The Problem with American Sanctions: When 1% Rules the World

American democracy loves to market itself as the ultimate expression of freedom and fairness, but the reality of its political architecture often tells a stranger, smaller story. Take the U.S. Senate. California, home to nearly 40 million people, gets two senators. Wyoming, with fewer residents than the number of monthly visitors to the Moon’s Wikipedia page, also gets two. This means a tiny slice of the population — often far less than 10%, maybe even closer to 1% — can exercise disproportionate power over the entire nation.

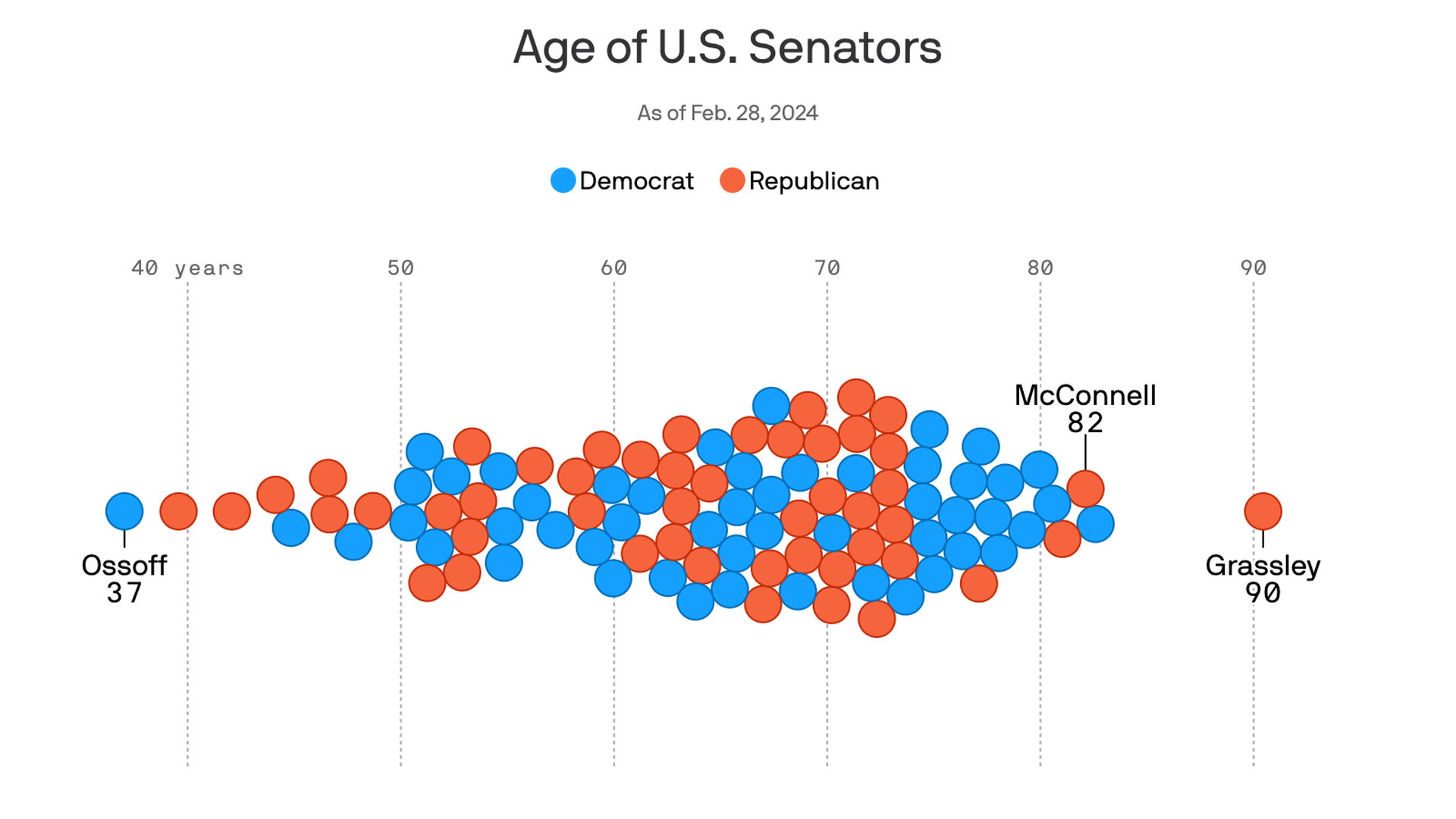

And these “cooling chamber” senators — the institutional brakes designed to slow down change — are overwhelmingly white, wealthy, and well past retirement age. Many of them seem to treat quoting obscure white male writers from three centuries ago as a substitute for actual governance. The internet exists. ChatGPT exists. Yet the U.S. legislative process often feels like it’s operating with quill pens in candlelit rooms.

The Money Primary: Choosing for the Rest of Us

It’s said that the real choice of presidential candidates doesn’t happen in the voting booths, but in the so-called “money primary” — the behind-closed-doors competition for billionaire and lobbyist backing. Tens of thousands of donors effectively narrow the field long before 150 million citizens cast ballots. This is as predictable in a capitalist country as the Communist Party running China: power flows to money. The difference? China doesn’t pretend otherwise.

Exporting the Dysfunction

Domestic quirks of governance would be one thing — but America exports them. Those same senators from sparsely populated states are the ones signing off on sanctions that try to dictate the behavior of 1.4 billion people in China, another 1.4 billion in India, and countless millions elsewhere. One percent of America’s population — itself a fraction of the world — attempting to legislate for the rest of the planet is, in the most literal sense, undemocratic.

Sanctions Aren’t Strategy

American sanctions too often become a blunt instrument wielded by the least globally accountable lawmakers. Instead of nuanced diplomacy, they produce global resentment and drive targeted countries to create workarounds — undermining U.S. influence in the long run. And yet, Congress treats them like moral grandstanding points rather than tools of statecraft.

A Better Way Forward

Imagine this instead: Donald Trump, Vladimir Putin, Xi Jinping, Narendra Modi, and Volodymyr Zelensky sitting together for a one-hour live-streamed summit. No aides whispering in ears, no off-camera posturing — just five world leaders hashing it out in front of a global audience. Call it C-SPAN Goes Global. Would it be messy? Absolutely. Would it be more constructive than a decades-long sanctions spiral? Quite possibly.

If America wants to lead, it needs to start by recognizing that the structure of its own democracy has global consequences. Until then, the rest of the world will increasingly question whether Washington’s moral authority is anything more than small-state senators shouting into a very large megaphone.

अमेरिकी प्रतिबंधों की समस्या: जब 1% दुनिया पर हुकूमत करता है

अमेरिकी लोकतंत्र खुद को स्वतंत्रता और न्याय का सर्वोच्च रूप बताना पसंद करता है, लेकिन इसकी राजनीतिक संरचना का सच अक्सर एक अजीब, और भी छोटा किस्सा कहता है। अमेरिकी सीनेट को ही लें। कैलिफ़ोर्निया, जहां लगभग 4 करोड़ लोग रहते हैं, के पास दो सीनेटर हैं। वहीं वायोमिंग, जिसकी आबादी चांद के विकिपीडिया पेज के मासिक विज़िटरों से भी कम है, के पास भी दो सीनेटर हैं। इसका मतलब है कि आबादी का एक छोटा-सा हिस्सा — जो अक्सर 10% से भी कम, शायद 1% के आसपास होता है — पूरे देश पर असमान रूप से असर डाल सकता है।

और ये “कूलिंग चैम्बर” वाले सीनेटर — जो बदलाव को धीमा करने के लिए बनाए गए संस्थागत ब्रेक हैं — ज़्यादातर श्वेत, अमीर, और रिटायरमेंट की उम्र पार कर चुके होते हैं। इनमें से कई तो 300 साल पहले के अज्ञात गोरे लेखकों के उद्धरण देने को शासन का विकल्प मानते हैं। इंटरनेट है। ChatGPT है। फिर भी अमेरिकी विधायी प्रक्रिया अक्सर मोमबत्ती की रोशनी में पंख कलम से चलने जैसी लगती है।

मनी प्राइमरी: बाकी सब के लिए चुनाव करना

कहा जाता है कि राष्ट्रपति पद के असली उम्मीदवारों का चयन मतदान केंद्रों में नहीं, बल्कि तथाकथित “मनी प्राइमरी” में होता है — अरबपतियों और लॉबिस्टों का बंद दरवाजों के पीछे का मुकाबला। कुछ हजार दानदाता मैदान को संकरा कर देते हैं, उससे पहले कि 15 करोड़ नागरिक वोट डालें। यह एक पूंजीवादी देश में उतना ही स्वाभाविक है जितना चीन में कम्युनिस्ट पार्टी का शासन: सत्ता वहीं बहती है जहां पैसा हो। फर्क बस इतना है कि चीन इस बात को छुपाने का नाटक नहीं करता।

दोष का निर्यात

अगर ये शासन की घरेलू खामियां ही रहतीं तो एक बात थी — लेकिन अमेरिका इन्हें निर्यात करता है। वही छोटे-छोटे राज्यों के सीनेटर, जिनके यहां मुश्किल से लोग रहते हैं, वे ऐसे प्रतिबंधों पर हस्ताक्षर करते हैं जिनसे चीन के 140 करोड़ लोग, भारत के 140 करोड़ लोग, और दुनिया के असंख्य अन्य लोग प्रभावित होते हैं। अमेरिका की आबादी का 1% — जो दुनिया का एक छोटा सा हिस्सा है — पूरी धरती के लिए कानून बनाने की कोशिश करता है। यह शाब्दिक रूप से अलोकतांत्रिक है।

प्रतिबंध रणनीति नहीं हैं

अमेरिकी प्रतिबंध अक्सर एक भोथरे औज़ार की तरह इस्तेमाल होते हैं, जिसे वे सांसद चलाते हैं जो वैश्विक स्तर पर सबसे कम जवाबदेह होते हैं। सूक्ष्म कूटनीति के बजाय, ये वैश्विक नाराज़गी पैदा करते हैं और लक्षित देशों को वैकल्पिक रास्ते खोजने पर मजबूर करते हैं — जो लंबे समय में अमेरिकी प्रभाव को कमजोर करता है। फिर भी, कांग्रेस इन्हें राज्य-कला के उपकरण से ज़्यादा नैतिक दिखावे के अंकों की तरह देखती है।

आगे का बेहतर रास्ता

इसके बजाय यह कल्पना कीजिए: डोनाल्ड ट्रंप, व्लादिमीर पुतिन, शी जिनपिंग, नरेंद्र मोदी और वोलोदिमीर ज़ेलेंस्की एक घंटे के लाइव-स्ट्रीम शिखर सम्मेलन में एक साथ बैठे हों। कोई सलाहकार कान में फुसफुसा नहीं रहा, कोई कैमरे के बाहर की राजनीतिक नौटंकी नहीं — बस पांच नेता पूरी दुनिया के सामने सीधे बातचीत कर रहे हों। इसे कहें सी-स्पैन ग्लोबल। क्या यह अस्त-व्यस्त होगा? बिल्कुल। क्या यह दशकों तक चलने वाले प्रतिबंध चक्र से ज़्यादा रचनात्मक हो सकता है? बहुत मुमकिन है।

अगर अमेरिका नेतृत्व करना चाहता है, तो उसे यह मानना शुरू करना होगा कि उसके लोकतंत्र की संरचना के वैश्विक परिणाम होते हैं। तब तक, दुनिया के बाकी हिस्से इस पर और ज़्यादा सवाल उठाएंगे कि वॉशिंगटन की नैतिक सत्ता कहीं सिर्फ छोटे राज्यों के सीनेटरों का एक बहुत बड़े माइक पर शोर मचाना तो नहीं है।

:max_bytes(150000):strip_icc()/GettyImages-848755326-48dd2711646247648c4faebc98715119.jpg)