Trump’s Tariffs: Frontloading, Economic Fallout, and the Path Forward

The assertion that early frontloading by importers has temporarily delayed the effects of Donald Trump’s sweeping new tariffs—but that empty shelves and price increases are inevitable—is increasingly supported by leading economists and recent market data. This piece evaluates that claim, explores its impact on inflation, polls, and the stock market, and offers a roadmap to a more stable trade policy.

Frontloading and the Illusion of Stability

One of the reasons prices haven’t immediately surged despite tariff hikes is due to frontloading, where companies rushed to import goods ahead of tariff deadlines. As Ernesto Tedeschi of the Yale Budget Lab notes, “Companies beat the clock by bringing in foreign goods before Trump’s tariffs took effect.” This led to a temporary surge in imports: U.S. goods imports in the first five months of 2025 rose 17% compared to the same period in 2024.

This tactic, however, only buys time. Once those stockpiles deplete—expected to happen by mid-July 2025, per retail industry warnings—price hikes and shortages are expected to ripple across the economy.

Empty Shelves and Rising Prices: The Next Phase

The frontloading buffer masks what nearly every economist sees as inevitable: higher prices and supply chain disruption.

-

The Yale Budget Lab estimates that the new tariff regime will reduce the average household’s purchasing power by $2,800 annually.

-

Prices on essential goods have already shown early signs of pressure: shoes (+15%) and clothing (+14%), with more expected to follow.

Neil Saunders of GlobalData warns:

“The combination of ballooning supply chain costs and consumer pullback is what ultimately creates conditions for empty shelves.”

Jamie Dimon, CEO of JPMorgan Chase, adds:

“We are likely to see inflationary outcomes, not only on imported goods but on domestic prices, as input costs rise and demand increases for substitute domestic products.”

Murat Tasci of J.P. Morgan confirms that consumers, not foreign producers, shoulder the burden:

“The tax incidence nearly always falls on domestic sellers and consumers. Our models show a near one-for-one pass-through of tariff costs.”

This is consistent with data from Trump’s first term: the 2018–19 tariff round caused U.S. companies to absorb higher input costs and pass them on to consumers, with negligible reductions in Chinese export pricing.

On the Ground: Retailers and Manufacturers Sound the Alarm

Industry leaders are preparing for the worst:

-

Retail CEOs warned the White House on April 21, 2025, that product shortages could hit within weeks.

-

Pulte Homes projected that home prices would increase by $5,000 on average due to costlier imported materials.

-

Cox Automotive’s Jonathan Smoke said tariffs on auto parts and vehicles could raise average new car prices by $3,000–$5,000, depending on the make and model.

A recent National Retail Federation survey found that 79% of retailers expect to raise prices by late July, with many planning layoffs if sales fall.

Economic Consensus: A Coming Storm

By June 2025, Trump’s tariff policy had raised the average U.S. tariff rate from 2.5% to 15.8%, the highest since the 1930s. Economists across the spectrum warn of long-term damage.

Diane Swonk, Chief Economist at KPMG, warns:

“Uncertainty is its own tax on the economy.”

Jason Furman, former Chair of the Council of Economic Advisers, states:

“There’s a lot to be worried about. These tariffs create inflationary pressure, reduce competitiveness, and introduce policy unpredictability that businesses hate.”

A 2025 joint statement from 16 Nobel Prize-winning economists, including Paul Krugman and Joseph Stiglitz, declared:

“The current trade policy path risks reigniting inflation, reducing consumer welfare, and undercutting America’s global leadership.”

Poll Numbers: Delayed Pain, Delayed Political Fallout

Trump’s base has so far shown resilience to negative economic news, but this may not last. Political identity plays a strong role in economic perception.

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, notes:

“Partisanship clouds how people perceive their economic reality.”

However, swing voters and independents may become more sensitive as economic pain becomes tangible. A Leadership Now/Harris poll (April 2025) showed that 84% of business leaders were “very concerned” about tariff fallout. Meanwhile, the Conference Board’s consumer confidence index fell to its lowest since May 2020, a sign of eroding optimism.

Expect a polling dip post-July 2025, when suspended tariffs on key consumer goods expire and price shocks hit the public directly.

Tariff Chaos vs. Trade Diplomacy

The Trump administration’s stop-start tariff policy has introduced confusion into the market:

-

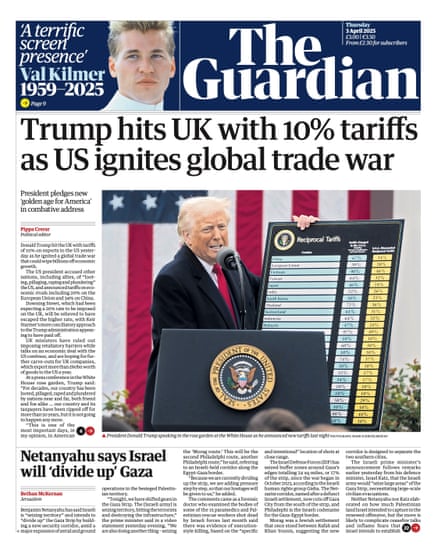

Tariffs were paused on April 8, 2025, for 90 days, leading to a 9.5% surge in the S&P 500—the biggest one-day gain since 2008.

-

Earlier that month, the Nasdaq fell into bear market territory, and the Russell 2000 plunged 6.5% due to tariff panic.

-

Trade deals remain limited: a temporary truce with China, and narrow agreements with the UK and Vietnam, with no NAFTA successor and no EU deal.

Zanny Minton Beddoes, editor-in-chief of The Economist, called the tariff strategy:

“The largest and most chaotic trade policy intervention in U.S. history.”

Janet Yellen, former Treasury Secretary, echoed:

“This is a massive, self-inflicted wound. We’re applying 1930s-style tactics to a 2025 economy.”

Meanwhile, foreign leaders are standing firm:

-

Mexico’s Claudia Sheinbaum has refused to renegotiate under threat.

-

Canada’s Mark Carney imposed retaliatory tariffs worth $21 billion.

-

UK PM Keir Starmer walked out of early trade talks in May 2025, citing “lack of predictability.”

Markets and Macro Risks

Tariffs have introduced volatility, and analysts warn of a long-term drag:

-

Penn Wharton Budget Model projects an 8% reduction in U.S. GDP and a $58,000 lifetime income loss per middle-income household.

-

U.S. imports fell 20% in April 2025, signaling disrupted supply chains.

-

Oren Cass, of American Compass, cautions:

“Markets hate uncertainty. Without a strategic framework, this chaos is more destructive than any specific tariff rate.”

The Core Problem: Tariff Overreach and Policy Volatility

The fundamental issue isn’t just the tariffs—it’s the scale, unpredictability, and lack of strategy. Instead of addressing real concerns—like China’s industrial policy or supply chain resilience—Trump’s approach has:

-

Increased costs on friendly trading partners (e.g., Canada, Japan).

-

Applied tariffs indiscriminately (e.g., raw materials, consumer goods, components).

-

Ignored global supply chain realities. The Peterson Institute estimates that the effective tariff rate on Chinese goods is 76% due to Chinese parts embedded in global products.

As Anson Soderbery of Purdue University puts it:

“Tariffs aren’t a magic wand. You can’t just punish a country and expect your own economy to benefit.”

A Way Out: Strategy Over Spectacle

Leading economists and trade policy experts outline a more pragmatic path:

-

Targeted Tariffs: Address specific sectors (e.g., semiconductors, green tech dumping) rather than blanket levies.

-

Extend Tariff Pauses: Use temporary suspension windows to negotiate instead of pressure allies.

-

Comprehensive Trade Deals: A single multilateral deal could take time, but it provides long-term certainty.

“One comprehensive deal is worth more than 100 chaotic tweets,” says Paul Ashworth, chief North America economist at Capital Economics.

-

Currency Coordination: Some advisors (e.g., Stephen Miran) propose a “Mar-a-Lago Accord” to weaken the dollar and spur exports—but this risks capital flight.

-

Diversify Supply Chains: Businesses should reduce overdependence on any one country, as CLA Global advisors suggest.

-

Transparent Communication: The White House should clarify tariff goals, conditions for their removal, and timelines. Without this, markets and consumers remain in the dark.

Conclusion

The claim that frontloading has temporarily muted Trump’s tariffs but that empty shelves and higher prices are inevitable is well-supported by economic data and expert opinion. The long-term risks—from consumer inflation and political backlash to global supply chain disruption and market instability—are real.

Tariffs are a tool, not a trade strategy. The U.S. must pivot toward focused, deliberate trade policy rooted in economic data, diplomatic consensus, and market confidence. Otherwise, America risks trading short-term bravado for long-term pain.

ट्रंप के टैरिफ: अस्थायी राहत, आर्थिक झटका और आगे का रास्ता

यह दावा कि आयातकों द्वारा पहले से माल इकट्ठा (फ्रंटलोडिंग) कर लेने के कारण ट्रंप के नए टैरिफों का असर अभी तक स्पष्ट नहीं हुआ है — लेकिन जल्द ही खाली दुकानों और कीमतों में वृद्धि के रूप में इसके परिणाम दिखेंगे — अब अग्रणी अर्थशास्त्रियों और हालिया आंकड़ों द्वारा प्रमाणित हो रहा है। यह लेख उस दावे की समीक्षा करता है, मुद्रास्फीति, जनमत सर्वेक्षण, और शेयर बाज़ार पर इसके प्रभाव को देखता है, और एक स्थिर व्यापार नीति की ओर संभावित मार्ग प्रस्तुत करता है।

अस्थायी राहत: फ्रंटलोडिंग का भ्रम

कीमतों में तात्कालिक वृद्धि न होने का एक प्रमुख कारण यह है कि कंपनियों ने टैरिफ लागू होने से पहले ही बड़ी मात्रा में सामान आयात कर लिया। जैसा कि येल बजट लैब के एर्नेस्टो टेडेस्की ने कहा:

"कंपनियों ने ट्रंप के टैरिफ लागू होने से पहले विदेशी सामान मंगाकर घड़ी को मात दी।"

इससे 2025 के पहले पांच महीनों में अमेरिकी आयात 17% बढ़ा, लेकिन यह भंडार सीमित है — और जुलाई के मध्य तक समाप्त होने की संभावना है।

खाली शेल्फ और महंगाई: अगला चरण

लगभग सभी अर्थशास्त्रियों की राय है कि टैरिफ से कीमतों में वृद्धि और सप्लाई चेन में व्यवधान अपरिहार्य है।

-

येल बजट लैब का अनुमान है कि इन टैरिफों के कारण प्रत्येक अमेरिकी परिवार की क्रयशक्ति $2,800 सालाना तक घट सकती है।

-

जूते में 15% और कपड़ों में 14% तक की मूल्य वृद्धि पहले ही देखी जा चुकी है।

नील सॉन्डर्स (GlobalData) के अनुसार:

"आपूर्ति श्रृंखला की लागतों में उछाल और उपभोक्ता की खपत में गिरावट मिलकर दुकानों को खाली करने वाली स्थिति बना देते हैं।"

जेपी मॉर्गन चेस के सीईओ जेमी डाइमोन कहते हैं:

"टैरिफ न केवल आयातित वस्तुओं बल्कि घरेलू वस्तुओं की कीमतों में भी मुद्रास्फीति लाएंगे।"

मुरात टास्की (जेपी मॉर्गन) ने स्पष्ट किया कि:

"टैक्स का बोझ आमतौर पर घरेलू उपभोक्ताओं और विक्रेताओं पर ही पड़ता है।"

उद्योग और खुदरा क्षेत्र की चेतावनी

-

21 अप्रैल 2025 को खुदरा क्षेत्र के सीईओ ने ट्रंप को चेताया कि दो सप्ताह में मूल्यवृद्धि और माल की कमी शुरू हो जाएगी।

-

पल्ट होम्स ने बताया कि टैरिफ के कारण घरों की औसत कीमत में $5,000 की वृद्धि होगी।

-

कॉक्स ऑटोमोटिव का अनुमान है कि वाहन की कीमतों में $3,000–$5,000 तक की वृद्धि होगी।

अर्थशास्त्रियों की आम राय: यह स्थायी संकट है

2025 तक, ट्रंप की टैरिफ नीति के चलते अमेरिका का औसत टैरिफ रेट 2.5% से बढ़कर 15.8% हो गया — 1930 के दशक के बाद सबसे ऊंचा।

डायन स्वोंक (KPMG) ने कहा:

"अनिश्चितता खुद एक तरह का टैक्स है।"

जेसन फुरमैन, पूर्व व्हाइट हाउस सलाहकार, कहते हैं:

"ये टैरिफ मुद्रास्फीति को बढ़ाते हैं, प्रतिस्पर्धा को घटाते हैं, और नीति में अस्थिरता लाते हैं।"

पॉल क्रुगमैन और जोसेफ स्टीग्लिट्ज़ समेत 16 नोबेल विजेता अर्थशास्त्रियों ने मिलकर कहा:

"यह नीति अमेरिका की वैश्विक स्थिति और उपभोक्ता कल्याण को कमजोर कर सकती है।"

ट्रंप की लोकप्रियता पर प्रभाव

राजनीतिक झुकाव के कारण लोग आर्थिक वास्तविकताओं को अलग तरह से देख सकते हैं।

लिज़ ऐन सॉन्डर्स (Schwab) कहती हैं:

"राजनीतिक पहचान यह तय करती है कि लोग अर्थव्यवस्था को कैसे अनुभव करते हैं।"

लेकिन स्विंग वोटर और मध्यमवर्गीय उपभोक्ता जब कीमतों में तेज़ वृद्धि और माल की कमी महसूस करेंगे, तब असंतोष बढ़ सकता है।

व्यापार नीति या व्यापार में अफरा-तफरी?

-

8 अप्रैल 2025 को टैरिफ स्थगन के बाद S&P 500 में 9.5% उछाल आया — 2008 के बाद सबसे बड़ा।

-

परंतु इससे पहले, शेयर बाजार में भारी गिरावट आई — Nasdaq में मंदी, और Russell 2000 में 6.5% गिरावट।

Zanny Minton Beddoes (The Economist) कहती हैं:

"यह अमेरिकी इतिहास की सबसे अव्यवस्थित व्यापार नीति है।"

जैनेट येलेन, पूर्व ट्रेजरी सचिव, ने कहा:

"यह एक आत्मघाती कदम है।"

शेयर बाजार और दीर्घकालिक जोखिम

पेन व्हार्टन बजट मॉडल का अनुमान है कि टैरिफ से:

-

अमेरिकी GDP 8% तक घट सकता है

-

एक मध्यम वर्गीय परिवार को जीवन भर में $58,000 की हानि हो सकती है।

ओरेन कैस चेताते हैं:

"बाजारों को रणनीति चाहिए, न कि संदेह और ड्रामा।"

असली समस्या: असंगत टैरिफ नीति

मुख्य समस्या टैरिफों की अनियमितता, वृहदता, और रणनीतिक दृष्टिकोण की कमी है।

-

मित्र देशों पर भी टैरिफ (जैसे कनाडा, जापान)

-

असंवेदनशील श्रेणियों पर शुल्क (कच्चा माल, उपभोक्ता वस्तुएं)

-

वैश्विक सप्लाई चेन की अनदेखी

Peterson Institute का अनुमान है कि चीन से आने वाले सामान पर वास्तविक प्रभावी टैरिफ 76% तक है।

एंसन सोडरबेरी कहते हैं:

"टैरिफ कोई जादू की छड़ी नहीं हैं। आप किसी देश को दंडित कर अपनी अर्थव्यवस्था को मजबूत नहीं कर सकते।"

समाधान क्या है?

-

लक्ष्यित टैरिफ — पूरी अर्थव्यवस्था पर नहीं, चुनिंदा रणनीतिक क्षेत्रों पर।

-

टैरिफ स्थगन — स्थायी समझौतों के लिए समय खरीदा जा सकता है।

-

व्यापक व्यापार समझौते —

"एक ठोस समझौता 100 ट्वीट से बेहतर है," — पॉल ऐशवर्थ

-

डॉलर को नियंत्रित करना — मार-ए-लागो समझौता जैसी नीति पर विचार (जो निर्यात बढ़ा सकती है, लेकिन जोखिम भरी है)।

-

आपूर्तिकर्ता विविधता — व्यापारिक संस्थानों को विविधता लानी होगी।

-

स्पष्ट संचार — उद्देश्य, समयसीमा और रणनीति की पारदर्शिता आवश्यक है।

निष्कर्ष

फ्रंटलोडिंग ने केवल अस्थायी राहत दी है। कीमतें बढ़ेंगी, सप्लाई गड़बड़ाएगी, और इसका असर धीरे-धीरे उपभोक्ता और वोटरों दोनों पर पड़ेगा।

टैरिफ एक उपकरण हैं, रणनीति नहीं। अमेरिका को डेटा-संचालित, साझेदार-आधारित, और बाज़ार-संतुलित व्यापार नीति की आवश्यकता है — नहीं तो अस्थायी राजनीतिक जीत के बदले, लंबी अवधि का आर्थिक नुकसान उठाना पड़ेगा।

Trump loves ICE. Its Workforce Has Never Been So Miserable.

How Nvidia Became the World’s First $4 Trillion Company Nvidia, based in Santa Clara, Calif., designs the chips, known as graphics processing units, or GPUs, that power the AI industry. The rally in Nvidia’s shares caps a remarkable run and comes barely two years after the company notched a $1 trillion closing valuation for the first time. The AI chip maker which closed at $162.88 a share and just shy of the $4 trillion mark, is now worth as much as the 214 smallest companies in the S&P 500 combined, according to Dow Jones Market Data........... Apple and Microsoft have come close to the $4 trillion mark. Apple closed with a market cap of $3.915 trillion in late 2024, and Microsoft had a valuation of $3.708 trillion last week. ......... Founded by Taiwanese-American engineer Jensen Huang in 1993, Nvidia initially had a much more niche purpose: making personal-computer game graphics better. Its ascendance from a graphics-chip designer catering mainly to videogamers into the digital arms dealer at the red-hot center of the AI boom has been meteoric. ...... Last year, Nvidia released its newest microarchitecture, Blackwell, which represented its most powerful GPUs yet, including the B200, which crams 208 billion transistors onto a chip roughly the size of four Scrabble tiles arranged in a square.

Zelenskyy urges west to hit Russia with sanctions after huge attack on Kyiv

The Dollar’s Troubles Are Just Beginning The U.S. dollar has fallen 10% since January, bucking expectations that tariffs might move the currency higher. Strategists say that downward trend may be here to stay, despite some recent gains in the dollar. ........ The dollar has been trading in an unusual pattern since President Donald Trump announced tariffs on Liberation Day, April 2. Like other currencies, the dollar is seen as a barometer of health of the national economy. But the greenback is special in also serving as a haven for the entire world when things are uncertain. ....... European and other global investors are selling the dollar ....... Investors have been reacting to the uncertainty around tariffs and “what could be a U.S. administration that is really looking to deglobalize to various degrees,” Cohen said. “You have a foreign pool of U.S. assets that have ultimately been underhedged for a long time,” he said. The administration’s “more isolationist approach” to the world is prompting investors to rethink their hedging. ......... To be sure, strategists say there has been no mass exodus from dollar assets. There is also no real fear at this point the dollar’s reserve currency status is at risk. ......... An unusual pattern has shown up this year, where events like the April 2 tariff announcement prompt stocks, Treasuries, and the dollar to sell off simultaneously.

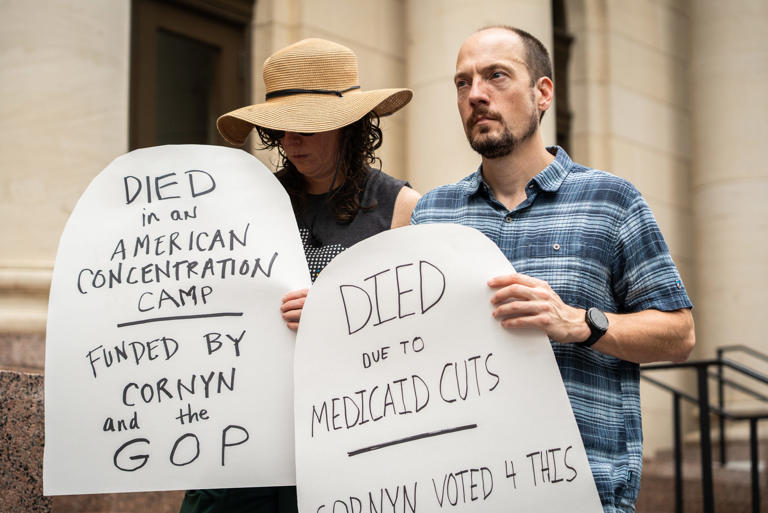

Dear Grandma: Trump took your Medicaid, so it's time for you to work the fields | Opinion Agriculture Secretary Brooke Rollins presented her farm-work-for-Medicaid-coverage plan on July 8, Tuesday, saying: “There will be no amnesty. The mass deportations continue, but in a strategic way, and we move the workforce toward automation and 100% American participation, which, again, with 34 million people, able-bodied adults on Medicaid, we should be able to do that fairly quickly.” ......... The Los Angeles Times quoted Ventura County citrus and avocado farmer Helen McGrath responding to Rollins’ idea: “I can confidently say that most farmers in the country either laughed out loud or were just deflated by those comments. It just shows how uninformed and out of touch some of these officials are with what food production looks like in this country.”

“Typical corporate response to someone who will not be missed” — Internet reacts as Elon Musk responds to X CEO Linda Yaccarino’s resignation

Opinion: Trump’s immigration raids have gone too far

India Seeks to Dodge Trump’s BRICS Wrath as It Eyes Trade Deal On Wednesday, Trump followed through with a new round of levies, including a 50% tariff on Brazil, one of the highest so far announced for the tariffs which are set to hit in August. The letter to Brazil comes just after a two-day BRICS summit in Rio de Janeiro, in which leaders agreed on a joint statement that criticized trade-distorting tariffs. ............ But while Brazil and South Africa have blasted Trump separately for his anti-BRICS comments, India has refrained from responding publicly, a sign that it’s treading a fine line in maintaining its relationship with Washington. ......... India doesn’t support moves for a single BRICS currency, and any participation in local currency trade arrangements is aimed solely at reducing risks ......... “Trump is unhappy with some BRICS members who have been talking about an alternate reserve currency,” said Mohan Kumar, a former Indian envoy and lead negotiator at the World Trade Organization, who now teaches at OP Jindal Global University. “India has time and again differentiated between local currency trade and de-dollarization and therefore doesn’t fall in that category.” .......... India has been cultivated by several US administrations over the years as a strategic partner and key regional counterweight to an increasingly assertive China. As recently as April, US Vice President JD Vance remarked that the fate of the 21st century “is going to be determined by the strength of the United States and India partnership.”

The Courts Won’t Save Democracy From Trump David argues that Trump’s budget and tax policies are reshaping the U.S. economy in ways that will leave the country poorer, less innovative, and more isolated from the rest of the world than we were before. ....... threats to the rule of law in the United States, and the question of how well the federal courts are coping with the challenges to legality under the Trump administration. ........ It cuts other kinds of benefits for many, many people. It’s going to raise a lot of revenue by heaping tariffs on the people least-well positioned to afford them. It will give big tax cuts to many other people, and despite all this—all the cuts in spending, all the new tariffs—the tax cuts are so big that this bill will lead the United States more in debt than ever before, running bigger deficits than ever before, and paying more in interest payments than ever before. .......... This world was so poor not so very long ago, and it’s become so wealthy, so abundant for so many people—all of that because we are able to extract more value from fewer resources at an ever-accumulating pace, on and on our way to bringing full development to more and more of the planet’s population. ........ the Trump budget and the Trump presidency leaves the United States not just a little but dramatically worse off in all the ways that are going to matter for the next decade, the indefinite future. ........ no one was grabbing people off the streets, putting bags on their heads, and sending them to a foreign country to be tortured indefinitely without any kind of hearing, rights, and liberties. .......... More and more Americans—because many of the people who live inside this country live with a status somewhere between that of an alien and a citizen (they’re green-card holders; they’re on temporary visas)—those people, more and more of them, live in a fear society. And that makes them less effective as economic actors, among many other things. It changes the nature of the society in which they live in ways that are less productive, less innovative. ......... This is an administration that is more and more a predatory one, and where the methods that it is using to pass its measures involve seizing or manipulating or extorting, bribes, presence, gratuities. The permission to have mergers depends on if the merged company owns a media company, controlling the content of that media company. We are not living in a world of honest government anymore. .......... Governments that run big, chronic deficits, that have large debts—those are governments whose currency is probably on the way down. .......... one of the worst years in the performance of the American dollar in a long time .......... that’s another price of Trumpism: fewer rights and freedoms, less-honest government, and a future of a less-stable currency. ............. the most important of the fiscal measures of the government is tariffs—those are utterly unpredictable. No one knows next week what you’ll have to pay to unload freight at an American port, never mind next year, the next 10 years. So the tax regime—although the Trump people keep advertising that tax cuts are coming, the tax regime is less and less predictable. Predictability more than level is the most important thing about a tax. ................ So fewer rights and liberties, less-honest government, less-stable currency, unpredictable taxes. ......... Adam Smith taught us a long time ago that the real wealth of nations is their people, their people’s collective ability to solve problems ........... Scotland in the 1700s probably had more literacy than any place else in the world, thanks to a good system of religiously founded, comprehensive primary schools. Almost all Scottish people could read or write. ........... Well, are we building an ever-more educated and ever-healthier society? It doesn’t look that way. We’re certainly not going to be a healthier society when we’re getting rid of vaccinations and waging war on modern medicine and bringing back a treatment regime of amulets and trinkets, instead of proper health and research, when we’re punishing universities for other things the president doesn’t like by shutting down cancer research and other forms of medical research. And when you’re taking away health coverage and other health benefits, you’re not gonna get a healthier population. .............. And as for a better-educated population, again, this administration is undercutting in every way it can the availability of education, limiting the availability of college education, and cutting back spending on primary and secondary education, and having a culture war against institutions of not only higher learning, but secondary learning. ........... So our future is one of more plagues and more ignorance, not fewer plagues and less ignorance. So fewer rights and liberties, less-honest government, less-stable currency, unpredictable tax regime, a population with declining health and levels of education. What else are we doing wrong? ............ in a modern economy, one of the drivers of economic growth is investment in science and technology. And the United States, especially since the end of World War II, has led the world in big investments in science and technology. And many of the investments in science and technology are not the obvious ones. You know, whenever you hear some congressman trying to score a point by making fun of some kind of research—The love life of mosquitoes; who’d wanna study the love life of mosquitoes?—it usually turns out that study on the love life of mosquitoes is a subject of some kind of medical research that is connected to another piece of medical research, which when connected to a third piece of medical research will bring about some new treatment or drug. But we are seeing enormous pressure on institutions of higher learning and independence of research, closing down of atmospheric research because it yields conclusions that are unwelcome or unwanted by the Trump administration. ................... the things they seem to really want are to make this an economy that is about coal, that is about oil extraction, that is about cutting down trees—the industries of 100, 200 years ago, not the industries of tomorrow, which they find kind of ridiculous and embarrassing. ............ China’s the world’s largest producer of energy from wind. These are industries of the future. We seem to be attached to the industries of the past. So less support for science and technology. ............ While you would have a limited government in a high-growth society, you would wanna make sure that that government does what it does do very well, very effectively, very efficiently. You’d want a competent, well-trained civil service recruited for merit, not for political loyalty, with some security of tenure and some independence from pressure from interest groups. Well, we’re going the opposite way on that. ............... And finally, what you would value above all—not above all, but climatically—is commerce with the rest of the world, because as big as the U.S. economy is, the world is bigger.

Americans out there to succeed need to sell to the whole world. And selling to the whole world means having world-competitive prices. And that applies that Americans must buy world-competitive components, which they integrate into their goods and into their services at the world price. ............ Well, Donald Trump is trying to sever the United States economy from the world, having special, higher made-in-America prices for everything. The world’s most expensive components mean the world’s most expensive outputs. When you don’t trade in peace and freedom with the rest of the world, your goods and services become less sellable in peace and freedom to the rest of the world. You wall yourself off like a hermit kingdom. Well, that is hardly a path to progress. .............. And the last thing—and this is climactic—societies that are growing faster than their neighbors tend to attract labor. And that’s true whether you’re Holland in the 1600s, Britain in the 1700s, America in the 1800s, Canada and Australia in the 1900s.

Fast-growing societies need more labor, pay higher wages, and attract more labor. Now, the movement of people must always be regulated according to law, but when very large numbers of people want to come to your country—again, you have to regulate it, but—that is a sign of strength. And when very large numbers of people don’t want to come to your country, that’s a warning that your country is developing in ways that are slower growing than other places where people could go. ..................... oftentimes, it seems like their idea is to repel as many people; to scare away people; to make people who have uncertain status, who are here on as permanent residents or student visas, to make them feel unwelcome; to empower every agent of government to be as hostile as possible at ports and airports, at border crossings; to harass and belittle and monitor and bully those people who are plighting their faith and their future to the United States. That is not the path to wealth, but it’s the path that the United States is on. ................. There’s gonna be a lot more debt and a lot more interest to pay. .............. The big decisions that have to be got right—predictability; stability; honesty; integrity; money that holds its value; investment in knowledge and technology; making people feel that they live in a society of rules, not a society of fear; and understanding that the pressure of immigration, which always has to be regulated, is nonetheless a sign of your society’s success, not a betrayal of the people who are already here—flunk, flunk, flunk, flunk, flunk. ................. That’s not the America we’d like to leave our children, but that is the America that is being bequeathed to them unless something quite decisive is done quite soon. ................. In 2019, he published in The Atlantic—our Atlantic—the definitive case, over 11,000 words, for diagnosing Donald Trump as a narcissistic sociopath, and not as an insult, but in the most clinical sense of those terms. ............. And you can see the relevance of those principles to Donald Trump, who couldn’t—you know, he was about basically the last person you’d want in a fiduciary position of any sort. Would you trust him? Would you make him the trustee for your children? Of course not. Would you trust him with any piece of property of yours? You’d not. .............. these manifest personality disorders that he has, that are just—you know, you could just check the boxes: He’s a narcissistic sociopath by any reasonable definition. Those people can’t serve as fiduciaries, because they can’t follow rules and they only think of themselves. .................. They basically said the only solution for something, someone as bad as this, who is going to do bad things because he is basically programmed to, is impeachment and removal. Or the alternative will be the fourth section of the 25th Amendment, and that’s still the case. .................. explains why so many, in the especially New York legal world, have been so vulnerable to the pressures we have seen in the second Trump presidency to pay ransom, to yield, that they can rationalize, Well, we’re following rules. And you somehow were not crushed. Your moral sense was not crushed by that technicality. ............ we saw it very, very recently in the D.C. Bar, which had an election involving Pam Bondi’s brother, who tried to challenge somebody to become president of that bar, and he got singularly trounced and embarrassed and humiliated. ............. one of the things we’ve all discovered from Donald Trump is there are a lot of things that presidents might do that they shouldn’t do that turned out not to be illegal, exactly. .............. there doesn’t seem to be a law that says the president can’t sell perfume while being president. We just think he shouldn’t. And other presidents didn’t. .............. The 30-some counts of felony that Donald Trump has been convicted for were not the worst things he did. And the worst things he did may not trigger any federal statute. And that loss of moral sense that some lawyers have, the flight from morality into legality, has in some ways left us disabled in the face of the Trump presidency. .................. he embarrasses himself, he embarrasses the country, he embarrasses the office, and he disrespects the office. He has contempt for what his job actually is, which is to enforce the Constitution, enforce the laws, to do right by the country for the people of the country. And he’s not capable of doing that. ............. the courts are following this rule familiar from children’s games: One for him, and one for you. One for him, and one for you. ......... So can masked men put a bag over somebody’s head on an American street, shove them into an airplane, fly them to another country without a hearing, and throw them into a dungeon? The courts have said that one—that one’s for you. No, no, we can’t do that. The next question is: Well, can the president commit crimes? Can he try to overthrow the Constitution and be prosecuted? And the courts said, That’s one for him. We give him one. .............. And then we have this complex, multipart balancing test about whether or not the president can violate criminal statutes. Yes or no? We will give you a muddy answer that is completely useless. ............. I think the federal courts overall have been doing a tremendous job in fighting back. ............... where they inexplicably stayed an injunction where a judge basically said that you have to give people being removed from the country due process as to where they’re being removed to, because they could be removed to someplace that they might not survive. .................. the Court does have to pick its spots somewhat carefully because it doesn’t have, as Bickel points out—doesn’t have armies, doesn’t have police. ............. For example, if somebody violates a court order and is held in contempt, the U.S. Marshals Service system is the organization that goes out and takes somebody and sends them to jail. Well, that’s controlled by the Department of Justice, by Pam Bondi and Donald Trump. And who controls the jails? The federal jails? The United States Bureau of Prisons, also a part of the United States Department of Justice—also beholden, also managed and run by Donald Trump and Pam Bondi. ................ The courts cannot save us .............. Piers Morgan, who was defending Donald Trump, and one of the points he made is that when there was a court case and Donald Trump lost it and lost it and lost it, on appeal and in multiple courts, eventually he would comply with the law, and doesn’t that make him a very, very good boy? ................ we have a lot of examples of Donald Trump receiving benefits, including, most flamboyantly, a jumbo jet from the government of Qatar that maybe they offered willingly, maybe he extorted. That’s a little unclear. But the question is, the Constitution says, look—the president can’t accept any gift from anybody without a vote of Congress. But the defense is gonna say, He’s not the president. It’s going to his library, so-called, and maybe the library will operate as a flying library, a book-extension service. The books come to you by plane, with the president and/or his family aboard on their way to, you know, Rio de Janeiro. ................. it’s really up to the Congress to pass laws, to enforce restrictions on what the president can accept. ............. It could be just, Thank you for being a good president. Here’s $1 million. That would be a violation of the gratuities law, both by the person who’s giving gratuities and by the person who is receiving the gratuity. ................ Because Donald Trump is president of the United States, he controls the prosecutorial agenda. He doesn’t want to prosecute himself. He wants to prosecute people he doesn’t like. And so that’s the fundamental problem. ............... The United States, because the Constitution is so old, it also includes a lot of ideas that have gone out of fashion in other democracies. And one of the fashions in most democracies is that the people in charge of initiating prosecutions are not political. Whether they’re federal or state, they’re not elected, and they don’t answer to the elected bodies. ............. in the United States, the attorney general is a member of the president’s cabinet. That’s not how most democracies do things anymore, but the United States is sort of stuck with it. .............. the fundamental problem that we have today is not any particular provision of the Constitution, but the people are failing to abide by its text and by its spirit. And fundamentally, those people who are doing that are the Republicans in Congress. ................ the problem we have here is that too many people in our governmental system are failing to comply with their duties to the country and to the Constitution, and putting their loyalty in one man instead of the law. ................ legal realism is a body of thought that said the law is just a way of predicting what courts will do.

No comments:

Post a Comment