|

| speaking at CPAC in Washington D.C. on February 10, 2011. (Photo credit: Wikipedia) |

The Donald has been seen uncomfortable with question answer sessions. As in, why me?

|

| speaking at CPAC in Washington D.C. on February 10, 2011. (Photo credit: Wikipedia) |

Jeb Bush Chooses Twitter-Bate as Platform

Jeb Bush Chooses Twitter-Bate as Platform Trump won't rule out possible independent run

Trump won't rule out possible independent run Jeb Bush Is Meaner Than He Looks

Jeb Bush Is Meaner Than He Looks Scott Walker, Jeb Bush Spar Over Iran Nuclear Deal

Scott Walker, Jeb Bush Spar Over Iran Nuclear Deal Q-poll: Hillary Slumping in Colorado, Iowa, and Virginia - Daniel Doherty

Q-poll: Hillary Slumping in Colorado, Iowa, and Virginia - Daniel Doherty Odd Couple: Bill Clinton and George W. Bush Appear on Cover of TIME

Odd Couple: Bill Clinton and George W. Bush Appear on Cover of TIME Jeb Bush Slams Donald Trump: He Does This to Inflame, Incite... Doesn't Represent GOP (VIDEO)

Jeb Bush Slams Donald Trump: He Does This to Inflame, Incite... Doesn't Represent GOP (VIDEO) Bush: 'Absolutely' offended by Trump's comments on Mexicans

Bush: 'Absolutely' offended by Trump's comments on Mexicans Does The Donald Really Have a Shot at the White House In 2016?

Does The Donald Really Have a Shot at the White House In 2016? Jeb Bush takes Uber to San Francisco startup

Jeb Bush takes Uber to San Francisco startup |

| English: Logo of The Goldman Sachs Group, Inc. Category:Goldman Sachs (Photo credit: Wikipedia) |

A global super-rich elite had at least $21 trillion (£13tn) hidden in secret tax havens by the end of 2010, according to a major study....... The figure is equivalent to the size of the US and Japanese economies combined....... his $21tn is actually a conservative figure and the true scale could be $32tn. A trillion is 1,000 billion. ....... His study deals only with financial wealth deposited in bank and investment accounts, and not other assets such as property and yachts. ..... the super-rich move money around the globe through an "industrious bevy of professional enablers in private banking, legal, accounting and investment industries. ...... "The lost tax revenues implied by our estimates is huge. It is large enough to make a significant difference to the finances of many countries. ...... "From another angle, this study is really good news. The world has just located a huge pile of financial wealth that might be called upon to contribute to the solution of our most pressing global problems," he said. ......... the impact on the balance sheets of 139 developing countries of money held in tax havens that is put beyond the reach of local tax authorities. ....... since the 1970s, the richest citizens of these 139 countries had amassed $7.3tn to $9.3tn of "unrecorded offshore wealth" by 2010. ...... Private wealth held offshore represents "a huge black hole in the world economy," Mr Henry said. ....... Mr Whiting, though, urged caution. ...... if tax havens were stuffed with such sizeable amounts, "you would expect the havens to be more conspicuously wealthy than they are". ...... At the end of 2010, the 50 leading private banks alone collectively managed more than $12.1tn in cross-border invested assets for private clients ...... The three private banks handling the most assets offshore are UBS, Credit Suisse and Goldman Sachs ...... Less than 100,000 people worldwide own about $9.8tn of the wealth held offshore. ....... it was difficult to detail hidden assets in some individual countries, including the UK, because of restrictions on getting access to data. ..... A spokesman for the Treasury said great strides were being made in cracking down on people hiding assets......He said that in 2011-12 HM Revenue & Customs' High Net Worth Unit secured £200m in additional tax through its compliance work with the very wealthy........ He said that agreements reached with Liechtenstein and Switzerland will bring in £3bn and between £4bn and £7bn respectively.Wealth doesn't trickle down – it just floods offshore, research reveals

The world's super-rich have taken advantage of lax tax rules to siphon off at least $21 trillion, and possibly as much as $32tn, from their home countries and hide it abroad – a sum larger than the entire American economy. ...... sifting through data from the Bank for International Settlements (BIS), the International Monetary Fund (IMF) and private sector analysts to construct an alarming picture that shows capital flooding out of countries across the world and disappearing into the cracks in the financial system. ...... Comedian Jimmy Carr became the public face of tax-dodging in the UK earlier this year when it emerged that he had made use of a Cayman Islands-based trust to slash his income tax bill. ...... Despite the professed determination of the G20 group of leading economies to tackle tax secrecy, investors in scores of countries – including the US and the UK – are still able to hide some or all of their assets from the taxman....... large investors usually hold in cash .... "Inequality is much, much worse than official statistics show, but politicians are still relying on trickle-down to transfer wealth to poorer people. ...... for three decades extraordinary wealth has been cascading into the offshore accounts of a tiny number of super-rich." ...... 10 million individuals around the world hold assets offshore, according to Henry's analysis; but almost half of the minimum estimate of $21tn – $9.8tn – is owned by just 92,000 people. And that does not include the non-financial assets – art, yachts, mansions in Kensington – that many of the world's movers and shakers like to use as homes for their immense riches. ..... "If we could figure out how to tax all this offshore wealth without killing the proverbial golden goose, or at least entice its owners to reinvest it back home, this sector of the global underground is easily large enough to make a significant contribution to tax justice, investment and paying the costs of global problems like climate change" ........ estimates of the cumulative capital flight from more than 130 low- to middle-income countries over almost 40 years, and the returns their wealthy owners are likely to have made from them. ......In many cases, , the total worth of these assets far exceeds the value of the overseas debts of the countries they came from.

...... The struggles of the authorities in Egypt to recover the vast sums hidden abroad by Hosni Mubarak, his family and other cronies during his many years in power have provided a striking recent example of the fact that kleptocratic rulers can use their time to amass immense fortunes while many of their citizens are trapped in poverty. ...... Oil-rich Nigeria has seen more than $300bn spirited away since 1970, for example, while Ivory Coast has lost $141bn. ...... Assuming that super-rich investors earn a relatively modest 3% a year on their $21tn, taxing that vast wall of money at 30% would generate a very useful $189bn a year – more than rich economies spend on aid to the rest of the world. ......... standard measures of inequality, which tend to rely on surveys of household income or wealth in individual countries, radically underestimate the true gap between rich and poor. ...... both the very wealthy and the very poor tend to be excluded from mainstream calculations of inequality. ...... "There is rarely a household from the top 1% earners that participates in the survey. On the other side, the poor people either don't have addresses to be selected into the sample, or when selected they misquote their earnings – usually biasing them upwards." ...... Globalisation has exposed low-skilled workers to competition from cheap economies such as China, while the surging profitability of the financial services industry – and the spread of the big bonus culture before the credit crunch – led to what economists have called a "racing away" at the top of the income scale. ....... The surveys that are used to compile the Gini coefficient "simply don't touch the super-rich" ..... some experts believe the amount of assets being held offshore is so large that accounting for it fully would radically alter the balance of financial power between countries. .......... "the wealth held in tax havens is probably sufficiently substantial to turn Europe into a very large net creditor with respect to the rest of the world." ........ In other words, even a solution to the eurozone's seemingly endless sovereign debt crisis might be within reach – if only Europe's governments could get a grip on the wallets of their own wealthiest citizens.

| speaking at CPAC in Washington D.C. on February 10, 2011. (Photo credit: Wikipedia) |

A global super-rich elite had at least $21 trillion (£13tn) hidden in secret tax havens by the end of 2010, according to a major study....... The figure is equivalent to the size of the US and Japanese economies combined....... his $21tn is actually a conservative figure and the true scale could be $32tn. A trillion is 1,000 billion. ....... His study deals only with financial wealth deposited in bank and investment accounts, and not other assets such as property and yachts. ..... the super-rich move money around the globe through an "industrious bevy of professional enablers in private banking, legal, accounting and investment industries. ...... "The lost tax revenues implied by our estimates is huge. It is large enough to make a significant difference to the finances of many countries. ...... "From another angle, this study is really good news. The world has just located a huge pile of financial wealth that might be called upon to contribute to the solution of our most pressing global problems," he said. ......... the impact on the balance sheets of 139 developing countries of money held in tax havens that is put beyond the reach of local tax authorities. ....... since the 1970s, the richest citizens of these 139 countries had amassed $7.3tn to $9.3tn of "unrecorded offshore wealth" by 2010. ...... Private wealth held offshore represents "a huge black hole in the world economy," Mr Henry said. ....... Mr Whiting, though, urged caution. ...... if tax havens were stuffed with such sizeable amounts, "you would expect the havens to be more conspicuously wealthy than they are". ...... At the end of 2010, the 50 leading private banks alone collectively managed more than $12.1tn in cross-border invested assets for private clients ...... The three private banks handling the most assets offshore are UBS, Credit Suisse and Goldman Sachs ...... Less than 100,000 people worldwide own about $9.8tn of the wealth held offshore. ....... it was difficult to detail hidden assets in some individual countries, including the UK, because of restrictions on getting access to data. ..... A spokesman for the Treasury said great strides were being made in cracking down on people hiding assets......He said that in 2011-12 HM Revenue & Customs' High Net Worth Unit secured £200m in additional tax through its compliance work with the very wealthy........ He said that agreements reached with Liechtenstein and Switzerland will bring in £3bn and between £4bn and £7bn respectively.Wealth doesn't trickle down – it just floods offshore, research reveals

The world's super-rich have taken advantage of lax tax rules to siphon off at least $21 trillion, and possibly as much as $32tn, from their home countries and hide it abroad – a sum larger than the entire American economy. ...... sifting through data from the Bank for International Settlements (BIS), the International Monetary Fund (IMF) and private sector analysts to construct an alarming picture that shows capital flooding out of countries across the world and disappearing into the cracks in the financial system. ...... Comedian Jimmy Carr became the public face of tax-dodging in the UK earlier this year when it emerged that he had made use of a Cayman Islands-based trust to slash his income tax bill. ...... Despite the professed determination of the G20 group of leading economies to tackle tax secrecy, investors in scores of countries – including the US and the UK – are still able to hide some or all of their assets from the taxman....... large investors usually hold in cash .... "Inequality is much, much worse than official statistics show, but politicians are still relying on trickle-down to transfer wealth to poorer people. ...... for three decades extraordinary wealth has been cascading into the offshore accounts of a tiny number of super-rich." ...... 10 million individuals around the world hold assets offshore, according to Henry's analysis; but almost half of the minimum estimate of $21tn – $9.8tn – is owned by just 92,000 people. And that does not include the non-financial assets – art, yachts, mansions in Kensington – that many of the world's movers and shakers like to use as homes for their immense riches. ..... "If we could figure out how to tax all this offshore wealth without killing the proverbial golden goose, or at least entice its owners to reinvest it back home, this sector of the global underground is easily large enough to make a significant contribution to tax justice, investment and paying the costs of global problems like climate change" ........ estimates of the cumulative capital flight from more than 130 low- to middle-income countries over almost 40 years, and the returns their wealthy owners are likely to have made from them. ......IMF ReportIn many cases, , the total worth of these assets far exceeds the value of the overseas debts of the countries they came from.

...... The struggles of the authorities in Egypt to recover the vast sums hidden abroad by Hosni Mubarak, his family and other cronies during his many years in power have provided a striking recent example of the fact that kleptocratic rulers can use their time to amass immense fortunes while many of their citizens are trapped in poverty. ...... Oil-rich Nigeria has seen more than $300bn spirited away since 1970, for example, while Ivory Coast has lost $141bn. ...... Assuming that super-rich investors earn a relatively modest 3% a year on their $21tn, taxing that vast wall of money at 30% would generate a very useful $189bn a year – more than rich economies spend on aid to the rest of the world. ......... standard measures of inequality, which tend to rely on surveys of household income or wealth in individual countries, radically underestimate the true gap between rich and poor. ...... both the very wealthy and the very poor tend to be excluded from mainstream calculations of inequality. ...... "There is rarely a household from the top 1% earners that participates in the survey. On the other side, the poor people either don't have addresses to be selected into the sample, or when selected they misquote their earnings – usually biasing them upwards." ...... Globalisation has exposed low-skilled workers to competition from cheap economies such as China, while the surging profitability of the financial services industry – and the spread of the big bonus culture before the credit crunch – led to what economists have called a "racing away" at the top of the income scale. ....... The surveys that are used to compile the Gini coefficient "simply don't touch the super-rich" ..... some experts believe the amount of assets being held offshore is so large that accounting for it fully would radically alter the balance of financial power between countries. .......... "the wealth held in tax havens is probably sufficiently substantial to turn Europe into a very large net creditor with respect to the rest of the world." ........ In other words, even a solution to the eurozone's seemingly endless sovereign debt crisis might be within reach – if only Europe's governments could get a grip on the wallets of their own wealthiest citizens.

If you weren't harmed by the Great Recession, there is a silver lining

If you weren't harmed by the Great Recession, there is a silver lining #U.S.Election2016 Jeb Bush Slams Donald Trump For 'Rhetoric Of Divisiveness'

#U.S.Election2016 Jeb Bush Slams Donald Trump For 'Rhetoric Of Divisiveness' The real problem with Jeb Bush's suggestion that Americans work more hours

The real problem with Jeb Bush's suggestion that Americans work more hours Who will flourish after Donald Trump self-destructs?

Who will flourish after Donald Trump self-destructs? Jeb Bush, Married To Mexican, Denounces Donald Trump, Takes 'Ugly' Remarks About Immigrants

Jeb Bush, Married To Mexican, Denounces Donald Trump, Takes 'Ugly' Remarks About Immigrants Jeb Bush Responds To Donald Trump's Comments About His Wife

Jeb Bush Responds To Donald Trump's Comments About His Wife Trump: Jeb Likes 'Mexican Illegals' Because of Wife

Trump: Jeb Likes 'Mexican Illegals' Because of Wife Trump Says Rivals Couldn't Handle 'El Chapo'

Trump Says Rivals Couldn't Handle 'El Chapo' Trump Says He Could Handle 'El Chapo'

Trump Says He Could Handle 'El Chapo'

Modest minimum wages do not seem to sap demand for labour. Truckloads of studies, from both America and Europe, show that at low levels—below 50% of median full-time income, with a lower rate for young people—minimum wages do not destroy many jobs. When Britain set a new minimum wage in 1998 doom-mongers forecast that jobs would vanish. Employment proved resilient. Minimum wages help offset firms’ bargaining power over employees reluctant to risk moving elsewhere. They may even boost productivity and reduce staff turnover by making workers value their jobs. .......... Encouraged by this evidence, many are clamouring to make minimum wages far more generous. In America campaigners want the federal minimum wage more than doubled from today’s stingy $7.25 an hour to $15 an hour, or 77% of median hourly income. They have had some success; several big cities, including New York this week, plan to phase in a $15 minimum wage ...... nobody knows what big rises will do, at any time horizon. It is reckless to assume that because low minimum wages have seemed harmless, much larger ones must be, too. ..... One danger is that a high minimum wage will push some workers out of the labour force for good. A building worker who loses his job in a recession can expect to find a new one when the economy picks up. A cashier with few skills who, following the introduction of a high minimum wage, becomes permanently more expensive than a self-service checkout machine will have no such luck. The British government’s defence of its new policy—that a strong economy will generate enough jobs to replace those lost to a higher minimum wage—is disingenuous: the jobs are still lost. That is why Milton Friedman described minimum wages as a form of discrimination against the low-skilled. .......... Technological advances are enabling firms to replace more and more people with computers and robots, imperilling jobs. ..... An ever-higher minimum wage will encourage investment in the technology to replace them. Higher minimum wages will also affect workers in tradable sectors such as tourism and manufacturing, where they risk losing ground to foreign competitors....... The irony is that minimum wages are a bad way to combat poverty. The Congressional Budget Office reckons that only one-fifth of the income benefits go to those beneath the poverty line. The richest 10% of British households will benefit more from the higher rate than the poorest 10%, because many low-paid people are their family’s second earners. ...... a minimum wage is not free. Someone must pay. The common refrain that companies will shoulder the burden is the product of hope rather than evidence. If the cost is passed on to consumers, the minimum wage turns into a subsidy funded by a sales tax—a revenue-raiser that, again, falls heavily on the poor. ..... Tax credits (income top-ups for low earners) are a much more efficient way for governments to help the poor—about three-quarters of the benefit ends up with employees. To the extent that firms benefit, they are encouraged to employ low-skilled workers rather than automate jobs.How The Small State Of Israel Is Becoming A High-Tech Superpower

Minimum wages have a powerful emotional and political appeal. But governments should deal in evidence not sentiment.

Minimum wages can work as part of the policy mix only if they are modest. Set too high, they harm the very people they are supposed to help.

With the exception of the U.S., Israel–a country of a mere 8 million people–leads the world in high tech, an astonishing feat. ....... why Israeli milk cows are the world’s most productive and how this desert nation solved its water crisis (California, take note). ....... By all accounts Israel is now one of the top two or three high-tech powers in the world–

ahead of the European Union, with its 500 million people

. You’ve done this with 8 million people. ........ We decided here, in the middle of the Negev Desert, to bring in our special information units of the Israeli Army and put them right next to Ben-Gurion University. And right next to that—all within 100 yards–to build a cyber industrial park to bring in the leading companies of the world. And they’re here. We have this interaction between our finest military and cyber-security minds and the finest at the university and the nearby businesses. ....... Foreign companies, international companies realize that it’s all in the brains, in the ability to solve problems, foresee future problems and address the questions that will determine a lot of the world’s future...... nothing, absolutely nothing will escape the Internet ..... This is the South of Israel, the wild South. But the Internet is like the Wild West. It’s growing at a geometric pace, and for it to continue its growth with safety, security and stability, we need cyber security. And Israel is right up there. I took it as a goal to be among the top three cyber-security powers of the world. And I think we’re definitely there, but we’re shooting even higher. ....... There’s been a lot of pessimism about cyber security, that not much can really be done about it–just as in the old days it was said there was no defense against suicide bombers. What have you seen that makes you feel that we can not only defend but also go on the offensive and anticipate what these guys are going to do? ..... It doesn’t mean you can protect yourself against everything, but you can protect yourself against a lot of things. And that’s useful. And this is evolving all the time. ...... I think the hardest thing about cyber—which is different from other forms of attack, offense and defense–is the difficulty in setting rules. In normal competition, or even in warfare, you can set rules. Most of the time you know who’s attacking and who’s defending. You can use protection, you can use deterrents, you can use punishment. But in the world of cyber it’s not always clear. Cooperation is necessary yet also dangerous, because your partners can be infiltrated. The cyber world is complex and evolving, but if we sit back and say, “Okay, because I have these problems I’m not going to do anything, because I can’t solve everything,” we won’t solve anything. No, that’s not the way we work....... young minds–some of them very young–are. And they think outside the box, which is an understatement. This kind of talent–academic, military, security and entrepreneurial–has converged in one place and is producing a lot of startup companies and a lot of innovations that will give the Net a measure of security it just doesn’t have today. ....... the most important thing in our army is the head, the brain. It’s a very large brain compared with those of other powers. We invest heavily in military intelligence. And developments in military intelligence, especially in IT, were a great unrealized potential until we created a more business-friendly environment. You can have the most brilliant minds, the most brilliant mathematicians and physicists–as you had with those who came from the former Soviet Union. But, as you know, that didn’t go anywhere [until] you [took] those scientists on a plane to Paolo Alto. Then they were producing added value within two weeks. ......... the most important thing [we did] was to create a pro-business environment, a pro-entrepreneurial environment and to introduce the idea of venture capital. The minute we fused intelligence capabilities with business capabilities, the Israeli high-tech economy just took off. And that’s something to which I’ve devoted a good part of my time as prime minister. Now I’m especially concentrating on the enormous growth area of cyber security, which, I believe, will be a growth engine for the next 50 years. The problems aren’t going to go away, and the need for solutions is going to grow. And we intend to be there with the solutions. ........ the first thing is you’ve got to have products that actually give added value–and we do ...... in all areas of technology Israel is, in many ways, a world leader. ....... I spoke to Mr. Modi, the prime minister of India. And he told me, “Look, in all my four color revolutions–in water, dairy, clean air [and the other things he wants, such as agriculture]–I need Israeli technology.” ........ The [breed of] cow that produces the most milk per cow is not a French cow or a Dutch cow; it’s an Israeli cow. Every moo is computerized. And it produces an enormous amount of milk. Now, if you have to feed over a billion people in China, that makes a difference. The same is true in India ....... Water? We recycle–87% of our waste water is recycled. The next runner-up is Spain, with about 20%. ...... when Israel was founded 67 years ago, we had twice the rainwater that we have today. Our population’s grown more than tenfold; our GDP per capita has grown almost 40 times. We should have a water problem, but we don’t. Because we recycle more than any other country in the world. We’ve desalinated. We’ve got drip irrigation. We’ve got controls on our waste and spillage, electronic controls. We don’t have a water problem. ....... the future belongs to those who innovate.Israel innovates

....... that’s one of my big pleasures in public life, slashing the bureaucracy. We had to fight big bureaucratic battles to get this cyber park and to get our military to move all their key units here. But eventually, you know, we got it done. ....... if we’ve grown an average of 5% a year with the amount of bureaucracy we have, that tells you how much more we could grow if we removed that bureaucracy. ....... For most of modern Israel’s existence we didn’t have any natural resources–except for our brains. ..... We were fortunate–as, I think, you once said–to be the only Middle Eastern country with practically no energy. We had to use our mental energy. But then, in roughly the sixth decade of our life, we found gas. ........ We always thought that Moses was a great leader but a lousy navigator. It turns out he wasn’t such a lousy navigator. He brought us to a country not with flowing milk and honey, but with a lot of gas–not manna from heaven, but manna from under the ocean bed, under the sea bed. ..... Private companies, once they started looking for it, were able to do what our government companies could not do: They found gas. They’ve taken some of it, and now we have a big political battle to get the rest out and enable the companies to make money and the Israeli government to get its share. ....... Obviously, we have a lot of populism to fight. Where do you not?

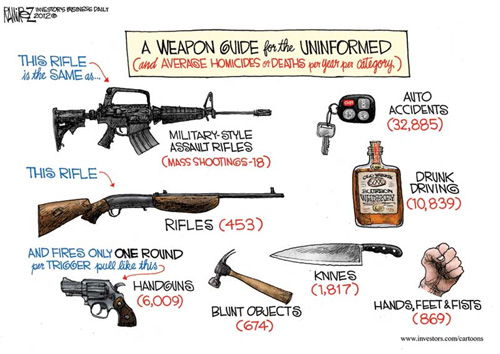

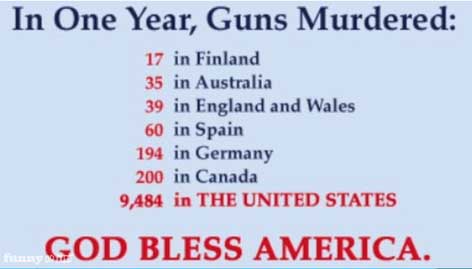

"If you look at the number of Americans killed since 9/11 by terrorism, it's less than 100. If you look at the number that have been killed by gun violence, it's in the tens of thousands," he told BBC.

"Ye mote Gururaj uncle har chhoti cheez par article kyu likh dete hain." ........ The moment you saw this comment you knew a backlash was around the corner. Not so much because of what was said but because of who said it. These days to be Rahul Yadav is to cop it no matter what. ....... Ravi Gururaj, chairman of Nasscom’s Product Council, the writer of that column, will be the first to admit that he cannot be called thin. He had written a column on yourstory.com about a supposed social media spat between Snapdeal’s Rohit Bansal and Flipkart’s Sachin Bansal. ..... Rohit was perceived to be saying in a newspaper article that India did not have enough good programmers. Sachin took a dig at him, suggesting that the fault lay in Snapdeal and not in the country. ....... Rahul’s was the first comment on Gururaj’s article. Others followed quickly, saying all he wanted was cheap publicity. Publicity? By trying to make fun of Gururaj? Come on. There are other ways; Rahul knows some of them. Almost inevitably, an article appeared in ET Panache about how Gururaj was large hearted enough to ignore Rahul’s comment. What was he going to do? Sue? Equally inevitably, Alok Kejriwal, an early entrepreneur, jumped to Gururaj’s side to say how much he loved him for his “stature and presence and depth”. ......... Funny. But Kejriwal waited for his chance. Which came when Yadav resigned — the first time. People who make fun of other people’s houses can’t live in their own, he posted. He also posted a power point presentation, for Rahul, on how to write emails. ....... With the internet start-up revolution, all the world is a boys’ hostel. ..... Rahul also got into other unnecessary spats with Deepinder Goyal (he likes to call Goyal a restaurant menu scanner) and Sequoia’s Shailendra Singh (the story is too well known to recount here). ...... Fine. He is cheeky, at times irritating. He likes to troll people. But he is not just that. This columnist had a chance to talk to him in March. He was then in the middle of the spat with Sequoia......... To his credit, Rahul refused to go into any more gory details about Sequoia (confession time: he was goaded). Instead, he wanted to talk about his ideas on how to run the world. All it will take, according to him, is 50 intelligent people. People like him....... It was easy to dismiss this as hyperbole. But he made some valid points about the way the human race has messed it up in areas like oil, education, travel, and housing. Why have been just burning oil instead of looking for sustainable energy sources? Why are all houses boxes, boxes and more boxes? Why such little infrastructure? Why has no innovation happened in house construction? Why are so many people in cities like Mumbai forced to spend so much time travelling? ...... Basic questions, you say? It was responding to the basic needs that made Housing.com such a success: show what it looks like, give her a tour, verify the location, good user interface, data, data and more data. ....... The sadness of it was captured in all its delicate sensitivity by Haresh Chawla, an early investor in Housing.com........ He brought out Rahul’s personality in all its complexity: a shy, socially-awkward, brilliant soul driven to pain and distraction because he was forced to ride the tiger of investor money...... It was tempting to call this article “Boy Interrupted”. But it is not just that; it is brightness, enterprise, spirit interrupted. Until he comes back.

A week after withdrawing resignation, Housing.com chief executive Rahul Yadav decided on Wednesday to allot all his personal holding in the company worth Rs 150-200 crore to the employees. ...... "Rahul Yadav has decided to allot all his personal shares worth Rs 150-200 crore to the employees of Housing.com who number 2,251," the housing portal said in a late evening statement....... The value of this stock is worth the employees' one-year salary, it added....... Yadav justified the surprise move, saying he is "just 26 and it's too early in life to get serious about money etc." ...... "Housing.com was started because of two reasons. The problems related to house hunting is unsolved globally. Across the globe there are over 500 players who aggregate the market data for buyers. We want to unify all those and create a global platform for real estate," he said. ...... Yadav had reportedly written a resignation letter on April 30 to the board and investors and questioning their "intellectual capability" and giving them a one-week deadline to "help in the transition". However, on May 5, he withdrew the resignation and apologised for his outbursts. ..... Housing.com, which is backed by Japan's Softbank, said its board has been reconstituted to include all main shareholder representatives....... Last December, it received $90 million funding, led by Japan's SoftBank, valuing the portal at about Rs 1,500 crore........ It would use the funds to map over 40 million houses across 300 cities........ Its other shareholders include Nexus Venture Partners, Helion Venture Partners, Qualcomm Ventures, Nirvana Ventures and Falcon Edge Capital.Housing.com CEO Rahul Yadav apologises, withdraws resignation

Rahul Yadav, the CEO of realty portal Housing.com, on Tuesday withdrew his resignation and apologised for reportedly calling fellow board members and investorsNDTV Exclusive: Housing.com CEO Rahul Yadav Gets Candid (Video)

'intellectually incapable of any sensible discussion'

. ...... He added: "I look forward to staying on at Housing as CEO and building an even greater company, while working in full harmony with the board"......... Yadav, the 26-year-old co-founder, had reportedly written a resignation letter on April 30 to board members and investors questioning their "intellectual capability" and giving them a one-week deadline to "help in the transition"..... Founded in 2012 by a dozen IITians, the Mumbai-based company currently offers services in rent/resale, PG/hostels, new projects, land/plot projects, home loans and rental agreement among others.

This announcement from Yadav comes a day after he was trolling on newly formed social networking site Bluegape.com, where it was mentioned that cricketer-turned-investor Yuvraj Singh has invested in Yadav's next venture called ‘NextHousing.com’ through YouWeCan. YouWeCan, a media-focused start-up fund, is planning to take legal action against Bluegape.com. .... A few days after that Yadav was asked to leave the company. However, it didn't end there. A week after Yadav left, Housing was in the news again as the company's website was hacked and Yadav was alleged to be behind the act. However, Yadav announced on his Facebook page that he was not involved in the act.Timeline: The highs and lows of Rahul Yadav at Housing.com

Yadav spent Rs 100 crore on an advertisement blitzkrieg 'Look Up' that was seen by the investors as throwing away millions. He is also said to have been pushing for acquiring online subscription based real estate data and analytics platform PropEquity, which the investors were not confident of. The investors are said to have been looking for a professional CEO to replace Yadav. .......... Later in May, Yadav gave away his entire stake in the company - Rs 150-200 crore worth of shares - to the 2,251 employees as a gift, saying he is only 26 and "it's too early in life to get serious about money etc.".... Soon after, he challenged Ola Head Bhavish Aggarwal and Zomato's Deepinder Goyal to also give away half of their shares to employees...... Most recently, Yadav had taken a pot shot at Infosys CEO Vishal Sikka by posting a picture of him sleeping at an airport lounge. ........ Housing.com was started in June 2013 by 12 IITians, including Yadav. Currently, nine of the founding members remain involved with the company, holding a combined stake of 8-9 per cent in the company. ..... Yadav holds a 4.5 per cent stake in the company, which was started with the aim of providing housing solutions and unifying all the other real estate players functioning in the country. "We want to unify all those and create a global platform for real estate", Yadav has said in the past. ..... Japan's SoftBank is the major investor in the company giving Housing.com $90 million of funding. It holds 32 per cent stake in the housing company. Besides, Nexus Venture Partners (19 per cent stake), Helion Venture Partners, Qualcomm Ventures and Falcon Edge are the other investors in it.Now, Housing.com's Rahul Yadav takes a dig at Infosys CEO Sikka

After taking digs at Zomato and Ola, Housing.com head Rahul Yadav has now taken pot shots at Vishal Sikka by posting a picture of the Infosys CEO sleeping at an airport lounge on social networking site, Facebook...... Along with the picture, Yadav wrote: "Infosys CEO Sikka...... When I asked something he replied 'I just want to sleep' without listening to the question grin :D"........ When asked about his opinion on Deepinder Goyal and Zomato during a Reddit AMA (ask-me-anything) session, he said, "A company scanning menus from last 7 years and doing no innovation. And the CEO says 'Aww. So cute'."

After promising a '100x' return in a matter of 30 days, the infamous Housing.com's former CEO Rahul Yadav has given his fist interview to none other than Femina while turning away a bunch of other news organisations because 'the oldest and one of the most widely read ‘women's magazine has one purposes — to give readers content they want to know about. ..... Yadav now is planning something even bigger than Housing. But he's working alone, so he's working 24/7. .... He thinks Indians do not know how to work. "Yahan sab dhanda karte hain" ..... Apparently, in the last Housing board meeting which lasted barely five minutes, Yadav was just called and and fired. "Within two minutes my email id was deactivated and I can’t access it since," he tells Femina. Yadav, it appears, is unhappiest about losing access to his email which contained all his contacts and more importantly his diet plan! ......Despite Housing co-founders not supporting Yadav, they are still his friends. No hard feelings, boss. ..... Apart from working on three to four different things, Yadav is busy eating, sleeping and surfing the internet. Even the interview to Femina was given from under the covers.

The most gripping boardroom battle in India’s startup ecosystem is over—and the enfant terrible has been ejected...... After multiple bouts of speculation and much drama, Rahul Yadav—the 26-year-old chief executive officer and co-founder of real-estate portal Housing.com—has been fired from his job. ..... Yadav—who dropped out of the Indian Institute of Technology (IIT), Bombay to start Housing.com—had it coming, some would say. A polarising figure in India’s startup scene, fellow entrepreneurs viewed his brashness and arrogance as “a recipe for disaster.” Others saw a “hint of Steve Jobs” in him. ..... December 2014: Japan’s Softbank invests $90 million (Rs572 crore) in Housing.com. The funds, Housing says, would be used to map over 40 million houses across 300 cities in India. ...... March 2015: Yadav asks Shailendra Singh, managing director at private equity firm Sequoia Capital, to not “mess” with him and his company. Singh had reportedly offered a job to a Housing.com employee, which ticked off Yadav. ...... March 2015: India’s largest media house, the Times Group, sends a legal notice to Housing.com and seeks Rs100 crore ($16 million) in damages from the company. Yadav had reportedly claimed in an email to his employees that the Times Group was out to malign Housing.com. Times Group owns MagicBricks, a real estate search portal and a competitor. ...... May 2015: Yadav quits as the company’s CEO, with this scathing email to investors:The Rahul Yadav Story You’ve Never Heard Before

Dear board members and investors,

I don’t think you guys are intellectually capable enough to have any sensible discussion anymore. This is something which I not just believe but can prove on your faces also!

I had calculated long back (by taking avg life expectancy minus avg sleeping hrs) that I only have ~3L (hours) in my life. ~3L hrs are certainly not much to waste with you guys!

Hence resigning from the position of Directorship, Chairmanship and the CEO position of the company. I’m available for the next 7 days to help in the transition. Won’t give more time after that. So please be efficient in this duration.

Cheers,

Rahul

May 2015: Yadav announces that he is giving away his stake in Housing.com to its employees. The shares are estimated to be worth between Rs150 and Rs200 crore ($23.58-31.44 million). “I’m just 26 and it’s too early in life to get serious about money etc,” Yadav explains.

Some are calling him a maniac and a loser, and some a genius and a maverick. One thing is certain though: he suffers no such dilemma - in his view he’s the latter. ..... It was the version 2.0 of how classifieds should work. .... Rahul then started talking about the business, the opportunity and what his team and he wanted to create - and I was hooked. The energy was palpable - the teenager-like awkwardness was gone. I committed, then and there, that I would back their endeavour. When we finished I was thinking "Heck! Look at these kids nowadays. I did not have even an iota of their confidence when I graduated some 20 years ago." I admit, I felt every bit my age. ........ It took a few more meetings to close the terms of the deal. He was a hard-as-nails negotiator, supremely confident of the team and himself. Eventually, I enjoyed the negotiation so much that I gave in to what he was asking for. It was clear that this guy was different. He was very sharp - intense, almost. You could sit in a meeting with him for hours and he wouldn't take a sip of water or a bite to eat or a moment to pause. He was more focused than most people one had met. And he dreamt with his eyes open and made you visualise a new future. ....... For the first six months, we would meet regularly. He would come home, usually on Sunday afternoons. He was very shy and quiet and would barely say a "Hi" to the kids who know him as Rahul uncle. We would sit on the terrace for hours and all he would accept is a cup of tea, which would often go cold as we discussed.Rahul Yadav: The early years at Housing.com Meet the real Rahul Yadav: I found him ‘rocking it’ in his Mumbai office

One could never persuade him to have a meal with the family

. ......... I would often go by to Housing's Powai office. There he would be a different animal - obsessed with doing more and better. His thinking was ten years ahead of the market. He wanted to do 10X better. Always. And as he raised more funding and engaged with more people, I saw his confidence soar. ...... As the business got funded and grew larger, our meetings became infrequent and were replaced by phone calls. Always late at night - at 11.30pm, just as I would be about to turn into bed, the phone would ring and I knew it was Rahul. He would usually have a new idea or mostly he would be bothered about something - like, how he did not have enough time to dedicate to the business. Or didn't have time or people to handle everything. He would say, "We are growing too fast. I don’t have anyone who can manage the growth." Or his struggles with some of his co-founders. And sometimes for just plain help - how he was running the firm hand-to-mouth because funding was delayed. ........ In June 2013, I wrote a piece in Business Standard that while Housing had a bunch of talented folks, the real test of the business would be the transition it would have to make from an "outfit" to an organisation. I said that the young team would need to induct experienced professional talent who would become the building blocks of a scalable company. ....... I recall a day when we had discussed that the company would take its first baby steps and pilot Pune city, but suddenly two weeks later, I heard that they were launching across 10 cities. With no team, no systems, no experience - the investors had asked them to go for broke. ........ First came the VC funding and then these youngsters were asked to ride a tiger - the team grew from 100-odd to over a 1,000 in a matter of a few months. There was no support system - no financial controls, no infrastructure and processes. Nothing that would normally form the chassis of a company. Just a blind race to grow - to create new categories before the older ones had stabilised. A car with an accelerator but no steering wheel - fuelled by the adrenalin of hundreds of youngsters and millions of dollars of VC money. ........ No one asked them to pause, to review, to reflect. No one asked them to measure, to monitor, to plan. One wonders what the hurry was about. It’s not as if the market was running away. The real-estate market was beginning to evolve - online players were barely 2% or less of the entire ecosystem…and Housing had a brilliant solution. They had built technology that could rival the best in the world. ..... It put him in a corner - he had no mentor in the group, no one he could reach out to. Once his funding round was stuck because he needed a little money to clear up some statutory dues - he ran from pillar to post for days - and for a few nights I had a frustrated Rahul on the phone. No one helped. Eventually I stepped in with a loan which allowed this lockjam between investors who have millions of dollars at their disposal to be cleared. It was painful to see this young boy handling so much. ....... He said, "Sir, the investors have told me not to bother with revenues for the next 10 years. They have said they will support the business and we can build a $10 billion company." ..... But that was not to be - they went on ahead and made a big splash with their campaign, adding more cities….riding a bigger tiger even harder. ...... My last conversation with him was a day before he was asked to go. He said, "I can’t relate to these people and I can’t understand why they can’t see what I see. They can’t see what we can build." That he did not know whether he wanted to stay on and do it anymore. It was the first time I saw his energy low - he was pensive and seemed downbeat. ....... If you are a lone-player with great talent - like a sportsperson or an artist or painter - you are then free to work alone, without regard to what the world thinks of you. You have no responsibility, except to hone your own talent - to become the best in the world, and to strive for excellence. It’s a lonely journey, where you learn to practice hard and live your own failures. After all, no one remembers the third seed at Wimbledon, or the second man on the moon................ But if you’ve chosen to be a manager, you’ve then got to be among people, collaborate with them, lead them or be led by them, be able to handle their frustrations, to handle their competence and their incompetence. It's an ego-crushing journey where you need to learn to allow people their space to work. It has very little to do with intelligence - it is more about developing sensitivity - finding a way to motivate people, to pull them in one direction. A journey of frustration, but equally one of triumph when you see the team working together and winning - a journey you share with your team.......... Finally, I told him that if he chose to be the leader, he would need to eat crow, sit and repair relationships and find a way to move ahead. ..... Work on your culture, people. Work on yourself. You are not here to create an app. You are here to build something that lasts. That can weather any storm and outlast the founders. Only then will you be truly successful in your endeavour. ......... It’s crazy to see over 20 start-ups getting funded to do the same thing. Everybody you meet today is an angel investor - people are spreading their bets - but no one is providing the start-ups "adult supervision", something they sorely need. Start-ups need help to become organisations with culture, with rituals, with codes of conduct and with an operating philosophy. Something that’s taken successful companies years to build. ....... He deserves a second chance. Wouldn’t you want one for yourself? ...... Going beyond Housing, I see a worrying phenomenon across the start-up ecosystem: a mis-alignment, if you will, in the relationship between founders and VCs. .. To understand what I mean, check the level of founder shareholdings across most major start-up firms. It has uniformly come down to anywhere between 15 percent to the low single-digits. ......... We need to learn from our counterparts in the West. Founders there understand passion and raw talent are not enough to build a scalable company. They have the maturity to step aside and work with experienced managers, investors and advisors.

Yadav appears casual in his navy blue T-shirt and beige cargos but his office doesn’t look like a “startup office.” It is done up in a sleek white with tinges of bright color in the form of red chairs and green furniture. ...... He pushes all his employees out of his cabin as soon as I enter to greet in the most soft spoken tone. In true Housing style, he picked up his marker to explain the smallest of details and fumbled to find alternative words to IIT Bombay lingo macha rahe hai (meaning “rocking it” in “cool” Hindi). ...... “Players worldwide think that real estate is a local problem and so they haven’t launched overseas operations. We want to change that perception,” said Yadav. “We have set up a dedicated Data Science Lab which sieves through mountains of data to develop indices and metrics that help identify consumer needs. Nobody else has verified photographs of houses on their platform,” he said. ....... “With tools like heat maps, lifestyle rating, locality insights, child friendliness index, demand-supply tool, and so on, we have made the search for homes more fun than a burden,” he explained. “Families can sit together and discuss while taking a peek at the internal and external amenities of a home with a few clicks.” ...... Another step to complete the loop was a housing loans service. ..... This was a day before Housing unveiled its new logo – an arrowhead pointed upward. “It’s a symbol of optimism,” he said. “The sharp outer edges direct towards the future. We are aggressive on growth and aim to be 10 times better in terms of customer experience. However, the curvy edges show that we are soft from the inside.” ...... Housing also revamped its website and app with more colors as it is “a young company with immense vibrancy.” ..... Last year, the company reported a US$8 million loss on revenue of just US$300,000 for the fiscal year ended March 31, 2014. “The online real estate industry is at a nascent stage. We are focusing on building a product right now,” explained Yadav, dismissing concerns over the high cash burn rate. ...... In December last year, Housing said that it aims to map over 40 million houses across 300 cities in India. ....... Yet the founder, who is said to own less than 5 percent of Housing, is now reportedly on his way out, even as the company is in talks to be acquired by Quikr for US$120 million at a valuation of US$172 million. That’s a decline from a US$235 million valuation during its last round of funding...... Housing.com is one of the world’s fastest-growing online real estate platforms.

In Mumbai for a three day visit, a friend pointed me to Rahul Yadav’s residence in Powai. “Everyone in the startup ecosystem knows this man,” this friend who works at a tech startup tells me. ..... has since managed to raise more than $130 million in capital and has been constantly making news for a variety of reasons- from pissing off investors to brute force advertising to law suits with competitors. Curious about knowing the man behind the company, I wrote an email to him asking for an interview and he agreed for a meeting within 12 hours. ...... This interview was conducted a day before the news of Rahul’s resignation .... Housing ads are everywhere. Everywhere. Billboards, TV, Radio, internet, Housing is pumping every channel with ads. Social media has been abuzz with bewilderment at the amount of money Housing has been spending on advertising. “This is normal. You have to build a brand, people have to know about Housing to see what we’ve built! And this is the second phase. We first built the product and didn’t do any marketing! Now, it’s time for showing the world what we’ve built,” says Rahul with an air of confidence. ...... He’s still peering into his laptop and grimaces at an email he received. He excuses himself to reply and looks a bit disturbed. “Some not so nice things are happening,” he dismisses my probing. ..... There are crores of properties in Mumbai alone and Housing has only about 10% of the available properties online as of now. “People need to stop hating us. We are building a brand and are working very hard to solve a problem which no one has tackled head on. We don’t guarantee that we’ll get you a house. Finding a house is a problem and we’re trying all our best to solve this,” Rahul adds. ........ Fund raising hasn’t been a problem for Housing. “There are so many investors willing to put in money, that has never been a problem,” Rahul tells me the obvious........... Most of it boils down to the entrepreneur’s ability to present a case in which the investors believe. ..... “The private markets are huge and I see this continuing for a few years to come. When people can raise $200 million in private markets, why go for an IPO?” he asks. ...... Rahul agrees that he has a brash attitude. “I’ve always been like this. It was the deans during college and now it is the VCs. It’s just an attitude I have,” he says after some reflection. Indifferent to most of the things, Rahul looks everything from a mathematical lens. Talking of Housing, he pens down a function and says it is all about managing variables. ....... Rahul has a general disregard for humankind. Yes. “While growing up, I observed things and always kept thinking. Why are the trains so dirty? Why is this thing like this? Why are people not working hard? Why are hostels so dirty? Why is everything so broken? Why are people so dumb?” he asks rhetorically. ......... You have to be in the best of the places with best of the people ........ Housing is a 2500 people company at the moment and will soon grow to over 4000..... “It’s all mathematics, look at the bigger picture. I assign everything certain weightage and change it to see the changes,” he says and also confirms that it works. Housing gets more than 11 million visitors on the website per month and has crossed a million app downloads. “We’re clearly ahead of all the competitors on all metrics now,” he talks about competition. MagicBricks recently filed a law suit against Housing but Rahul doesn’t really take it seriously. ........ Rahul is very excited about the scale of the housing problem. He believes that Housing.com can be a much larger company than AirBnB, just looking at the market size. And Housing is just getting started, the team believes they’re just starting to scratch the surface. “We’ve been tackling this problem for a few years and we’ve reached midway. We have gained a lot of insights and have figured out some very basic dynamics on the basis of which we’d be changing the model in the future,” he says. ........ In the relatively short period of its existence, Housing has revolutionized the real estate market in India and it continues to lead and disrupt with world class product innovations.

Rahul Yadav, ex-CEO of Housing.com says, “I will be back”

Rahul Yadav, ex-CEO of Housing.com says, “I will be back”

Being the cynosure of all eyes and touted as India’s answer to Steve Jobs and Mark Zuckerberg, Rahul Yadav is rather blasé about the latest developments in the start-up that was his brainchild. Yadav set up Housing.com, which was making waves before a dramatic turn on events after a board meeting got the young former IIT-an fired. ....... a half-asleep Yadav stated how start-ups are far difficult to set up in India than a country like USA. Yadav also chats about how annoying his new-found fame is and that it has played havock with his reticent personality. ...... Known as a media shy person, Yadav shunned interviewers for the last couple of years before the latest turn of events. He quipped that they ask the same questions. Despite being fired from Housing, he remains friends with most of them and remains in contact with them. He revealed that all the content that he was working on was wiped out completely from his system, five minutes after his expulsion. He signed off by stating that he was working on a big project, all alone.

Softbank's 57-year-old billionaire founder Masayoshi Son is known for his long-term bets that look at the potential over decades........ he is betting on India to overtake the US economy in 25 years ...... Last year, I had a meeting with the Prime Minister (Narendra) Modi in Tokyo. We talked about India and the opportunities there and he invited me to come to India. I came in October last year. From that visit, we ( SoftBank) said we will make a $10 billion investment and I made a commitment for the next 10 years. Then, PM Modi asked me why don't I look at not just internet-related business, but also solar energy? I said okay. ......... he (Modi) then announced a 100 gigawatt vision for solar, increased from the last government's 20 GW target. I said, wow, that's a great vision and I would like to support and contribute to making that happen. So, here we are. ..... Like in the beginning of the automobile (industry), car accidents happened often. Regulations come, the traffic lights come and you cannot drive when you drink—all kinds of rules come as solutions to solve issues. In internet in general, there are security, privacy and many other issues. ...... Snapdeal (at least the business model) is an Alibaba-style model. Flipkart is more like the Amazon model. ....... Alibaba model is the model that I am supporting in China, in India and even in Japan. ...... I think

in the next 30 years, the number of robots will be equal or greater than number of humans

. That's my view. Thirty years ago there was no mobile phone. Today, everyone has a mobile phone. So 30 years is a big change. ...... And the number and kind of robots will be more than the kind of humans. ...... Of course Jack Ma was the guy who impressed me. But I sometimes get very excited with the wrong guys and I regret that five years later. Out of the 24 investments over the last 18 years, actually only with four of them we did minus results; 20 of them reported positive results. And aggregate return on investment was 46% annually. ...... Sometimes there are guys who are smart but selfish, unfair. ...... the Chinese economy will be larger than the US in the future. After that, India is the next best candidate that could surpass US economy in the next 25 years. After that China and India could be competing for number one. So India has that much opportunity. ..... I would like to participate in this exciting moment as we participated in the Chinese 'hockey stick' moment.