Adjusted for Productivity: A New Way to Rethink Wages and Economic Fairness

For over a century, “adjusted for inflation” has been the standard way economists and policymakers measure the real value of wages and economic growth over time. But what if we introduced a new metric—Adjusted for Productivity? What if we assessed worker compensation based not just on purchasing power, but on how much more productive each worker has become due to advances in technology, processes, and education?

This seemingly simple idea could have radical implications for the economy, public policy, corporate practices, and the very fabric of how we define fairness in capitalism.

The Productivity-Wage Gap: A Brief History

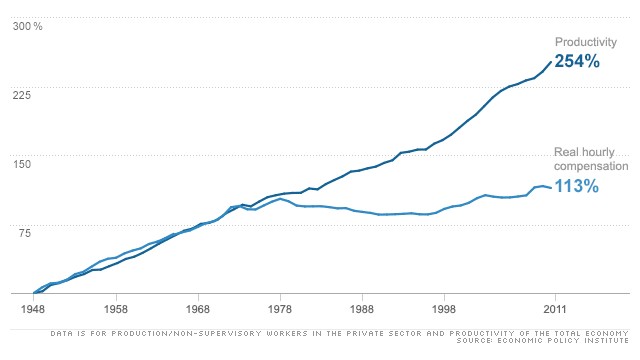

Since the 1970s, productivity in advanced economies—especially the United States—has soared, thanks to automation, software, AI, and globalization. But wages have stagnated for the average worker. According to data from the Economic Policy Institute, between 1979 and 2020:

-

Productivity grew by 61.8%

-

Hourly compensation grew by just 17.5%

In a world “Adjusted for Productivity,” real wages would be much higher. If compensation had kept up, median workers would be earning tens of thousands of dollars more per year than they do today.

What Would "Adjusted for Productivity" Mean in Practice?

It could be used in three ways:

-

A new wage benchmark – Employers, unions, and governments could use productivity-adjusted compensation as a guideline for setting fair wages.

-

A policy framework – Tax incentives, wage floors, or profit-sharing laws could align pay with productivity.

-

A public narrative shift – Just as “adjusted for inflation” changed how we view prices, “adjusted for productivity” could reframe how we view economic fairness.

Imagine a society where workers say, “I don’t just want a raise to beat inflation—I want my fair share of the productivity I helped generate.”

Counterarguments – And Why They Fall Short

1. "We can’t raise wages or we’ll hurt competitiveness."

This is the most common refrain from opponents of wage increases. But if productivity has risen, then businesses are getting more output per worker. Higher wages in this case don’t reflect inefficiency—they reflect shared success. In fact, higher wages can lead to:

-

Better employee retention and morale

-

Increased consumer demand (because workers have more to spend)

-

Incentives for further innovation (to maintain margins)

Moreover, companies enjoying record profits while suppressing wages are not protecting competitiveness—they are extracting surplus value.

2. "Some workers aren’t more productive—they just benefit from tech."

True, much of the productivity gain comes from systems, not individual effort. But this is a flawed argument. Companies adopt new technology because it enhances the value of their workforce. It’s a symbiotic relationship. If your software allows one worker to do what used to take three, that gain should be shared.

We don’t blame the steam engine for productivity gains in the 19th century—we credit the companies and workers who adapted it. Same goes today.

3. "Markets set wages, not fairness."

Yes—but markets are not neutral. They are shaped by power. When unions are weak, worker bargaining power is low. When monopolies dominate sectors, they can suppress wages. “Market wages” don’t always reflect value—they reflect who has leverage.

Adjusting for productivity wouldn’t override the market. It would inform it, giving us a clearer lens through which to understand what workers truly contribute.

Potential Economic Impacts of Widespread Productivity-Linked Compensation

1. Stronger Consumer Economy

More income for workers = more spending = stronger demand = more economic activity. This is especially vital in a consumer-driven economy like the U.S., where 70% of GDP is tied to household spending.

2. Reduced Inequality

If the gains of AI, automation, and global supply chains were shared fairly, it would close the gap between the wealthy and the working class. The billionaire class would still be rich—but the middle class would not be hollowed out.

3. More Political Stability

Economic despair breeds political extremism. Fairer distribution of productivity gains could reduce populist backlash, anti-globalization sentiment, and distrust in democratic systems.

4. Business Innovation

If companies can’t rely on wage suppression to maintain margins, they may lean harder into true innovation—better products, better systems, more value creation.

Why This Matters Now

We are at the dawn of the AI era. The potential for productivity to skyrocket is real. If we don't build fair compensation systems now, we risk repeating the mistakes of the last 50 years—where gains go to capital, not labor.

“Adjusted for Inflation” was the tool of the 20th century.

“Adjusted for Productivity” should be the standard of the 21st.

Call to Action: Policymakers, business leaders, and citizens should begin integrating productivity-adjusted thinking into wage debates, economic modeling, and collective bargaining. A better economy isn’t just about more—it’s about fairer.

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

Velocity Money: Crypto, Karma, and the End of Traditional Economics

The Next Decade of Biotech: Convergence, Innovation, and Transformation

Beyond Motion: How Robots Will Redefine The Art Of Movement

ChatGPT For Business: A Workbook

Becoming an AI-First Organization

Quantum Computing: Applications And Implications

Challenges In AI Safety

AI-Era Social Network: Reimagined for Truth, Trust & Transformation

Remote Work Productivity Hacks

How to Make Money with AI Tools

AI for Beginners

_0.jpg)