Smoot-Hawley 2.0? No. But a Great American Chaos Is Brewing

The world is not on the verge of repeating the catastrophic spiral of the 1930s trade wars. We are not heading into another Smoot-Hawley moment. Back then, one country’s tariffs begot another’s, until global commerce ground to a halt and triggered the Great Depression. Today, the world has learned its lesson—or at least most of it has.

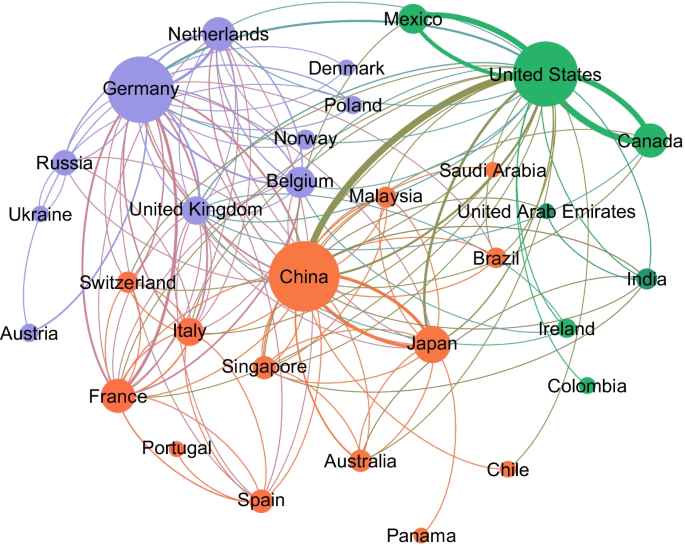

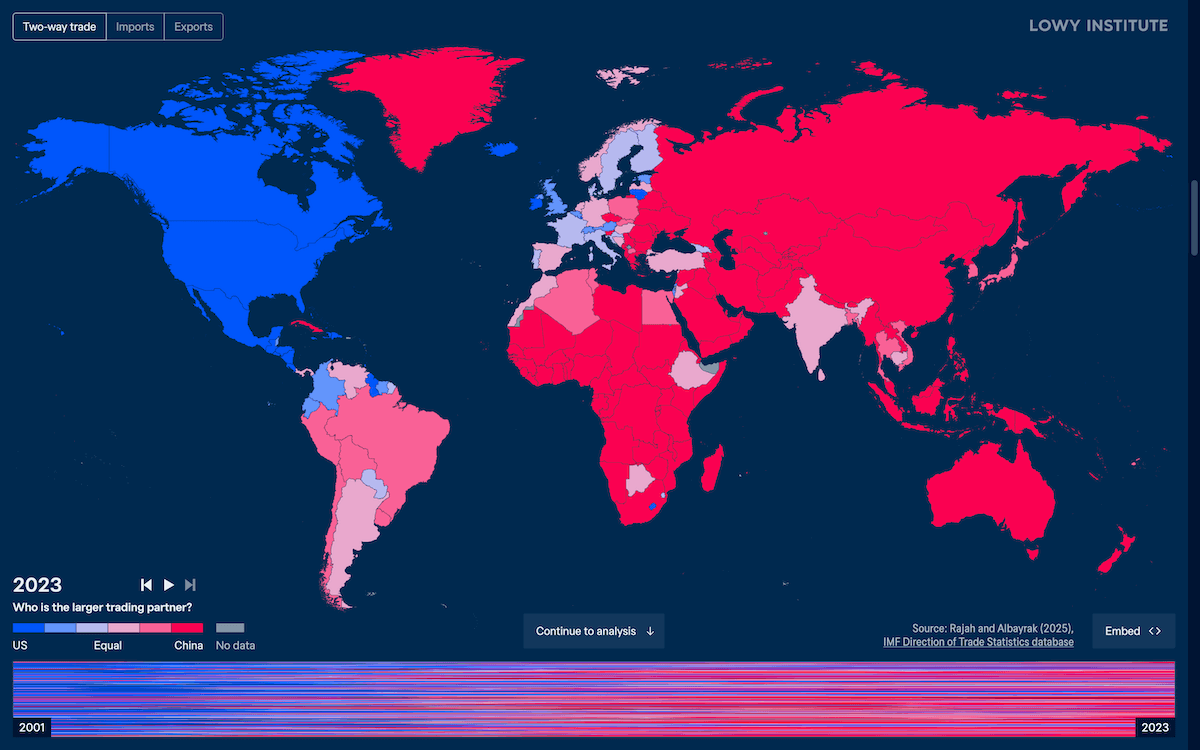

While the United States under President Trump is aggressively imposing tariffs, other nations are taking a wiser path. Even countries targeted by U.S. tariffs are not retaliating in kind. Why? Because they understand that trade, in the long run, builds resilience, expands markets, and reduces prices. They are not slashing each other with tariffs. On the contrary, they are embracing deeper integration—negotiating new free trade agreements, strengthening regional ties, and weaving a dense mesh of economic cooperation outside U.S. boundaries.

This strategic restraint makes America stand out—not as a leader, but as an outlier. A $19 trillion economy trying to strong-arm a world that collectively accounts for more than $90 trillion of GDP. America, the world’s largest consumer market, is acting unilaterally, but the world is no longer waiting for its lead. It’s adapting, evolving, and increasingly building a trade architecture where America’s voice is no longer the only one that matters.

And make no mistake—these tariffs are not being paid by China, India, Germany, or Mexico. They’re being paid by American importers, and the cost is being passed directly to American consumers. That’s not just bad economics—it’s political dynamite.

Welcome to the Great American Chaos

What we are about to witness is not a global depression, but a uniquely American crisis—a Great Chaos, unfolding within U.S. borders. Here’s what it will look like:

-

Price Chaos: A sharp rise in consumer prices as tariffs disrupt supply chains and inflate import costs.

-

Political Chaos: As prices surge and public frustration mounts, President Trump’s approval ratings may plummet into the low 30s—territory that could alienate even staunch allies in Congress.

-

Economic Chaos: Confusion among businesses, job losses in trade-exposed sectors, and a weakening investment climate.

-

Trade Chaos: As the U.S. exits or undermines global trade norms, partners forge ahead without it, isolating the U.S. in the long-term structure of the global economy.

In sum, the world won't collapse—but America may convulse.

The WTO Minus One

The breakdown of the WTO and the U.S.’s retreat from multilateral trade norms are ushering in a new phase in globalization: a “WTO minus one” world. Global trade continues, but increasingly without the active participation or leadership of the U.S.

This has implications far beyond commerce. The multilateral system that emerged from World War II—anchored by Bretton Woods, the United Nations, and the General Agreement on Tariffs and Trade (GATT, which evolved into the WTO)—is crumbling. The old architecture cannot contain the complexity of 21st-century trade, digital economies, and climate-linked development.

It’s time for new foundations.

Bretton Woods 2.0—and a New United Nations

To respond to the cascading crises of inequality, climate change, digital disruption, and geopolitical realignment, we need a Bretton Woods 2.0—a new framework for global economic cooperation that reflects today’s multi-polar realities.

At the same time, the United Nations must be reborn. The world today is vastly different from 1945. Population centers have shifted. New powers have emerged. Small countries, once sidelined, now have stakes and voices that matter. Global governance must evolve or perish.

For those who want to participate in shaping this future, two books offer compelling starting points:

-

📘 A Reorganized UN: Built From Ground Up — An ambitious blueprint to remake the United Nations with a governance structure based on population, economic size, and equal representation.

-

📘 Rethinking Trade: A Blueprint for a Just and Thriving Global Economy — A call to reimagine global trade not just for efficiency, but for justice, sustainability, and shared prosperity.

The World Won’t Wait for the U.S.

The good news is this: the world doesn’t need to wait for Washington to act. If enough countries step up, align, and build, the United States will eventually have no choice but to join the conversation. Not out of charity, but out of necessity. America needs a stable world too—economically, politically, and morally.

Let us not mourn the passing of an old system. Let us get to work on building the new one.

Let the Great Chaos inside the U.S. be the catalyst for global renewal.

Written in the spirit of global cooperation, institutional reinvention, and trade justice.

स्मूट-हॉली 2.0 नहीं, लेकिन अमेरिका में एक महान अराजकता निश्चित है

दुनिया एक बार फिर 1930 के दशक के व्यापार युद्धों की तबाही को दोहराने की कगार पर नहीं है। हम स्मूट-हॉली टैरिफ़ अधिनियम जैसे क्षण की ओर नहीं बढ़ रहे हैं। उस समय, एक देश के टैरिफ का जवाब दूसरे देश के टैरिफ से दिया जाता था, जब तक कि वैश्विक व्यापार रुक नहीं गया और महा मंदी की शुरुआत हो गई। लेकिन आज दुनिया ने सबक सीख लिया है—या कम से कम अधिकांश देशों ने।

जबकि अमेरिका राष्ट्रपति ट्रंप के नेतृत्व में आक्रामक रूप से टैरिफ लगा रहा है, अन्य देश समझदारी से काम ले रहे हैं। जिन देशों पर अमेरिका टैरिफ लगा रहा है, वे भी वैसा ही जवाब नहीं दे रहे। क्यों? क्योंकि वे जानते हैं कि व्यापार दीर्घकाल में स्थिरता लाता है, बाज़ारों का विस्तार करता है और कीमतों को कम करता है। वे एक-दूसरे पर टैरिफ नहीं लगा रहे, बल्कि नए मुक्त व्यापार समझौतों की दिशा में अग्रसर हैं, क्षेत्रीय सहयोग को मज़बूत कर रहे हैं, और अमेरिका को दरकिनार करके नई आर्थिक संरचनाएं बना रहे हैं।

यह रणनीतिक संयम अमेरिका को अलग-थलग करता है—नेता की तरह नहीं, बल्कि एक अपवाद के रूप में। 19 ट्रिलियन डॉलर की अर्थव्यवस्था एक ऐसी दुनिया को धमकाने की कोशिश कर रही है जिसका संयुक्त जीडीपी 90 ट्रिलियन डॉलर से अधिक है। अमेरिका, जो दुनिया का सबसे बड़ा उपभोक्ता बाज़ार है, एकतरफा कदम उठा रहा है, लेकिन अब दुनिया अमेरिका के नेतृत्व का इंतज़ार नहीं कर रही। वह अपना रास्ता खुद बना रही है।

और ये टैरिफ किसी और देश द्वारा नहीं, बल्कि अमेरिकी आयातकों द्वारा चुकाए जा रहे हैं। और इनका बोझ सीधे अमेरिकी उपभोक्ताओं पर पड़ रहा है। यह केवल आर्थिक नुकसान नहीं, बल्कि राजनीतिक विस्फोट भी है।

स्वागत कीजिए: महान अमेरिकी अराजकता का

हम एक वैश्विक मंदी नहीं देखने जा रहे, बल्कि एक विशेष रूप से अमेरिकी संकट का सामना करने जा रहे हैं—एक महान अराजकता, जो अमेरिका के भीतर उत्पन्न होगी। इसके रूप होंगे:

-

मूल्य अराजकता: उपभोक्ता वस्तुओं की कीमतों में तेज़ वृद्धि, क्योंकि टैरिफ आपूर्ति श्रृंखलाओं को बाधित करेंगे और आयात महंगे होंगे।

-

राजनीतिक अराजकता: जैसे-जैसे महंगाई बढ़ेगी और जनता का असंतोष फूटेगा, राष्ट्रपति ट्रंप की लोकप्रियता घटकर 30% के आसपास पहुँच सकती है—जिससे उनके ही दल के सांसद उनसे दूरी बना सकते हैं।

-

आर्थिक अराजकता: व्यापारिक अनिश्चितता, रोज़गार में गिरावट, और निवेश का धीमा पड़ना।

-

व्यापारिक अराजकता: अमेरिका के वैश्विक व्यापार नियमों से पीछे हटने के कारण, दुनिया उसे नज़रअंदाज़ करके अपने व्यापारिक ढांचे विकसित करेगी।

संक्षेप में, दुनिया नहीं गिरेगी—लेकिन अमेरिका ज़रूर हिल जाएगा।

WTO माइनस वन की दुनिया

WTO की निष्क्रियता और अमेरिका का बहुपक्षीय व्यापार व्यवस्था से हटना एक नए दौर की शुरुआत कर रहा है: “WTO माइनस वन” की दुनिया। वैश्विक व्यापार जारी है, लेकिन अमेरिका की भागीदारी और नेतृत्व के बिना।

यह केवल व्यापार की बात नहीं है। वह वैश्विक व्यवस्था जो द्वितीय विश्व युद्ध के बाद बनी थी—ब्रेटन वुड्स, संयुक्त राष्ट्र, और GATT (जो बाद में WTO बना)—अब अप्रासंगिक हो चुकी है। 21वीं सदी के जटिल वैश्विक व्यापार, डिजिटल अर्थव्यवस्थाओं, और जलवायु संकट को वह नहीं संभाल सकती।

अब समय है नए ढांचे का।

ब्रेटन वुड्स 2.0 — और एक नया संयुक्त राष्ट्र

असमानता, जलवायु संकट, डिजिटल संक्रमण, और भू-राजनीतिक पुनर्संरेखन जैसी चुनौतियों से निपटने के लिए हमें एक नया ब्रेटन वुड्स 2.0 चाहिए—एक ऐसा आर्थिक सहयोग ढांचा जो आज की बहुध्रुवीय दुनिया को प्रतिबिंबित करे।

साथ ही, संयुक्त राष्ट्र को भी फिर से गढ़ने की ज़रूरत है। 1945 की दुनिया और आज की दुनिया में ज़मीन-आसमान का फर्क है। अब जनसंख्या का केंद्र बदल गया है। नई शक्तियाँ उभरी हैं। छोटे देश, जो कभी किनारे पर खड़े थे, अब बराबरी से आवाज़ उठा रहे हैं। वैश्विक शासन या तो बदलेगा—या फिर समाप्त हो जाएगा।

जो लोग इस नई व्यवस्था को आकार देना चाहते हैं, उनके लिए ये दो पुस्तकें एक बेहतर शुरुआत हो सकती हैं:

-

📘 A Reorganized UN: Built From Ground Up — एक नई संयुक्त राष्ट्र संरचना का प्रस्ताव जिसमें जनसंख्या, अर्थव्यवस्था और समान प्रतिनिधित्व को संतुलित किया गया है।

-

📘 Rethinking Trade: A Blueprint for a Just and Thriving Global Economy — एक ऐसी वैश्विक व्यापार व्यवस्था की रूपरेखा जो केवल दक्षता ही नहीं, बल्कि न्याय, स्थिरता और समृद्धि को भी प्राथमिकता देती है।

दुनिया अमेरिका का इंतज़ार नहीं करेगी

अच्छी बात यह है कि दुनिया को वाशिंगटन का इंतज़ार नहीं करना पड़ेगा। यदि पर्याप्त देश एक साथ आएँ, निर्माण करें, तो अमेरिका को अंततः उस बातचीत में शामिल होना ही पड़ेगा। ज़रूरत से—not choice से।

अमेरिका को भी एक स्थिर, न्यायसंगत और समृद्ध वैश्विक व्यवस्था की उतनी ही ज़रूरत है जितनी किसी और को।

पुरानी व्यवस्था के जाने का शोक मत मनाइए—नई व्यवस्था के निर्माण में जुट जाइए।

अमेरिका के भीतर उठती अराजकता, पूरी दुनिया के लिए पुनर्निर्माण का अवसर बन सकती है।

what Trump is really waging is mostly a class war against middle- and lower-income Americans rather than a trade war against other countries

......... all of Trump’s tariffs violate solemn agreements — agreements ratified by Congress — that the United States has made in the past. So the Trump tariffs have inflicted massive and possibly irreparable damage on U.S. credibility.

:max_bytes(150000):strip_icc()/GettyImages-848755326-48dd2711646247648c4faebc98715119.jpg)