The U.S. dollar became the de facto global currency due to a mix of historical events, economic dominance, and structural advantages. Here's a breakdown of the key factors:

1. Bretton Woods System (1944)

-

After WWII, 44 Allied nations agreed to peg their currencies to the U.S. dollar, which was backed by gold.

-

The U.S. held the vast majority of global gold reserves, making it the most stable and trusted currency.

-

Although the gold standard was abandoned in 1971 (Nixon Shock), the dollar's central role persisted.

2. Size and Stability of the U.S. Economy

-

The U.S. has been the world's largest or second-largest economy for over a century.

-

It boasts deep, liquid, and open capital markets, especially for U.S. Treasury bonds.

-

The U.S. political system, despite flaws, has historically offered legal predictability and property protections.

3. Dollar-Denominated Trade

-

Oil and commodities are mostly priced and traded in dollars (petrodollar system).

-

Countries need dollars to buy oil, incentivizing them to hold dollar reserves.

-

Many global contracts and loans (e.g., for developing countries) are in dollars.

4. U.S. Treasury Securities as Safe Assets

-

Central banks around the world hold U.S. Treasury bonds as a reserve asset because they’re liquid and safe.

-

The U.S. government has never defaulted on its debt (though political standoffs occasionally threaten it).

-

This makes dollar-denominated assets the global "safe haven" during crises.

5. Global Confidence and Network Effects

-

Once the dollar became dominant, it created path dependency—most people and countries use it because others already do.

-

The dollar is used in over 80% of international trade transactions.

-

It's held as reserves by most central banks (60%+ of global foreign exchange reserves).

6. U.S. Military and Geopolitical Power

-

U.S. global military reach and strategic alliances reinforce trust in its system.

-

The U.S. can enforce sanctions and control access to the dollar-based SWIFT system, giving it powerful leverage.

7. Lack of Viable Alternatives

-

The euro lacks political and fiscal unity.

-

The Chinese yuan is not fully convertible and China’s capital markets are not as open.

-

Gold and cryptocurrencies are too volatile or impractical for most global trade.

Summary:

The U.S. dollar dominates because of a historical head start, economic strength, financial infrastructure, and global trust—not because it's perfect, but because nothing better has yet emerged.

While the U.S. enjoys significant benefits from the dollar’s status as the de facto global currency, there are also serious disadvantages—some subtle, some structural. Here's a breakdown:

🔴 1. Trade Deficits: The "Dollar Trap"

-

The global demand for dollars forces the U.S. to run persistent trade deficits—it must export dollars to the world.

-

This often means importing more than it exports, hollowing out U.S. manufacturing over decades.

-

It’s a paradox: for the world to hold dollars, the U.S. must supply them—usually by buying foreign goods.

Result: Loss of industrial base, fewer manufacturing jobs, regional economic decline.

🔴 2. Strong Dollar Hurts U.S. Exports

-

Global demand for dollars often drives up its value.

-

A strong dollar makes U.S. goods more expensive abroad, hurting American exporters.

-

It also makes imports cheaper, discouraging domestic production.

🔴 3. Asset Bubbles and Financialization

-

As dollars pour into U.S. capital markets, they inflate asset prices (stocks, bonds, real estate).

-

Encourages financial speculation over productive investment in infrastructure or R&D.

-

Increases wealth inequality by enriching those who own capital assets.

🔴 4. Dollar Weaponization Risks Blowback

-

The U.S. uses the dollar’s dominance for sanctions and financial pressure, which can be effective short-term.

-

But it incentivizes other countries to create alternatives (e.g. BRICS payment systems, CBDCs, gold settlements).

-

Overuse could undermine long-term dollar trust.

🔴 5. “Exorbitant Burden” of Responsibility

-

The U.S. Federal Reserve sets policy for domestic needs—but its decisions impact the entire global economy.

-

A rate hike to fight U.S. inflation may trigger currency collapses or debt crises in developing countries.

🔴 6. Global Financial Imbalances

-

The dollar system contributes to a two-tiered global economy where rich countries control currency flows.

-

It often traps developing countries in dollar debt cycles, requiring austerity or IMF bailouts.

-

This creates moral pressure on the U.S. to act as a global lender or crisis manager.

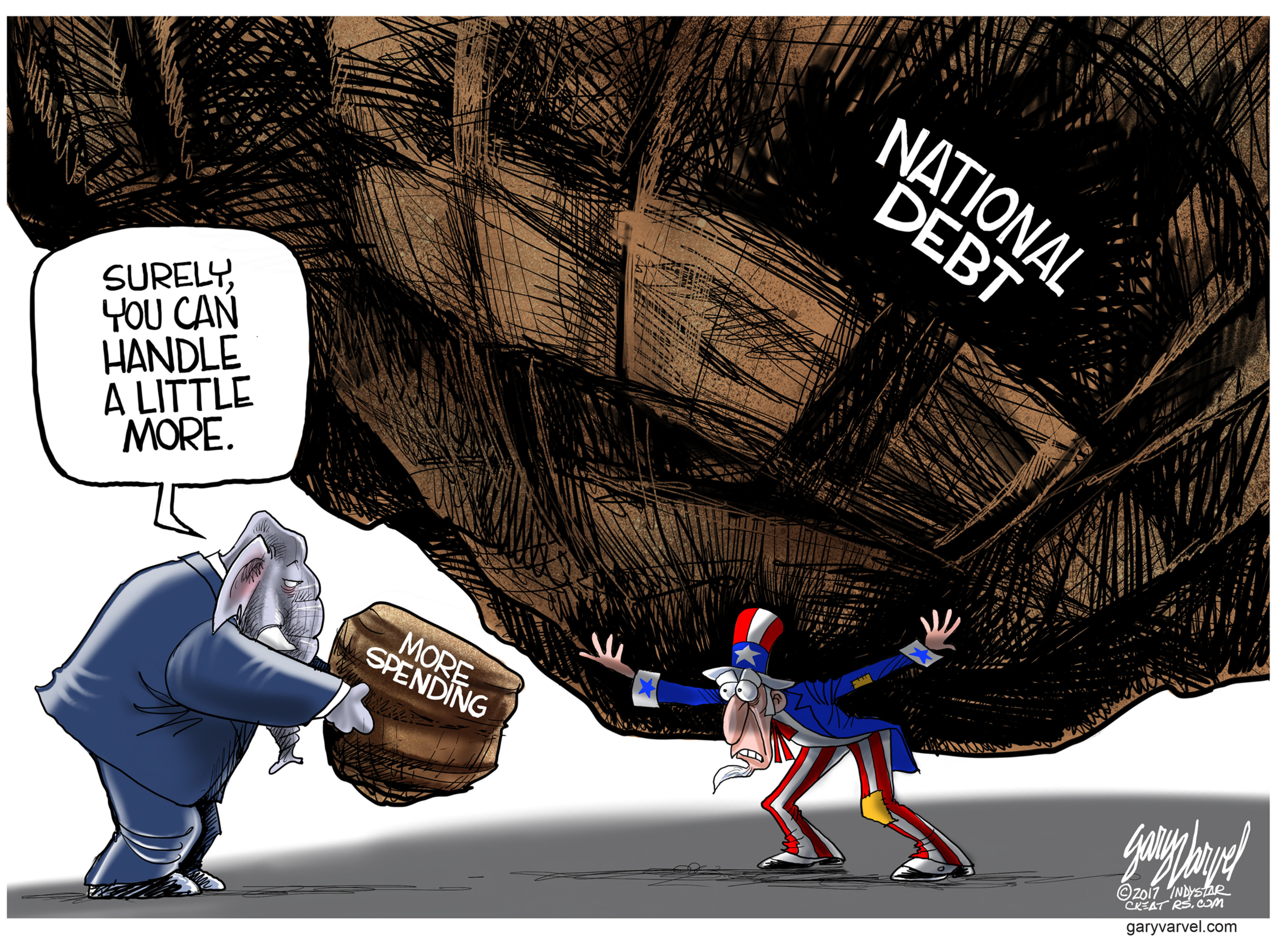

🔴 7. False Sense of Security

-

The U.S. can borrow cheaply because the world demands dollars.

-

This may encourage fiscal irresponsibility, growing the national debt without immediate consequences.

-

Eventually, that trust could erode if deficits become unsustainable or if alternatives to the dollar take hold.

Summary:

The U.S. dollar’s global role boosts U.S. financial power—but it comes at a cost to exports, industry, and stability, while inviting backlash from rivals. It’s a double-edged sword: enormous influence, but growing long-term vulnerability.

A multipolar currency world is already emerging. While the U.S. dollar remains dominant, several realistic scenarios point toward a future with multiple global currencies used for trade, reserves, and settlements.

🔄 SCENARIO: A Multipolar Currency System

In this world:

-

The U.S. dollar still plays a key role.

-

But the euro, yuan, and others share the stage.

-

Trade, reserves, and investment flows become more diversified.

-

Power is more balanced — both economically and politically.

🧭 Key Drivers of Multipolarity

1. Geopolitical Realignments

-

U.S.-led sanctions (e.g., on Russia and Iran) have pushed countries to seek dollar alternatives.

-

China and Russia are actively reducing dollar dependence in bilateral trade.

-

BRICS countries are discussing a common settlement currency backed by a basket of commodities.

2. Technological Disruption (CBDCs & Blockchain)

-

Central Bank Digital Currencies (CBDCs) from China, India, and others can bypass SWIFT and reduce dollar reliance.

-

Blockchain-based stablecoins or commodity-backed tokens can settle international trade instantly without needing dollars.

3. Growing Currency Blocs

-

Euro already accounts for ~20% of global reserves.

-

The Chinese yuan is being internationalized through the Belt and Road Initiative and swap lines.

-

Gulf countries and ASEAN are exploring regional payment systems, often linked to local currencies.

4. U.S. Overreach and Trust Erosion

-

Weaponization of the dollar (e.g., freezing reserves) has made other countries wary.

-

Holding too many dollars feels risky if geopolitical tensions rise.

🧮 How It Might Work

| Use Case |

USD |

Euro |

Yuan |

Others |

| Energy Trade |

✓✓✓ |

✓ |

✓✓ |

✓ |

| Reserves |

✓✓✓ |

✓✓ |

✓ |

✓ |

| Bilateral Deals |

✓✓ |

✓✓ |

✓✓✓ |

✓✓ |

| Tourism/Travel |

✓✓✓ |

✓✓ |

✓✓ |

✓✓ |

| Debt Issuance |

✓✓✓ |

✓✓ |

✓ |

– |

No single currency dominates across all domains. Instead, a flexible ecosystem emerges.

⚠️ Challenges to Multipolarity

-

Network effects: Most systems, banks, and contracts are dollar-based.

-

Liquidity: Dollar markets are deep; other currencies can’t yet match.

-

Trust and convertibility: The yuan, for example, is not fully convertible and China has capital controls.

-

Political unity: The euro lacks a centralized fiscal union; BRICS lack cohesion.

🔮 Future Scenarios

-

Gradual Decentralization

-

Regional Currency Zones

-

Tokenized Trade & Commodities

✅ Conclusion

A multipolar currency world is not only possible — it's already forming. The process will be gradual and uneven, but the dollar’s monopoly is weakening, and currency diversity is becoming a strategic imperative in a fragmented, deglobalizing world.

John Maynard Keynes's idea from 1944 may actually have been the best model for global trade: a neutral, global currency not controlled by any single country.

🧠 Keynes’s 1944 Proposal: The Bancor

At the Bretton Woods Conference in 1944, Keynes proposed creating an international clearing union (ICU) with a global unit of account called the bancor.

📌 Key Features:

-

The bancor would not be a national currency like the dollar or pound.

-

It would be used only for international trade settlements, not for domestic transactions.

-

Countries would hold bancor accounts at a global central bank (the ICU).

-

Trade imbalances would be automatically corrected by penalizing both surplus and deficit countries.

🌐 Why the Bancor Was a Brilliant Idea for Global Trade

1. Neutrality

2. Balanced Trade Incentives

-

Keynes didn’t just want to punish deficit countries (like IMF austerity does).

-

He also wanted surplus countries (like China today or the U.S. post-WWII) to spend more or invest abroad to rebalance trade.

-

This discourages hoarding of foreign reserves and encourages fair trade.

3. No Need for Dollar Hoarding

4. Reduced Global Imbalances

-

The bancor system would have automatic adjustments: limits on how much surplus or deficit a country could build up.

-

That could prevent crises like the Eurozone imbalance, or the U.S.-China trade gap.

🔴 Why It Didn’t Happen

-

The U.S., emerging from WWII as the dominant power, rejected it.

-

It insisted on using the U.S. dollar (tied to gold) as the backbone of the new global financial system.

-

As a result, global trade became dependent on the monetary and fiscal policy of one country — the U.S.

⚖️ What’s Best for Global Trade Today?

| System |

Pros |

Cons |

| Dollar Hegemony |

Deep liquidity, stability |

Biased, creates global imbalances |

| Multipolar System |

Flexibility, competition |

Complexity, fragmentation |

| Bancor/Neutral Currency |

Fair, balanced, stable |

Needs global governance and trust |

In principle, Keynes’s idea remains the most equitable and sustainable — especially in a world of multipolar powers (U.S., China, EU, BRICS). But it would require unprecedented international cooperation and a new global institution to administer it.

🧩 What Could a Modern Bancor Look Like?

-

Blockchain-based token issued by a global institution (e.g. a reformed IMF or a new BRICS+ clearing union)

-

Backed by a basket of currencies or commodities

-

Used only for cross-border settlements

-

With built-in rules to automatically penalize excessive trade surpluses and deficits

✅ Conclusion

Keynes’s bancor was ahead of its time — a neutral global reserve currency that promotes balanced trade. In an age of dollar fatigue and rising economic nationalism, a modernized version of the bancor could be the ideal framework for fair, sustainable global trade.

The Trump administration's desire to:

-

Maintain the U.S. dollar’s status as the world’s reserve currency, and

-

Simultaneously achieve balanced trade with every single country,

is inherently self-defeating. It's a classic case of wanting to have your cake and eat it too.

🧠 Why This Is a Contradiction

🔵 Reserve Currency Role Requires Trade Deficits

-

For the dollar to function as the world’s primary currency, the U.S. must export dollars to the rest of the world.

-

That usually happens through running trade deficits—importing more than it exports.

-

Countries need dollars to buy oil, repay debt, and build reserves. If the U.S. insists on balanced trade with each country, where would the world get those dollars?

🔁 Global dollar demand requires a U.S. trade deficit.

🔴 Bilateral Trade Balancing Undermines the System

-

The Trump-era strategy of bilateral trade negotiations (vs. multilateral frameworks like the WTO) ignores the reality of multilateral trade imbalances.

-

A country like Germany may run a big surplus with the U.S., but a deficit with China. The trade system is circular, not bilateral.

-

Trying to impose 1-to-1 balance with every partner is economically incoherent in a globally networked economy.

⚖️ Example: Dollar Hegemony vs. Balanced Trade

| Policy Goal |

Implication |

| Preserve global dollar role |

Must keep trade deficits flowing to supply global demand |

| Balanced trade with all nations |

Implies trade surpluses or zero-sum balancing, which would reduce global dollar circulation |

They cancel each other out.

🏛️ WTO Dismantling Makes It Worse

-

The WTO helps manage global trade under predictable rules. Its weakening under Trump increased trade uncertainty and undermined multilateral discipline.

-

Without a rules-based system, big countries can bully small ones, and currency manipulation and retaliation rise.

-

Ironically, this undermines trust in the dollar, especially if the U.S. itself is seen as destabilizing global trade norms.

🎯 Bottom Line

Yes — Trump’s trade and currency objectives are deeply at odds:

-

You can run global deficits to supply the world with dollars, or you can balance trade bilaterally, but not both.

-

You can dominate a rules-based system, or you can tear it down and go bilateral, but doing both makes the system weaker and less likely to support dollar supremacy.

In short, you can't run a global monetary system and a nationalist trade regime at the same time.

Grounded Greatness: The Case For Smart Surface Transit In Future Cities

The Garden Of Last Debates (novel)

Deported (novel)

Empty Country (novel)

Trump’s Default: The Mist Of Empire (novel)

The 20% Growth Revolution: Nepal’s Path to Prosperity Through Kalkiism

Rethinking Trade: A Blueprint for a Just and Thriving Global Economy

The $500 Billion Pivot: How the India-US Alliance Can Reshape Global Trade

Trump’s Trade War

Peace For Taiwan Is Possible

Formula For Peace In Ukraine

A 2T Cut

Are We Frozen in Time?: Tech Progress, Social Stagnation

The Last Age of War, The First Age of Peace: Lord Kalki, Prophecies, and the Path to Global Redemption

AOC 2028: : The Future of American Progressivism

:max_bytes(150000):strip_icc()/GettyImages-848755326-48dd2711646247648c4faebc98715119.jpg)