

Former Fetterman aide https://t.co/4EJHbPDAfD

— Igor Bobic (@igorbobic) June 30, 2025

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

Under Trump and Republicans’ “Big Beautiful Bill,” 17 MILLION people will lose their health care.

— Elizabeth Warren (@SenWarren) June 30, 2025

That’s your grandma with a walker, your niece who was born with a life-threatening condition, and your neighbor whose kid just broke his arm. pic.twitter.com/lJfikrljDz

"The IDF confirmed that in the most serious incident involving shelling of civilians, between 30 and 40 people were targeted—some killed, others wounded to varying degrees."

— Adil Haque (@AdHaque110) June 30, 2025

Those who said accusing the IDF of such acts is blood libel will now say these acts are legal and moral. https://t.co/w7oH3b7reT

Congrats. Do you want product ideas?

— Paramendra Kumar Bhagat (@paramendra) June 30, 2025

You and Mamdani should team up. He also has child care ideas.

— Paramendra Kumar Bhagat (@paramendra) June 30, 2025

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism