— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

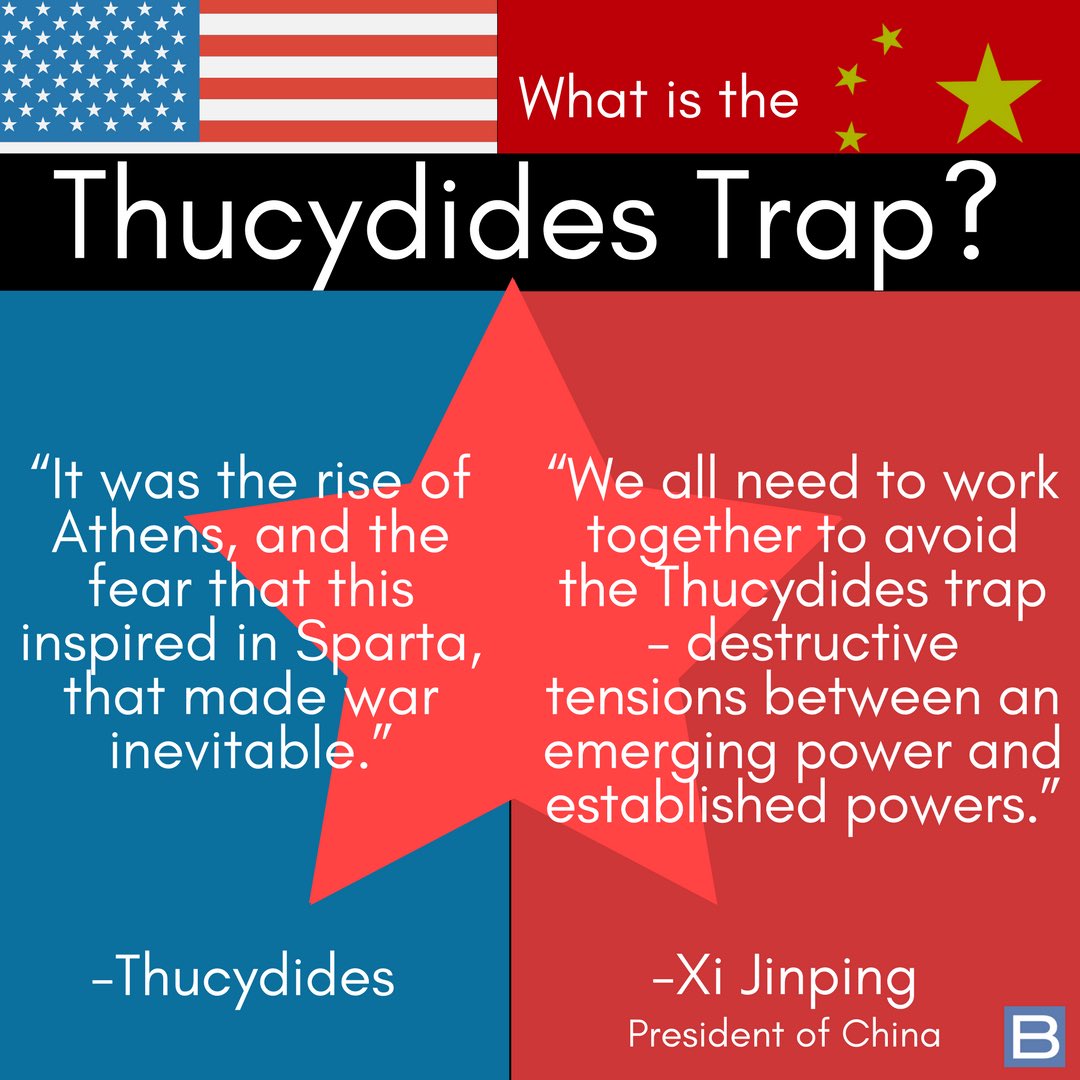

Slamming more tariffs on China isn't going to squeeze out a better deal from Beijing, says @abrownepek https://t.co/jaVBTfnqj5 via @bopinion

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

Your all time favorite President got tired of waiting for China to help out and start buying from our FARMERS, the greatest anywhere in the World!

— Donald J. Trump (@realDonaldTrump) May 10, 2019

Trump tweeted that despite the new round of tariffs that went into effect Friday, there is “no need to rush” negotiations with Beijing https://t.co/3jzL6gYYzY

— POLITICO (@politico) May 10, 2019

— Paramendra Kumar Bhagat (@paramendra) May 10, 2019

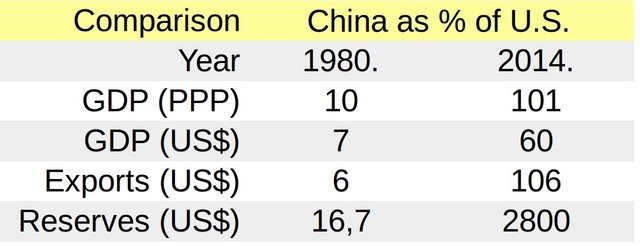

How Goes the Trade War? by Paul Krugman Donald Trump ... provided us with many iconic quotations .... extremely clear examples of bad ideas........ foreigners paid none of the bill, U.S. companies and consumers paid all of it. And the losses to U.S. consumers exceeded the revenue from the new tariffs, so the tariffs made America poorer overall...... These price hikes led to substantial changes in behavior. Imports of the tariffed items fell sharply, partly because consumers turned to domestic products, but also in large part because importers shifted their sourcing to countries that aren’t currently facing Trump tariffs. For example, a number of companies already seem to have begun buying goods they previously bought from China from Vietnam or Mexico instead........... Consider the following example: pre-tariff, the U.S. imports some good from China that costs $100. Then the Trump administration imposes a 25% tariff, raising the price to consumers to $125. If we just keep importing that good from China, consumers lose $25 per unit purchased – but the government raises an extra $25 in taxes, leaving overall national income unchanged.......... Suppose, however, that importers shift to a more expensive source that isn’t subject to the tariff; suppose, for example, that they can buy the good from Vietnam for $115. Then consumers only lose $15 – but there is no tariff revenue, so that $15 is a loss for the nation as a whole........... But what if they turn to a domestic supplier – say, a U.S. company that will sell the product for $120. How does this change the story? ......... Here the crucial thing is that producing a good domestically has an opportunity cost. The U.S. is near full employment, so the $120 in resources used to produce that good could and would have been employed producing something else in the absence of the tariff. Diverting them into producing what we used to import means a net loss of $20, with no revenue offset. ....... in practice any manufacturing jobs added by the Trump tariffs are probably offset by losses of other manufacturing jobs. ........ most of the tariffs are on intermediate goods – inputs into production, so that job gains in, say, steel are offset by losses in autos and other downstream sectors. Beyond that, the tariffs have probably contributed to a rising dollar, which makes U.S. exports less competitive.

.jpg?itok=BtsavwoJ)